On 5/30/25, Cabot, Dow and Stepan will all trade ex-dividend for their respective upcoming dividends. Cabot will pay its quarterly dividend of $0.45 on 6/13/25, Dow will pay its quarterly dividend of $0.70 on 6/13/25, and Stepan will pay its quarterly dividend of $0.385 on 6/13/25.

As a percentage of CBT’s recent stock price of $76.22, this dividend works out to approximately 0.59%, so look for shares of Cabot to trade 0.59% lower — all else being equal — when CBT shares open for trading on 5/30/25. Similarly, investors should look for DOW to open 2.42% lower in price and for SCL to open 0.68% lower, all else being equal.

10 Stocks Where Yields Got More Juicy »

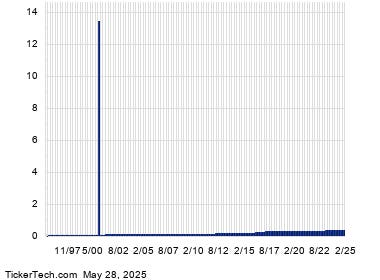

Below are dividend history charts for CBT, DOW, and SCL, showing historical dividends prior to the most recent ones declared.

Cabot:

CBT

Dow:

DOW

Stepan:

SCL

In general, dividends are not always predictable, following the ups and downs of company profits over time. Therefore, a good first due diligence step in forming an expectation of annual yield going forward, is looking at the history above, for a sense of stability over time. This can help in judging whether the most recent dividends from these companies are likely to continue. If they do continue, the current estimated yields on annualized basis would be 2.36% for Cabot, 9.68% for Dow, and 2.73% for Stepan.

Free Report: Top 8%+ Dividends (paid monthly)

In Wednesday trading, Cabot shares are currently up about 3%, Dow shares are up about 2.1%, and Stepan shares are up about 3.7% on the day.