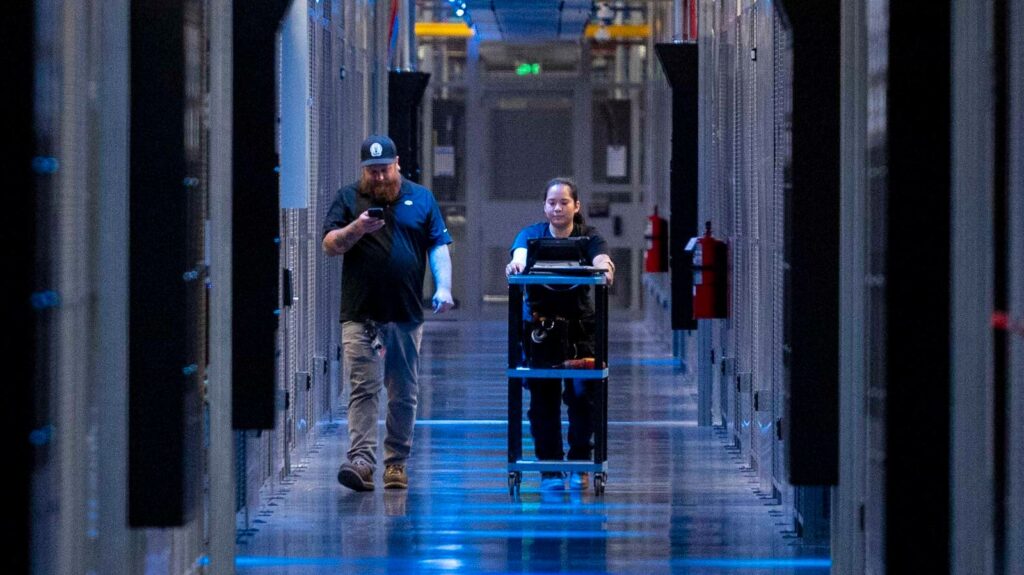

Growing demand for AI infrastructure has helped boost the prospects of the AI data center operator Applied Digital and an AI semiconductor provider, Broadcom.

The Washington Post via Getty Images

It’s tough to say for sure which growth stocks will be winners without a crystal ball. But investors may wish to consider investing in AI data center operator Applied Digital, AI semiconductor provider Broadcom and the pharmaceutical company Eli Lilly. These three companies have solid prospects for gains in addition to some better-known companies, such as Nvidia and Palantir.

Applied Digital, Broadcom and Lilly have the potential to rise in the short and long term. If they beat earnings targets and raise guidance, their share prices will keep rising. If they tap their strong competitive positions to win more market share, they’ll see lasting success.

How These Growth Stocks Were Chosen

These stocks were selected based on their rapid growth, good chance of exceeding expectations, and strong products and management.

If a company is growing rapidly now and has a track record of beating expectations, its stock is likely to rise. However, to sustain those increases over time, a company must innovate. If the company has great products and excellent management, better-than-expected growth is more likely to last.

3 Best Growth Stocks to Buy for November 2025

The three best growth stocks are ranked below in descending order of their stock price change in 2025 as of Oct. 21. More generally, the three stocks are ranked from the highest to lowest return and risk. Read on to learn why.

1. Applied Digital (APLD)

Business Overview

- Stock price as of Oct. 21: $35.90

- Sector/Industry: AI data centers

- Q1 FY 2026 revenue growth: 84%

Although it is not profitable, Applied Digital has grown rapidly. In the company’s first quarter of fiscal 2026, revenue increased 84% to $64.2 million, exceeding analyst expectations by $14.2 million, CNBC reported.

Why APLD Stock Is A Top Choice

- Fast-growing AI data center operator

- Partnership with CoreWeave to boost demand

- New data centers being built as hyperscalers seek more capacity

Applied Digital is benefiting from soaring demand for AI data centers. An estimated $350 billion will be spent in 2025 by large cloud services providers called hyperscalers. CoreWeave – a leading AI cloud services provider – recently leased 150 megawatts of Applied Digital’s Polaris Forge 1 campus, bringing Applied Digital’s total anticipated contracted lease revenue to about $11 billion over 15 years, CNBC also reported..

Strong demand for Applied Digital’s services looks likely to continue at least through 2026. That’s one reason, the company is building a 200 megawatt Polaris Forge 2 campus and is in “advanced discussions with hyperscalers,” according to CRN, with management projecting leased capacity for both Applied Digital campuses as high as 600 MW.

Business Overview

- Stock price as of Oct. 21: $349.24

- Sector/Industry: AI infrastructure

- Q2 2025 revenue growth: 22%

Broadcom CEO Hock Tan announced in 2017 that the company was moving its global headquarters to the United States.

The Associated Press

Broadcom is benefiting from demand for AI infrastructure. In the company’s third quarter of fiscal year 2025, AI semiconductor revenue grew 53% to $5.2 billion. The company is also gaining from a shift in AI chip architecture through Broadcom’s 65% revenue share of application-specific integrated circuits for hyperscalers, according to Ainvest.

Why AVGO Stock Is A Top Choice

- Fast-growing chip company

- Strong products enjoying rapid growth due to high value to customers

- New products from which new growth could flow

Broadcom provides hyperscalers with AI chips that deliver faster performance at lower prices than Nvidia’s products. The chip provider’s clients include Google, Meta, ByteDance and reportedly OpenAI, “representing a strategic alternative to purchasing Nvidia’s GPUs,” CNBC said.

More specifically, Broadcom’s custom AI accelerators deliver three to five times better performance-per-watt than Nvidia GPUs at a roughly $20,000 to $15,000 lower per unit cost, Datagravity estimated.

Such innovation has enabled Broadcom to exceed Wall Street expectations for eight consecutive quarters, typically resulting in 10% to 20% stock increases on earnings-announcement days, Ainvest reported.

Broadcom’s stock price could rise in November. A September announcement of a $10 billion order for the Titan AI inference chip from a fourth hyperscale customer— believed to be OpenAI —demonstrates Broadcom is winning new hyperscale customers. Though this program is scheduled to begin in the third quarter of fiscal year 2026, pre-production revenue and additional design wins could emerge in fourth-quarter 2025 results, Tom’s Hardware predicted.

2. Eli Lilly (LLY)

Business Overview

- Stock price as of Oct. 21: $808.96

- Sector/Industry: Pharmaceuticals

- Q2 2025 revenue growth: 38%

Lilly has seen rapid growth for its injectable weight loss and type 2 diabetes drug Mounjaro.

Peter Dazeley / Getty Images

Eli Lilly is an American pharmaceutical company combining strong profitability and rapid growth with its market-leading diabetes and obesity treatments.

Lilly’s latest financial results, in the second quarter of 2025 showed that revenue rose 38% to $15.56 billion, with net income increasing 91% to nearly $6.7 billion, according to a company release.

Why LLY Stock Is A Top Choice

- Fast-growing pharmaceutical company

- Strong products enjoying rapid growth due to leading market share

- Pipeline of new drugs that could be a catalyst for the stock

Lilly dominates the market for diabetes and weight loss drugs. More specifically, Lilly controls about 57% of the U.S. market for incretins – enjoying a competitive advantage over rival Novo Nordisk, Reuters reported.

Lilly has experienced rapid growth in demand for two drugs: Mounjaro, which helps manage blood-sugar levels in adults with diabetes, and Zepbound, for treating obesity and weight-related conditions. In Q2, sales of these products grew 68% to $5.2 billion for Mounjaro and 172% to nearly $3.4 billion for Zepbound.

The company communicated its optimism about future growth, raising its full-year 2025 guidance above Wall Street expectations. It’s projecting $60 billion to $62 billion in revenue and EPS between $21.75 and $23.00 amid strong demand.

A new obesity treatment called retatrutide, which is expected to report positive trial results late in 2025, provides another reason for optimism, Pharmaceutical-Journal noted. Moreover, An Alzheimer’s therapy called donanemab, sold under the brand name Kisunla, was approved in 2025 and could help Lilly exceed investor’s revenue expectations.

Bottom Line

Investors looking for stocks with upside potential may consider betting on shares of Applied Digital, Broadcom and Eli Lilly. While Applied Digital is losing money and investing to build capacity, its rapid revenue growth and feverish demand from hyperscalers makes it a compelling short-term investment.

Broadcom is a much larger, profitable beneficiary of AI chip demand while Lilly’s commanding lead in the booming markets for treatment of diabetes and obesity is propelling rapid growth, which could be even faster if the company shares positive results from new drug trials.