Building wealth that lasts across generations isn’t just about making money—it’s about instilling the right principles and systems that ensure prosperity endures long after the wealth creators are gone. While market volatility and economic uncertainty can erode financial assets, the families that successfully transfer wealth across multiple generations share common foundational principles that transcend individual investment strategies.

Education as the Ultimate Investment

The most enduring family principle among generationally wealthy families is their unwavering commitment to education. This extends far beyond traditional academic achievement to encompass financial literacy, emotional intelligence, and practical life skills. Wealthy families don’t just send their children to elite schools; they create comprehensive learning environments that prepare the next generation to be responsible stewards of family resources.

Financial education begins early, with children learning about budgeting, investing, and the responsibilities that come with wealth. Many families establish junior investment accounts where children can practice making financial decisions with real consequences on a smaller scale. This hands-on approach demystifies money management and builds confidence in handling larger sums later in life.

The Power of Patient Capital

Generational wealth builders think in decades, not quarters. They resist the temptation of get-rich-quick schemes and instead focus on sustainable, long-term growth strategies. This patience manifests in multiple ways: holding quality investments through market cycles, building businesses with enduring competitive advantages, and making decisions based on their impact on future generations rather than immediate gratification.

This long-term perspective also influences how they structure their investments. Rather than chasing the latest investment fad, they focus on diversified portfolios that can weather economic storms while providing steady growth over time. Real estate, established businesses, and blue-chip stocks often form the backbone of their wealth preservation strategy.

Governance and Family Structure

Successful multigenerational families establish clear governance structures that prevent wealth from being dissipated through family conflicts or poor decision-making. This includes creating family constitutions that outline shared values, mission statements, and decision-making processes. Regular family meetings ensure open communication and alignment on major financial decisions.

Many families establish family offices or work with trusted advisors who understand their long-term objectives. These structures provide professional management while maintaining family oversight and control. Clear succession planning ensures that leadership transitions are smooth and that the family’s wealth management philosophy continues across generations.

Work Ethic and Purpose

Contrary to stereotypes about trust fund children, families that maintain wealth across generations typically instill strong work ethics in their offspring. They understand that purpose and productivity are essential for personal fulfillment and wealth preservation. Many require family members to work outside the family business before joining family enterprises, ensuring they develop skills and perspectives that benefit the entire family unit.

This principle extends to teaching children that wealth comes with responsibility—both to the family and to society. Many generationally wealthy families have strong philanthropic traditions that give family members a sense of purpose beyond personal accumulation.

Risk Management and Diversification

Wealthy families understand that preserving wealth is often more challenging than creating it. They implement sophisticated risk management strategies that protect against various threats: market downturns, inflation, political instability, and family disputes. This includes geographic diversification of assets, multiple income streams, and appropriate insurance coverage.

They also diversify across asset classes and industries, avoiding the common mistake of keeping all wealth tied to the business or industry that created it. This diversification helps protect against sector-specific downturns that could otherwise devastate concentrated family wealth.

Communication and Transparency

Open communication about money matters helps prevent the family dysfunction that often destroys inherited wealth. Regular family meetings, clear financial reporting, and honest discussions about challenges and opportunities keep everyone aligned and engaged. Transparency about family finances helps prepare the next generation for their eventual responsibilities.

This communication extends to difficult conversations about money, including discussions about potential conflicts of interest, spending expectations, and the responsibilities that come with inherited wealth.

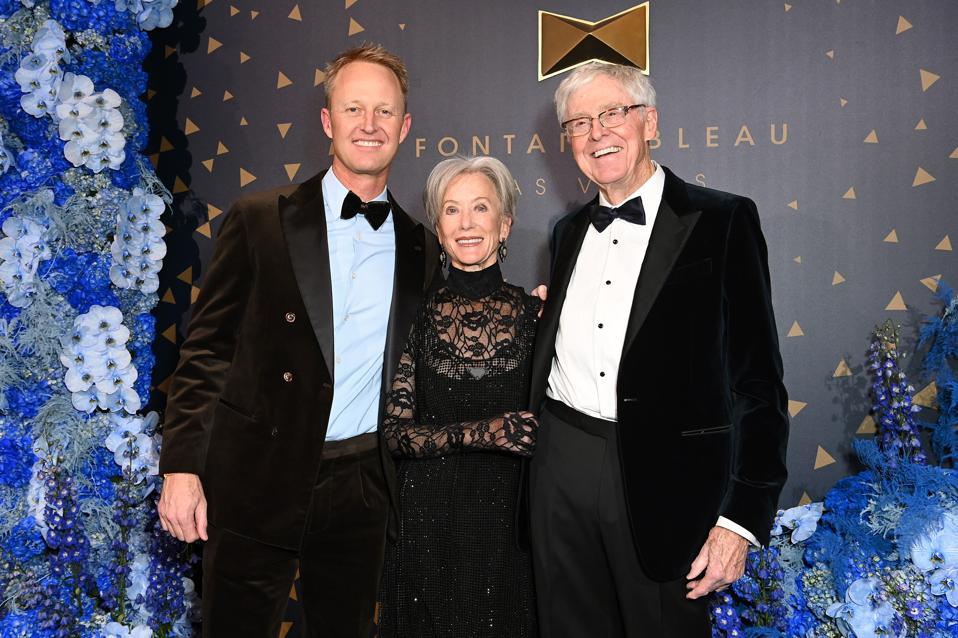

LAS VEGAS, NEVADA – DECEMBER 13: (L-R) Chase Koch, Liz Koch and CEO of Koch Industries Charles Koch … More

Building Systems, Not Just Wealth

The most successful families focus on building systems and institutions that outlast individual family members. This includes establishing family foundations, creating educational trusts, and developing investment philosophies that can guide decision-making across multiple generations.

These systems help ensure that the family’s wealth management approach remains consistent even as leadership changes and new challenges emerge. They provide stability and continuity that helps preserve both financial assets and family unity.

Generational wealth isn’t built overnight, and it requires more than just financial acumen. It demands a commitment to principles that prioritize long-term thinking, education, communication, and responsible stewardship. Families that embrace these principles create legacies that extend far beyond their bank accounts.