(Bloomberg) — Another report showing the US economy entered the trade war on solid footing pushed stocks away from session lows, while Donald Trump suggested his administration could strike trade deals as soon as this week.

Most Read from Bloomberg

A rebound in industrial shares helped the S&P 500 trim most of a slide that earlier approached 1%. Data showing a pick-up in growth at US service providers helped assuage concerns of a recession even as the outcome of the US trade war has yet to be felt. While Trump signaled no imminent accord with China, the president said the Asian nation wants to make a deal “very badly.”

“Encouraging comments out of the White House have led investors to grow increasingly optimistic that the Trump administration will soften its approach to trade,” said Brent Schutte at Northwestern Mutual Wealth Management Company. “Until final trade deals are in place and their impacts are reflected in the hard data, it is premature to draw conclusions.”

Subscribe to the Stock Movers Podcast on Apple, Spotify and other Podcast Platforms.

Attention will soon shift to Wednesday’s Federal Reserve decision after bond traders dialed back rate-cut bets that had steadily mounted as Trump’s trade war unleashed havoc in financial markets. As long as the economy holds firm, Jerome Powell and his colleagues can more easily justify the standing pat.

The S&P 500 fell 0.2%. The Nasdaq 100 slid 0.2%. The Dow Jones Industrial Average added 0.1%. The yield on 10-year Treasuries rose three basis points to 4.34%. The Bloomberg Dollar Spot Index slipped 0.2%.

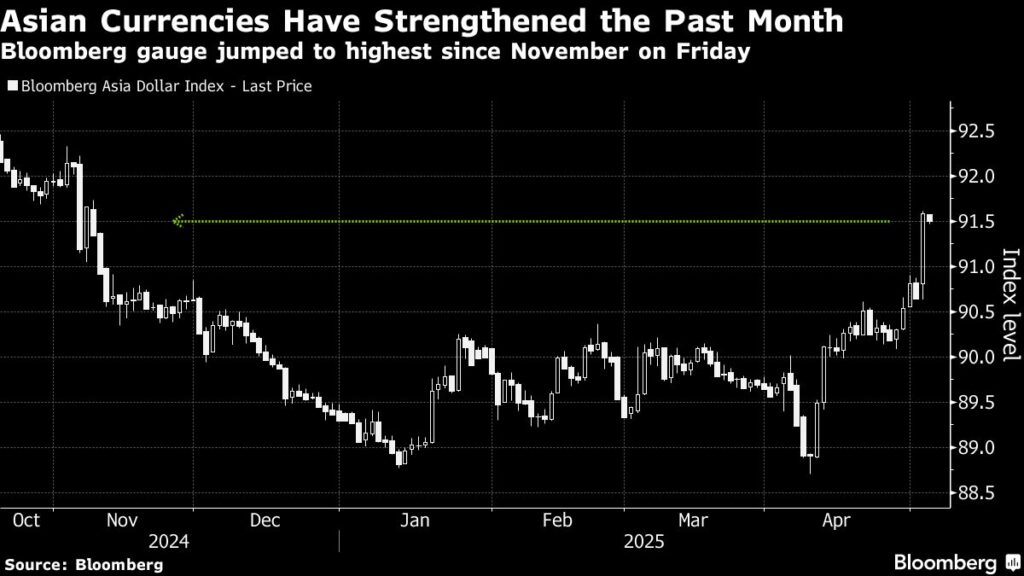

Oil sank as OPEC+ agreed to a bumper output increase. Taiwan’s dollar surged on bets authorities might allow it to appreciate to help reach a trade deal with the US.

Treasury Secretary Scott Bessent touted the US as the “premier destination” for global capital and argued that the Trump administration’s policies will solidify that position — countering the so-called sell America theme that materialized last month.

Concerns about the international appeal of dollar-based assets materialized last month during a selloff in stocks in the wake of Trump’s announcement of steep reciprocal tariffs on major trading partners. Contrary to typical practice, US Treasuries also tumbled — failing to play the haven asset role it has in the past.

“Clearly, it really is the uncertainty and the volatility — and so that is how clients are feeling globally, domestically. And as part of that, they’re trying to figure out: Is there opportunity in this market?” Racquel Oden at HSBC said at an event. “We’re seeing all these market swings, each day there’s a new report that may pivot things in the economy.”

After piling into short-term Treasuries, anticipating the Fed would start easing policy soon to contain the fallout, traders reversed course. Two-year yields rose for a third consecutive session – the longest run since December – as traders bet policymakers will remain in wait-and-see mode until there’s more clarity on the impacts of tariffs.

“We believe that the longer policy uncertainty persists, the greater the potential hit to economic activity,” said Invesco’s Global Market Strategy Office.

“Tariff clock is ticking, and the Trump administration has a fairly limited window to make progress on trade deals before the economic damage becomes more pervasive and less reversible,” said Dave Grecsek, managing director at Aspiriant. “The longer trade policy uncertainty lingers, the more economic damage accumulates.”

A trade deal with China would be a prerequisite to spur the S&P 500 to a new all-time high in the near term, according to strategists at Morgan Stanley.

The team led by Michael Wilson says a deal reached in the next few weeks would calm businesses that supply chains will face limited disruption going forward.

There are many reasons to doubt the recent rebound in US stocks, but it has at least one powerful factor on its side: momentum.

The S&P 500 notched its the longest winning stretch since 2004 on Friday, and such streaks have tended to precede further upside. The gauge was a median 20% higher a year after moves of similar magnitude while notching gains in shorter-term periods along the way, according to WisdomTree’s Jeff Weniger, who analyzed data going back to the late 1980s.

Corporate Highlights:

-

Shares in US media and entertainment companies fell after Trump announced that he plans to impose a 100% tariff on films produced overseas.

-

Berkshire Hathaway Inc. followed Chief Executive Officer Warren Buffett’s recommendation, naming Vice Chairman Greg Abel to replace the billionaire as CEO, effective Jan. 1.

-

Tyson Foods Inc. slumped as investors shrugged off stronger-than-expected quarterly earnings to focus on deepening losses at the company’s beef business.

-

Shell Plc is working with advisers to evaluate a potential acquisition of BP Plc, though it’s waiting for further stock and oil price declines before deciding whether to pursue a bid, according to people familiar with the matter.

-

Sunoco LP agreed to acquire Parkland Corp. for about $9.1 billion, including debt, offering a premium for a Canadian fuel distributor that’s in the midst of a leadership upheaval and a fight with its largest shareholder.

-

3G Capital will acquire footwear maker Skechers USA Inc. for $9.4 billion, marking a splashy return to dealmaking for the investment firm after nearly four years.

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.2% as of 3:15 p.m. New York time

-

The Nasdaq 100 fell 0.2%

-

The Dow Jones Industrial Average rose 0.1%

-

The MSCI World Index fell 0.2%

-

Bloomberg Magnificent 7 Total Return Index fell 0.5%

-

The Russell 2000 Index fell 0.3%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro rose 0.2% to $1.1317

-

The British pound rose 0.2% to $1.3295

-

The Japanese yen rose 0.8% to 143.87 per dollar

Cryptocurrencies

-

Bitcoin fell 0.9% to $94,896.92

-

Ether fell 0.6% to $1,825.87

Bonds

-

The yield on 10-year Treasuries advanced three basis points to 4.34%

-

Germany’s 10-year yield declined two basis points to 2.52%

-

Britain’s 10-year yield advanced three basis points to 4.51%

Commodities

–With assistance from Vildana Hajric and Isabelle Lee.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.