(Bloomberg) — Not since the financial crisis has Corporate America been so downbeat about the state of the economy in earnings calls, an ominous sign for investors trying to figure out how much more pain Donald Trump’s trade war will inflict on the stock market.

Most Read from Bloomberg

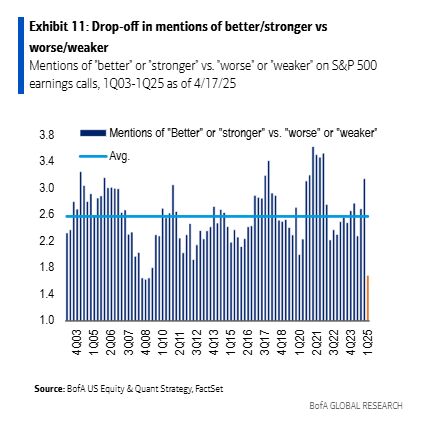

The ratio of positive to negative comments on macroeconomic conditions during this reporting season has dropped well below its average and is on track for the worst proportion since 2009, according to a Bank of America Corp. analysis of the first conference calls.

Earnings season is usually a boon for equities, but with the S&P 500 down nearly 15% from February’s all-time high as investors brace for the fallout of Trump’s attempts to rewrite the rules of global trade, the stakes could hardly be higher this time around. That’s especially true for firms with profits more closely tied to vagaries of the economy, like carmakers and transports.

Some executives are struggling to gauge the impact of the White House’s rapidly shifting policies on their businesses. That’s further pressuring US stocks that threatened to sink back toward a bear market in recent days on the heightened risk of a recession and a resurgence in inflation from Trump’s levies.

“Almost every corporate CEO is revising down their outlook,” said veteran market strategist Jim Paulsen. “The commentary warnings of the corporate sector have escalated.”

ASML Holding NV warned it doesn’t know how to quantify the impact of tariff announcements that are threatening to upend the semiconductor industry. Delta Air Lines Inc. withdrew its full-year financial guidance on the uncertainty surrounding global trade, while Kimberly-Clark Corp. has lowered profit expectations for the year, citing questions on the impact of the trade war on its costs.

Cutting Guidance

So far in the current quarter, 27% of the firms in the S&P 500 Index have cut their guidance for 2025 while only 9% have increased their outlook, according to data compiled by Bloomberg Intelligence.

Automakers had the grimmest expectations, slashing outlook for earnings over the next 12 months by around 9% on average in April, data compiled by Citigroup Inc. show. On the flip side, firms that make necessities like food and consumer staples, which tend to fare better during recessions, were among the most optimistic, raising their estimates by more than 1%.