The wellness industry is expanding rapidly, driven by consumers’ growing interest in health and their desire for greater control and transparency. As more health spending shifts beyond the doctor’s office to direct-to-consumer products and services, there is a critical need to bridge the financial gap between health and healthcare. Flex, an HSA/FSA solution provider, is at the center of this unification.

“Consumers are increasingly taking control of their health journey, leveraging technology and at-home solutions to monitor and improve their wellbeing through diagnostic tests, wearables, apps and lifestyle interventions,” said Sam O’Keefe, Flex CEO. “Our goal is simple: to make HSA/FSA payments available wherever consumers spend on their health.”

Health savings accounts (HSAs) and flexible spending accounts (FSAs) present a sizable revenue opportunity for fitness and wellness brands. With over $150 billion available in these accounts, consumers have substantial funds to invest in their well-being.

Alternative payment methods have already proven to be powerful drivers of growth — whether through buy now, pay later options in e-commerce or ACH payments in fitness studios. These solutions not only attract new customers and members but also improve retention over time. Flex empowers brands to harness these payment innovations, unlocking new revenue streams and turning up customer engagement.

Clearing Complexities

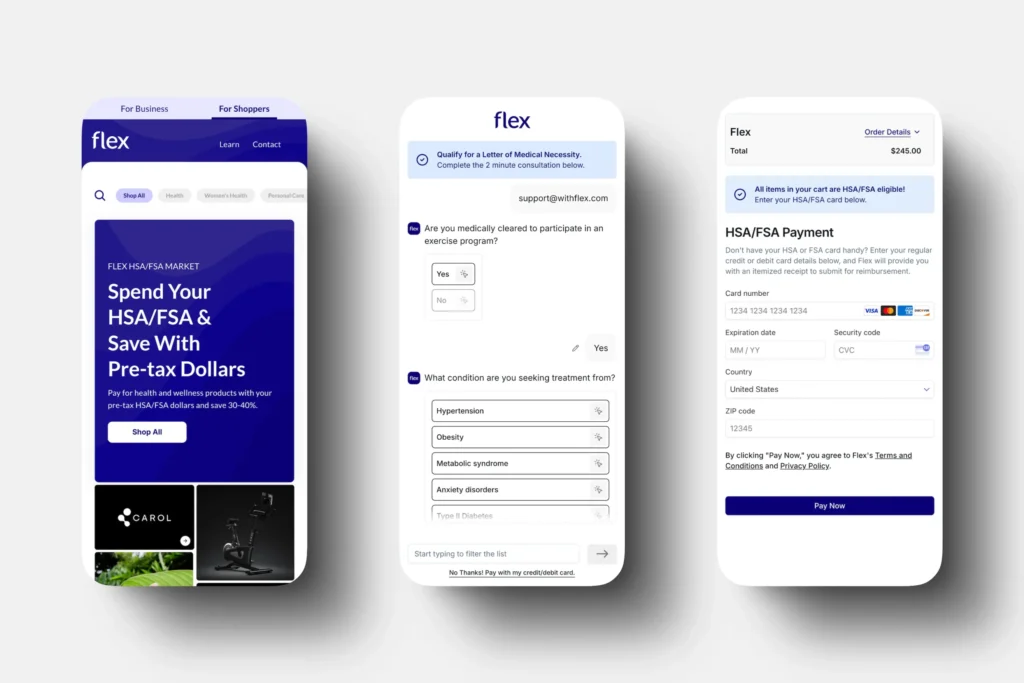

Flex provides a seamless, expert-driven solution for fitness and wellness brands looking to accept HSA/FSA payments. The platform not only enables eligibility at checkout but also simplifies the entire process, offering expertise in compliance, reimbursement and required documentation.

Flex supports eligible payments, letters of medical necessity, reimbursements and more — all while ensuring smooth transaction completion. Getting started is quick and hassle-free, with no scheduling required. Instead, users can complete a chat-based telehealth visit with a licensed healthcare provider to obtain the necessary documentation for HSA/FSA reimbursement.

“We start by conducting a thorough review of your products and services,” explained O’Keefe. “Through this audit, we determine which items can be automatically approved and which require a Letter of Medical Necessity to comply with IRS guidelines. Based on these findings, we customize your HSA/FSA integration to create the smoothest possible checkout experience.”

Flex then facilitates payment through a single, streamlined checkout flow designed to maximize conversion rates. Its real-time analytics dashboard also gives brands clear visibility into their HSA/FSA transactions, enabling them to manage and optimize these channels effectively.

Beyond payments, Flex actively connects its community of high-intent HSA/FSA buyers with partner brands through the Flex Market, newsletter and social media channels. This not only keeps both businesses and consumers well-informed but also helps drive more sales and savings.

The HSA/FSA Difference

Flex reports their partners have attracted new customers, higher average order value and boosts in subscription retention. Consumers also benefit by saving 30–40% on purchases made with their HSA/FSA, Flex says.

“By accepting HSA/FSA payments, businesses can attract this growing segment of health-conscious customers who actively manage their wellness journey,” said O’Keefe. “The ability to use HSA/FSA funds makes wellness products more accessible and affordable.”

More is Coming

As HSA/FSA adoption accelerates across the health and wellness industry, Flex is experiencing rapid growth, bringing its payment solutions to an expanding network of partners. The platform is already powering payments for leading brands such as Echelon, Kineon, iFIT, Trainwell, Ultrahuman, Ampfit and others, helping them unlock new revenue streams through HSA/FSA eligibility.

Since launching this partnership [with Flex], we’ve seen significant growth in HSA/FSA transactions, benefiting both our customers and our business, “ Echelon founder and CEO Lou Lentine said.

“We’re constantly expanding our capabilities — whether that means integrating with new platforms or refining our checkout process to maximize conversion rates,” added O’Keefe. “Every improvement we make is focused on one thing: helping our partners succeed.”