President Trump’s sweeping tariff plans kicked off a historically volatile 10 days in markets.

Stock indexes plunged, bonds sold off at the fastest rate in decades, and the dollar fell rapidly against the euro and yen. Wall Street leaders are sounding the alarm on a recession.

With the U.S. stock market adding and erasing trillions of dollars in value by the day, here is where things stand heading into the third week of trading since Trump escalated a global trade war:

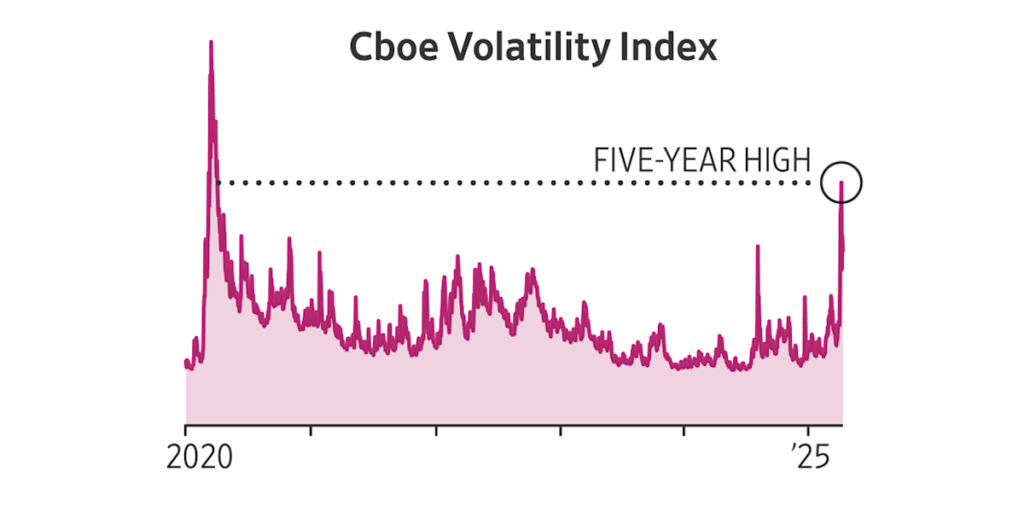

Equities cratered in the two trading days after broad tariffs were announced, with the S&P 500 posting back-to-back declines of more than 4%. Trading has been choppy ever since, with measures of volatility for the broad-based index at the highest level since the pandemic shut down the U.S. economy in March 2020.

All 11 S&P 500 sectors are down since the announcement, with energy the hardest hit. That is because oil prices have tumbled to their lowest levels since 2021 on fears that a global recession will curb demand.

The materials and consumer-discretionary sectors are both down sharply because of their reliance on imports, while real estate and financials were hit hard by worries about slowing growth.

The government-bond market has put both investors and the White House on edge.

Longer-dated Treasurys rallied over the first few days of the stock selloff. The yield on the 10-year Treasury, a key reference rate for borrowing costs on everything from mortgages to student loans, dipped below 4%.

It was what investors have come to expect during times of market turmoil and fear—money flowing from stocks to ultrasafe Treasurys—and why many turn to bonds as ballast for their portfolios.

This time, though, the rally ended abruptly. A bond selloff that began Monday turned into the biggest weekly climb in the 10-year yield in almost 25 years, alarming traders.

Concerns that investors had lost confidence and were cutting exposure even to safe U.S. assets played into Trump’s decision to put most of the new tariffs on a 90-day pause on Wednesday, The Wall Street Journal reported.

After a brief pause, however, yields rose to new recent highs on Friday. And the dollar slid to fresh lows.

Traders are bracing for more big moves ahead. The Cboe Volatility Index, which tracks expectations for the size of stock swings over the next 30 days, just touched the highest level since March 2020.