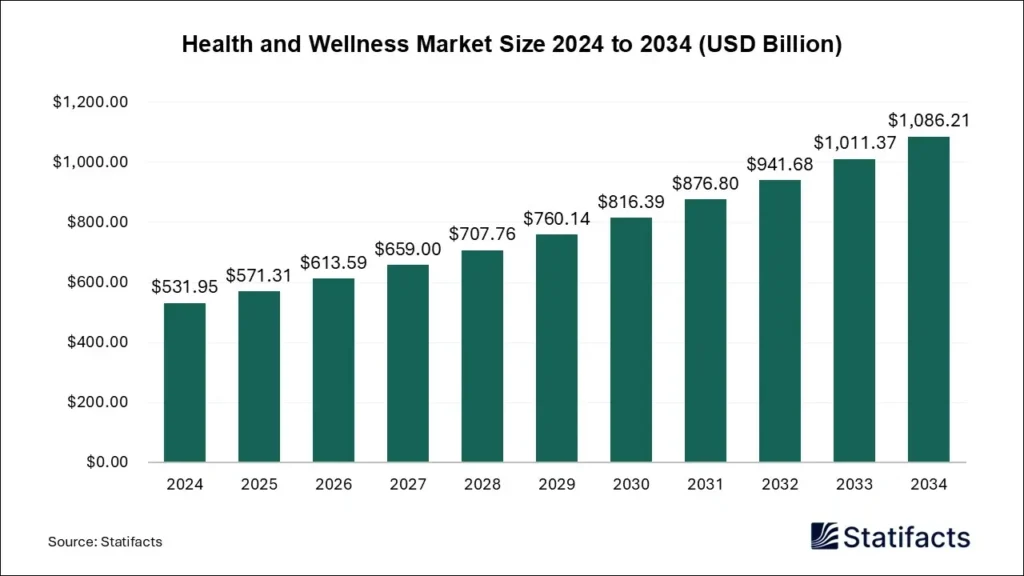

The global health and wellness market is on a powerful upswing—and is expected to surge from $571.31 billion in 2025 to $1,086.21 billion by 2034, according to new data from Statifacts, a sister firm of Precedence Research.

Driving the growth is a sweeping shift in consumer behavior, from embracing natural and organic products to prioritizing mental health, preventive care, lifestyle-driven wellness and rising disposable income.

Asia Pacific led the global health and wellness market in 2024, commanding the largest share at 36.6%. However, North America is poised for the fastest growth, with the highest projected compound annual growth rate (CAGR) through 2034. Products dominated the market, capturing 54.3% of total revenue in 2024, while services are expected to log the fastest CAGR over the next decade. Fitness centers, equipment and programs accounted for more than 30.92% of revenue in 2024.

Amid this growth, a handful of wellness niches are beginning to emerge—areas that show strong potential for future expansion:

Looking ahead, sleep and mental wellness services are expected to nab a significant market share through 2034

Accessible mental health solutions are already underway, and new research recently published in Nature Medicine highlights the work of a team of researchers from Kyoto University. The group has developed a smartphone app, Resilient, that offers users techniques based on cognitive-behavioral therapy (CBT). In the sleep category, Equinox Hotels is making moves in the sleep science arena as it offers guests a restful getaway and sleep wearable tech company Somnee is working with the NBA. Sleep mattress company Eight Sleep, meanwhile, has scored F1 driver Charles Leclerc as investor and ambassador.

As for the top consumer trends fueling the health and wellness market, Statifacts highlight the demand for holistic, preventative mental wellness tools, such as meditation apps and therapy platforms. Similarly, demand is rising for sustainable wellness products like clean-label goods that are free from synthetic fragrances, parabens and phthalates. The fitness industry is also an area of opportunity, as consumers are now familiar with (and expect) digital tech like apps and virtual fitness content.

Three areas of concern that could limit progress, according to the market research report, include rising privacy concerns—namely regarding digital health tools that collect and share personal data. Increased competition in the wellness space is another challenging area in terms of stress and potential burnout among founders and teams.