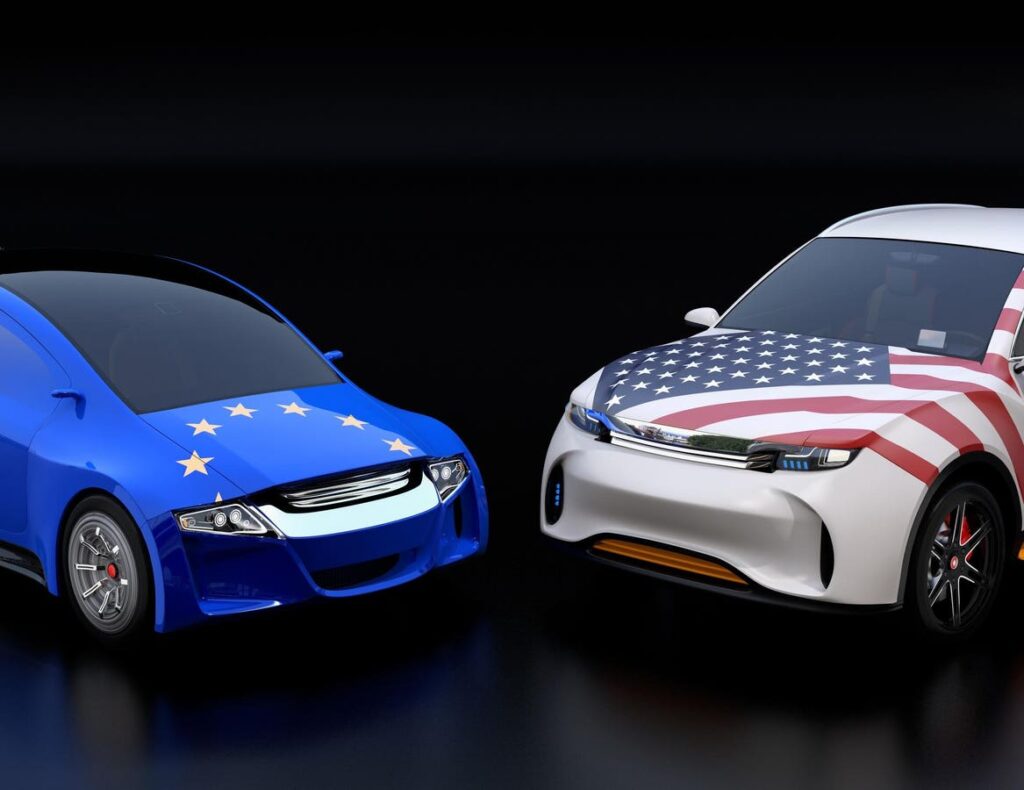

EU and US flags on two automobiles hood. black background. Europe USA trade war, American tariffs … More

The European Union responded to President Donald Trump’s tariff proposals with anger and talk of retaliation but with details remaining elusive, the first attempts at risk assessment for automakers pointed to Porsche and Stellantis as the most exposed exporters to U.S. risk.

Experts at investment bank UBS said they expected tariffs on both sides of the argument to be bid up in early negotiations but to settle back to between 10 and 15% by the end of the year.

It’s too early to predict how European automakers in the U.S. will respond. In the short-term they could raise prices or absorb the tariffs. Porsche and Audi could join with their parent company Volkswagen and build some models in the U.S. Geely of China-owned Volvo has said it will raise production and add more models to its South Carolina plant. BMW and Mercedes also have factories in the U.S.

The EU’s first response was hostile.

“We are now preparing for further countermeasures to protect our interests and our businesses if negotiations fail,” said European Commission President Ursula Von der Leyen.

Porsche 911 Turbo S. Will Porsche decide to make some of its cars in the U.S.?

“If you take on one of us, you take on all of us,” Von der Leyen said.

President Trump announced a 20% tariff on goods imported from the EU. Trump has long believed that EU tariffs and non-tariff barriers had unfairly restricted U.S. sales of automobiles and other goods.

Former U.S. ambassador to the EU Gordon Sondland recently said he expects the Trump Administration to seek big overall changes to long-term unfair trading including non-tariff barriers. Trump has described the EU’s trade policy as “an atrocity.” Trump also claimed the annual U.S. trade deficit with the EU was more than $300 billion.

The U.S. is tired of talking about impediments to its foreign trade and wants action now, Sonderland said.

“The message is very clear. We’ve had a list of demands and requests from all of these friends for years and sometimes decades and the results are similar every time. They take it under advisement. They’ll think about it then get back to us and Donald Trump has had enough of that,” Sonderland said in a BBC interview earlier this year.

Sonderland said he was not speaking for the Trump administration.

Any EU retaliation plan will not be received positively in Washington.

But according to Reuters’ BreakingViews column the EU has some powerful cards to play, including its big deficit in services.

“Last year the EU ran a $77 billion deficit in such trade. Brussels could use the threat of nasty consequences for U.S. services exporters as leverage to force Washington to lower its goods tariff,” BreakingViews columnist George Hay said.

There is also the threat of fines against Apple, Meta and Google’s Alphabet. They have been investigated for possible contravention of the EU’s Digital Markets Act. The assumption had been only minimal fines would be levied, but the EU could raise the fines to a potential 10% of their global sales, according to Hay.

Stellantis logo displayed with some of its brands. (Photo by Jakub Porzycki/NurPhoto via Getty … More

Meanwhile, investment bank Morgan Stanley said Porsche and Stellantis sales seemed most at risk amongst auto companies.

“Stellantis and Porsche have the highest U.S. exposures amongst our coverage, both with about 25% of unit sales. Out of these Porsche produces 100% in Europe and Stellantis produces about 53% of its cars locally in the U.S., 32% in Mexico, 11% in Canada and 4% in Europe,” Morgan Stanley said in a report.

“The U.S. market represents about 15% of unit sales for both BMW and Mercedes, produced out of Europe and Mexico and about 8% for VW,” the report said.

Profits will take a hit too.

According to UBS, Porsche, BMW and Mercedes earnings per share could be hit by around 20%, Volkswagen by 33%. Stellantis will be more affected by tariffs on Mexico and Canada with a 28% earnings per share risk.

“We expect the (manufacturers) to cut their full-year EBIT (earnings before interest and tax) margin guidance in due course, possibly even ahead of their first quarter disclosures. The cuts could be as high as (2 percentage points) for BMW and Mercedes and even higher for Porsche,” UBS said in a report.

A blog by UBS experts said they expected short-term U.S. tariffs to move higher as hikes were met by retaliation.

“Nevertheless, as we look over a three-to-six-month horizon, in our base case we do think that the effective tariffs rate will start to gradually reduce as legal, economic, political and business pressure mounts,” the blog said.

“In our base case we think that from around 25% today, effective U.S. tariff rates will peak in the region of 25-30%, be on a downward trajectory by the third quarter, and end 2025 in the 10-15% range,” the blog said.