(Bloomberg) — Emerging-market stocks gained for a second day, making a final push for the year on the back of an Asian tech rally and signs that China is gearing up to unleash more stimulus.

Most Read from Bloomberg

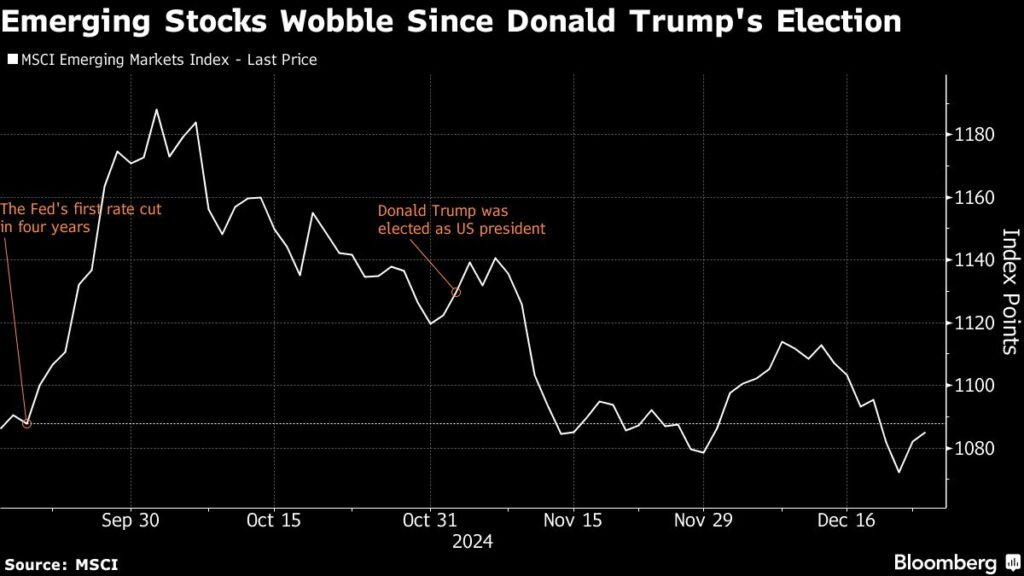

MSCI’s benchmark EM equity index closed 0.3% higher Tuesday in thin trading ahead of the holidays, buoyed by a 1% advance in Chinese stocks. While it’s headed for a total return of around 9% this year, it still has significantly underperformed developed market stocks, which have returned more than 20%.

MSCI’s gauge for emerging currencies, meanwhile, closed little changed after trading down most of the day, putting it on a path toward a 0.5% loss this year. Meantime, sovereign and corporate dollar bonds from emerging markets have returned about 6.5% in 2024, according to a Bloomberg index.

A number of headwinds loom for developing nations, including threats of tariffs increases by President-elect Donald Trump, geopolitical tensions and signs of sticky inflation. However, some investors remain optimistic.

The year “2025 will bring again volatility, specially when Trump arrives officially in the power seat, but EM companies have very sound fundamentals which will help them navigate in this uncertain environment,” said Arnaud Boué, a senior fixed-income portfolio manager at Bank Julius Baer in Zurich. “Net leverage is very low for investment grade but also high-yield companies and default expectations are also very low.”

In a positive for markets, Chinese markets got a boost from a Reuters report that policymakers plan to sell a record three trillion yuan ($411 billion) in special treasury bonds in 2025 to bolster the slowing economy. Chinese stocks rose, bringing this year’s gains to over 16%.

Asian tech shares also extended their recent rally, with Taiwan Semiconductor Manufacturing Co. hitting a record high, putting the world’s largest contract chipmaker on course for its best annual stock performance in 25 years. The stock climbed as much as 1.4% on Tuesday, before erasing the gain to end flat. Shares in Alibaba Group Holding Ltd. also jumped 2.7%.

The Colombian peso climbed 1% as the outperformer among developing currencies, while the South African rand was a notable laggard with a 0.7% slide. The South Korean won also fell, undermined by weak consumer confidence data as well as the opposition party’s pledge to open impeachment proceedings against Acting President Han Duck-soo.