a Successful Investors’s Goal is Making Money, not Caring How or Where it’s Made.

I was fortunate to have several mentors early in my investment career that taught to me valuable financial knowledge. As a Forbes writer and co-host of the ABC talk radio show, “Winning with Winans”, I take my media responsibilities serious in providing sound investment advice to my audience in a turbulent year.

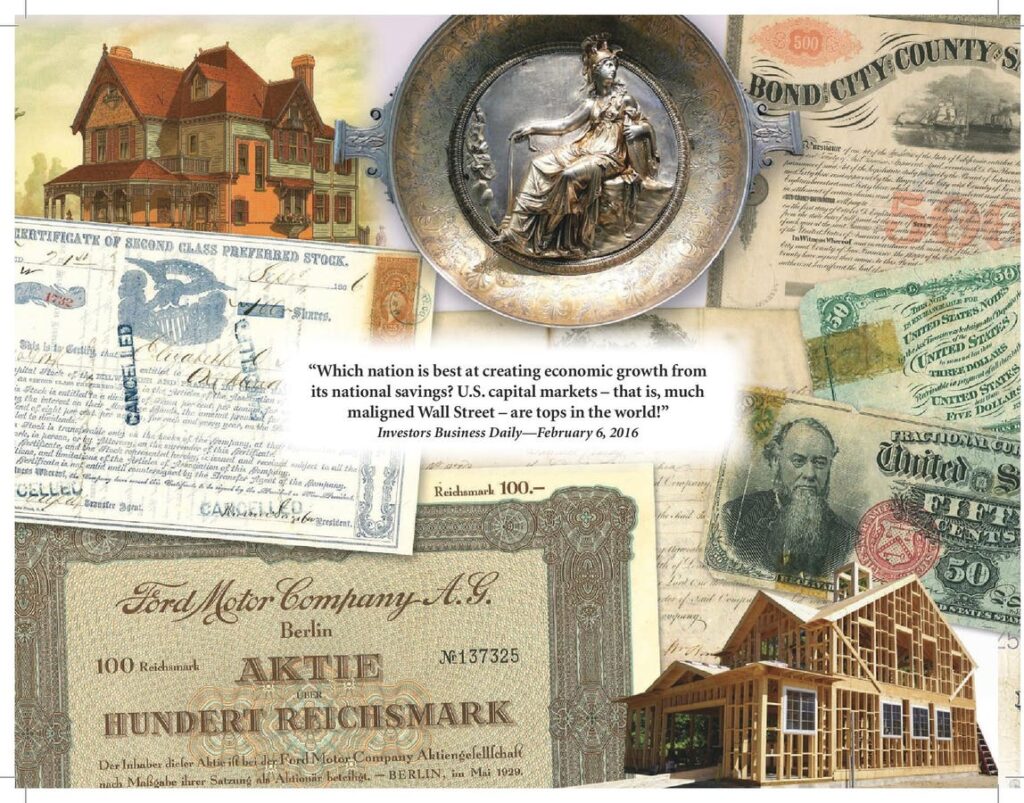

I call myself a historian who manages money which means I never think, “it’s different this time”.

Investment Atlas III

As I review my last twelve months of Forbes articles, these are the most important time-tested lessons my readers should have learned:

1. Follow Market Trends with Time-Tested Technical Tools:

a. (December 29, 2023) – “a reliable tool available on most financial websites that investors can use to gauge the overall trend of the stock market. It is the 200-day moving average (SMA) of the S&P 500 Index….An uncomplicated way for most investors to use this indicator is to simply check whether the current price of the S&P 500 is above or below the price of its 200-day moving average (by at least 2%) at month-end.”

b. (August 8, 2024) – “Historically, when the VIX reverses and drops below 40, there is reduced selling pressure and corresponds with intermediate market low points…when the VIX reaches these extreme levels at or near intermediate low points on the S&P 500 Index and proves to be a good place to remove a market hedge and/or commit new money for investment.”

c. (October 25, 2024) – “total outstanding margin significantly contracted throughout the bear markets of 2000-02, 2008-09 and followed by a rapid credit expansion that fueled new bull markets. The same can be said of the market correction of the 2022 (triggered by rising interest rates to battle high inflation) as traders paid down debt. But, the trend reversed in early 2023 as credit rapidly expanded and powered the stock market to new heights.”

2. Stick With American Stocks & Bonds

a. (August 30, 2024) – “International investors are not all in the same boat. While American investors have the luxury of staying 100% invested in domestic assets, foreign investment has historically flowed into U.S. assets out of necessity. The U.S. has long offered a relatively stable currency and sophisticated, well-regulated and liquid financial markets. It’s one of the key reasons U.S. equity indices are at historic highs during this volatile time in world history.”

3. Boring Stocks in Dull Industries Can Outperform the Market

a. (January 16, 2024) “I ran an analysis on stocks that have been publicly traded since 2000, I found seven stocks (also components of the S&P 500 Index) that, not only vastly outperformed the index, but also comparable with Apple’s superior upside performance but with far less volatility in uncertain times… At first glance, it was a surprising assortment of companies from various industry groups ranging from retail to chemicals – none with a celebrity CEO. What is important is that these stocks have different characteristics especially when it comes to market corrections. The true benefit of diversification!”

4. Crypto Assets and Commodities Can Be Tracked with Technical Analysis

a. (December 13, 2023) As a Commodity Trading Advisor (CTA), it’s hard for me to fathom the popularity of speculating solely in relatively untested, controversial “cryptos” while fortunes can be made in the current fast-running bull markets of commodity futures in cattle (108%), cocoa (up 109%), orange juice (up 254%) and sugar (up 158%)…It doesn’t need to be an “either or” choice! Yet, active traders (big and small) are missing a huge opportunity by not including these time-tested securities within a mix of exotic alternative securities.

b. (June 26, 2024) Both BTC & ETH display short, intermediate & long-term price trends like equities and commodities. This reason alone lays legitimacy to the claim these are in fact investment assets and not a fad. Simply put, if an asset trends, its tradable! Since 2015, a price crossing of more than 4% in the price of BTC above or below its 20-week moving average (red line) was a strong indicator of significant uptrends or downtrends emerging. In fact, 71% of the time a positive crossing signaled rallies that advanced 436% on average. On the flipside, a negative crossing was a precursor to the BTC bear markets in 2018 & 2022 where prices declined over 50%

5. Don’t Politicize Your Portfolio!

a. (January 26, 2004) “The total investment performance of the 31 presidential administrations since 1900 has ranged from 259% to (118%). Since 2000, there have been three Republican and three Democratic administrations. Obama’s first term and Trump tenure are a virtual tie and ranked 13th & 14th. The worst was G.W. Bush’s second term with a ranking of 28th. As of 2023, the Biden Administration currently ranks 27th with stocks advancing 33%, corporate bonds (11%) and housing modestly advancing 17% during this post COVID inflationary period.

Simply put, it all boils down to understanding financial history and using common sense. As the old phrase goes, ”The only pure form of insanity is making the same mistakes and expecting a different result.”