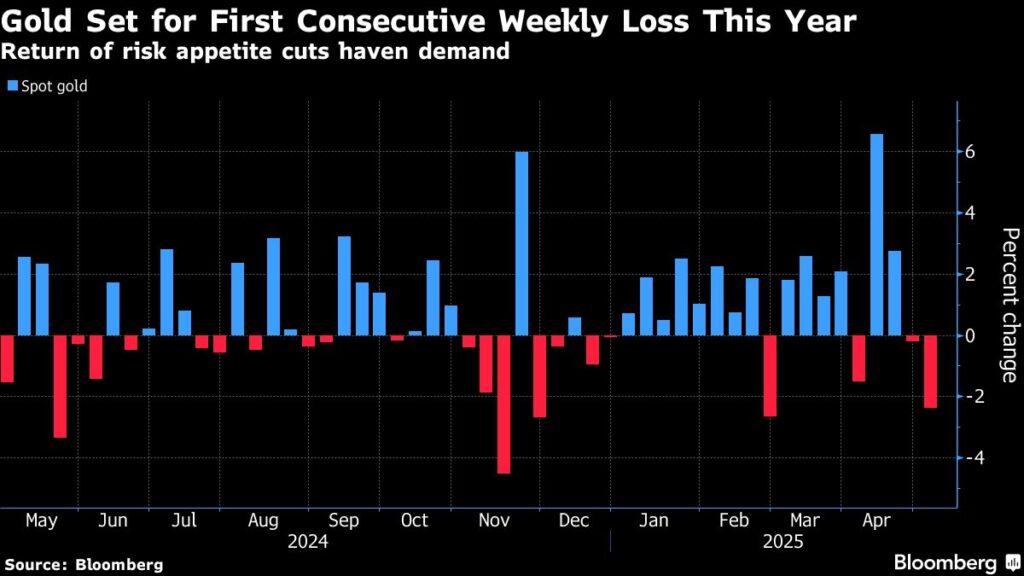

(Bloomberg) — Gold is on pace to record its first back-to-back weekly loss this year as haven appeal eased on strong US jobs data and progress in international trade talks.

Most Read from Bloomberg

Economic data released Friday showed buoyant hiring in April, providing evidence of resilience in an American economy increasingly beset by trade pressures. The strong numbers may keep the Federal Reserve on hold longer, with traders pulling back on bets for Fed rate cuts and pricing in the next reduction in July.

Meanwhile, China said it is assessing the possibility of trade talks with the US, the first sign since US President Donald Trump hiked tariffs last month that negotiations could begin between the two sides.

Despite this week’s sharp selloff, gold is about 23% higher this year and hit a record above $3,500 an ounce last week before losing some ground amid signs the rally was overheated. The ascent has been driven by investors taking refuge in the haven asset on concerns that White House trade policies could slow the global economy. Speculative demand in China and central-bank buying has also supported gains.

Spot gold fell 0.2% to $3,231.90 an ounce as of 12:23 p.m. in New York, and is down 2.7% this week. Silver and platinum fell while palladium rose.

–With assistance from Sybilla Gross and Jack Ryan.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.