(Bloomberg) — Investors are dipping their toes back into some of the riskiest emerging-market bonds, snapping up high-yield government debt that has been made cheap by tariff-induced volatility.

Most Read from Bloomberg

Money managers including Ninety One UK Ltd., Vontobel Asset Management and TCW Group Inc. argue that some prices have fallen to a level that justifies taking on the risk of sovereign defaults, which they say has been overblown.

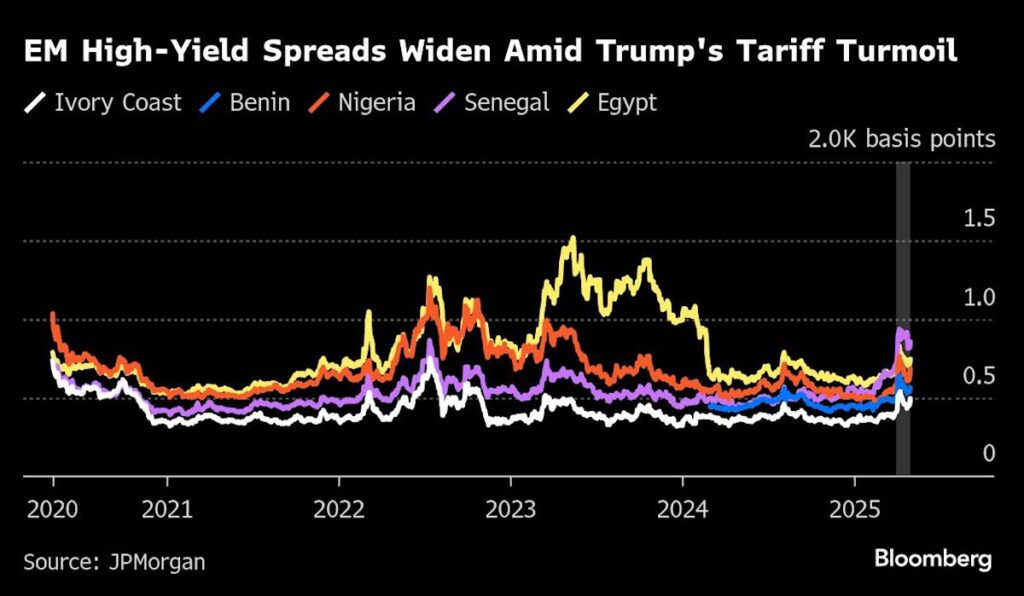

In April alone, the extra yield investors demand to own dollar-denominated junk bonds from emerging markets over Treasuries widened 37 basis points to 634 basis points. Meanwhile, credit-default swaps — a type of protection against defaults — saw limited deterioration, with a broad index trading far below levels seen ahead of the last wave of debt meltdowns in 2022-2023.

“We had ammunition to come back during the selloff,” said Carlos de Sousa, a portfolio manager at Vontobel, who scooped up notes from Ivory Coast to Benin. Before the turmoil, de Sousa had been holding an unusually high exposure to better-rated credits.

While tariff concerns haven’t vanished and the risk of a prolonged US economic downturn isn’t fully priced in, the move into high-yield is a window into how some money managers believe that the worst of President Donald Trump’s global trade war is over. They are adjusting their portfolios to take on more risk, wagering that fundamentals in some of the world’s most vulnerable nations will remain resilient.

It’s an investment that is so far fairly limited but catching on. JPMorgan Chase & Co. cited the appetite for higher-yielding opportunities among its key takeaways from an investor survey carried out during the International Monetary Fund and World Bank meetings in Washington last month.

For good reason: The asset class has been one of the brightest spots in emerging markets in recent years. In 2024, some of the notes handed triple-digit gains to investors. It hasn’t worked out that way so far this year, as investors moved to take profits in the run-up to Trump’s levies.

A Bloomberg gauge of EM high-yield dollar bonds is up about 1% this year, lagging an index tracking investment-grade bonds from emerging markets, which has advanced close to 3%. Spreads for countries like Egypt, Ivory Coast, Benin and Senegal have been on the rise since April 2, when Trump announced a shift in his tariff policy.