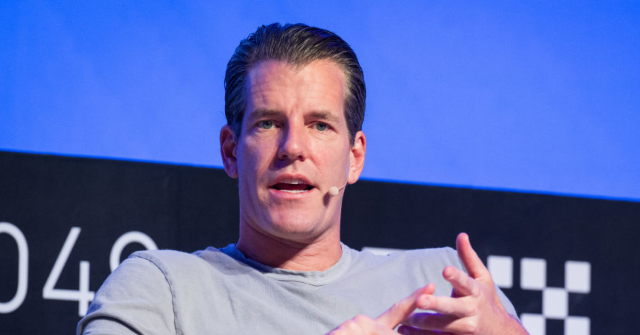

Tyler Winklevoss, one of the founders of the digital currency exchange Gemini, on Thursday told Breitbart News that JPMorganChase’s proposed fees on data aggregators run contrary to President Donald Trump’s goal to make America the crypto “capital of the world.”

Winklevoss spoke to Breitbart News as JPMorganChase (JPMC) decided it would charge fintech companies each time a customer’s information was accessed.

Fitntech and cryptocurrency companies such as Gemini have slammed this decision, likening it to the Obama-era Operation Chokepoint in which government agencies pushed banks to deplatform non-favored companies. Under “Operation 2.0” President Joe Biden and regulatory agencies pushed banks to deplatform cryptocurrency companies.

Winklevoss in mid-July raised the alarm about these proposed fees, believing that JPMorganChase is “trying to kill fintech and crypto companies.”

He wrote, “Jamie Dimon and his cronies are trying to undercut President Trump’s mandate to make America the pro innovation and the crypto capital of the world. We must fight back!”

In a written statement to Breitbart News, Winklevoss said that the fees directly impact their customers, explaining, “Fees, especially at the scale of the fees proposed, will be a new, significant tax on consumers simply for engaging with the modern financial system. If a customer wants to purchase $100 of bitcoin — but now has to pay a $10 tax to JPMorgan to link their bank account so they can fund their purchase — this creates new, unnecessary friction and burden on consumers just for trying to participate.”

After raising his concerns about the proposed fees, he said that JPMC paused their “re-onboarding” of Gemini to the nation’s largest bank:

JPMC believes that third-party data aggregators such as Plaid, MX, and Akoya abuse their secure application programming interface (API) and that roughly 90 percent of customer data is accessed with their knowledge. One CNBC report, citing an internal JPMorgan memo, said that of the 1.89 billion data request from data aggregators, only 13 percent were sent by a customer.

These data aggregators work to connect Americans’ bank accounts to third-party financial platforms such as Robinhood, Gemini, and Fidelity.

In response to claims that data aggregators abuse their use of data requests, Winklevoss retorted, “This claim is intellectually dishonest and totally misrepresents how data access works. Every connection to a bank API on behalf of a customer begins at the direction of the customer and with the customer’s permission. It is only at this point that fintechs like Plaid access a bank API. To represent such calls to a bank API as “not from the customer” when they were directed by and permissioned by the customer is patently false and disingenuous.”

He continued, noting that these data pulls work to prevent overdrafts and monitor suspicious activity, “The ability for consumers to direct and permission third-party applications to access bank APIs on their behalf for their banking data is crucial for their protection and participation in the modern financial system. It is how they get critical alerts for overdraft fees or suspicious activity and up-to-date data for budgeting. It is also how they link their bank accounts to fund their financial transactions with other fintech or crypto apps like Gemini, Coinbase, and Robinhood. Any policy position that restricts or prevents consumers from being able to easily and freely access their banking data or direct their capital to where they see fit is one that only serves to hurt consumers and hobble their ability to take part in the modern financial system.”

John Pitts, the global head of policy at Plaid, has noted that the data pull volume from data aggregators could be fixed through improving technology:

Lauren Bianchi, a JPMC spokeswoman, has said that these claims of a Chokepoint 3.0 are “patently false” and that the bank is not working to “choke off” crypto.

She has said in response to Winklevoss’s posts on X, “JPMorganChase banks many of the best-known crypto companies in the world and is currently onboarding new crypto clients. We’re the #1 bank facilitating consumers’ access to their data, including Chase clients connecting their bank accounts seamlessly to their crypto wallets, and we are focused on keeping that data safe from unregulated data middlemen. It’s patently false that we would block this traffic.”

JPMC this week announced its partnership with digital currency exchange Coinbase to make it easier for Chase banking customers to purchase crypto.

The fight over fees continues as the Consumer Financial Protection Bureau (CFPB) asked a judge on Tuesday to stay a lawsuit challenging the agency’s open banking rule that was implemented under the Biden administration. The open banking rule sought to interpret Rule 1033 of the Consumer Financial Protection Act to give consumers greater control over their financial data and the ability to share that data with third-party service providers such as Gemini.

However, the rule also establishes strict guidelines for third parties to obtain customer data and limit data collection and set robust data security measures. The CFPB aims to “substantially” revise the rule and will work with stakeholders and the public on changes to address the “defects in the initial Rule.”

As the CFPB weighs how to revise the open banking rule, Winklevoss said the policy should not stifle innovation or crypto, which Trump has promised to make America the “crypto capital of the world.”

President Donald Trump helped usher in the passage of the GENIUS Act, a bill to provide a light-touch regulatory state for stablecoins. He also called on Congress to pass legislation that would set a clear regulatory structure for the rest of the crypto industry. On Wednesday, the White House released a report on “strengthening American leadership in digital financial technology.”

“Policy should not be designed to enrich banks and embolden rapacious, rent-seeking behavior. This does nothing to spur innovation, the growth of crypto, and the larger economy,” Winklevoss said. “It only serves to create deadweight loss and enrich the bankers, which is totally contrary to the stated goals of President Trump and the Trump Administration.”

Sean Moran is a policy reporter for Breitbart News. Follow him on X @SeanMoran3