Despite closing FY’25 on a high note, Peloton has revealed new layoffs as part of its wellness-focused reset that includes sleep, recovery and nutrition

Peloton closed fiscal year 2025 with better-than-expected results and outlined a broader growth strategy under CEO Peter Stern, who took the reins in January and intends to evolve the connected fitness giant into a full-scope wellness platform.

Fourth-quarter revenue came in at $607 million, exceeding the high end of the company’s forecast by $21 million. Connected Fitness Subscriptions totaled 2.8 million, 10,000 above guidance, while paid app subscriptions reached 552,000, also ahead of target.

“Peloton performed above the high end of full-year FY25 guidance on all key metrics,” the company reiterated in its shareholder letter.

Stern used the quarter to debut a long-term vision that positions Peloton as a partner for improving the healthspan for its members.

“A profound shift is underway in how we define a life well-lived,” Stern penned in the letter. “Peloton was built for this moment. In our next chapter, we will build upon our leadership in cardio to support our members’ entire wellness journey, accelerating our progress in strength and mobility and exploring new frontiers in mental well-being, sleep and recovery, nutrition and hydration.”

Here are some other key takeaways from Peloton’s strategy update:

Retail Push & Commercial Growth

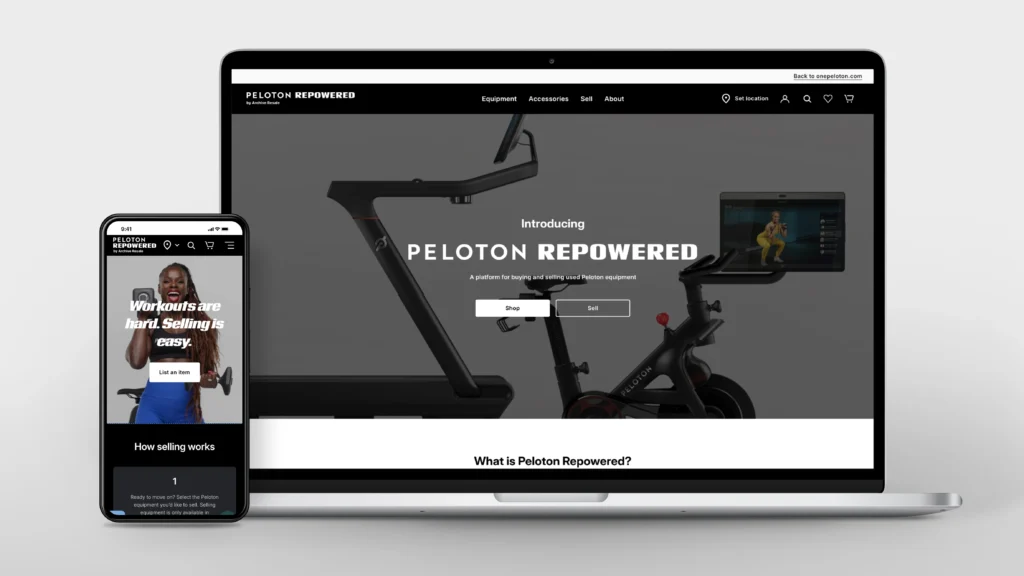

To reignite hardware and subscription growth, Peloton said it will expand its retail and commercial footprint. Plans include growing its microstore presence from one to 10 locations this year and increasing third-party retail partnerships to give more consumers hands-on access to its fitness hardware. The company will also scale its refurbished equipment program, “Peloton Repowered,” from pilot programs in three cities to nationwide availability.

In the commercial space, Peloton plans to integrate its Precor operations with its software and coaching into a unified business unit tailored to gym operators, hotels, residential buildings and campuses. Internationally, the company said it will offer localized, in-language experiences through native instruction, AI dubbing and flexible music licensing.

Driving Retention & Long-Term Engagement

As Peloton shifts from hardware-centric growth to holistic wellness engagement, the connected fitness company says it plans to focus on deepening member relationships.

“The biggest challenge in any wellness regimen isn’t getting started—it’s staying with it,” the company wrote, noting that while Peloton already benefits from a highly engaged community, “we can always do better.”

To that end, the company outlined several strategies to boost long-term commitment, such as gamified onboarding experiences and tailored support that are designed to help members overcome motivational dips early in their journey.

Peloton also teased the launch of a new rewards program designed to recognize healthy habits and member loyalty, an initiative that it says will “evolve and grow over time.” Social features are also getting an upgrade. Peloton plans to expand its Teams functionality, allowing instructors to guide more community-driven engagement and support within the platform.

The connected fitness company also noted an opportunity to position itself as the go-to wellness brand for Gen Z, citing growing interest among younger consumers in sleep, stress management and strength training alongside cardio.

AI, Strength & In-Person Events Take Center Stage

Peloton is also sharpening its competitive edge through personalization and experiential engagement. The company believes it’s already the leading strength subscription service, citing 2 million members who participated in strength training during Q4, more than in any other category.

In another move to deepen results and retention, Peloton said it will leverage AI and wearable integrations to offer members increasingly personalized recommendations, progress tracking and wellness plans. Meanwhile, the company is ramping up its presence beyond the screen, seeking to triple instructor-led in-person events this year and scale that number tenfold by 2027, building on initiatives like its recently launched run club out of its studios in New York City.

Layoffs Loom

Peloton has launched a cost-cutting initiative to generate $100 million in annualized savings by the end of fiscal year 2026, one that includes workforce reductions and relocation of certain roles.

It will begin charging optional fees for expert equipment assembly while expanding free self-installation options. A new “Special Pricing” program also launched, offering discounted equipment to teachers, first responders, military personnel and healthcare workers.