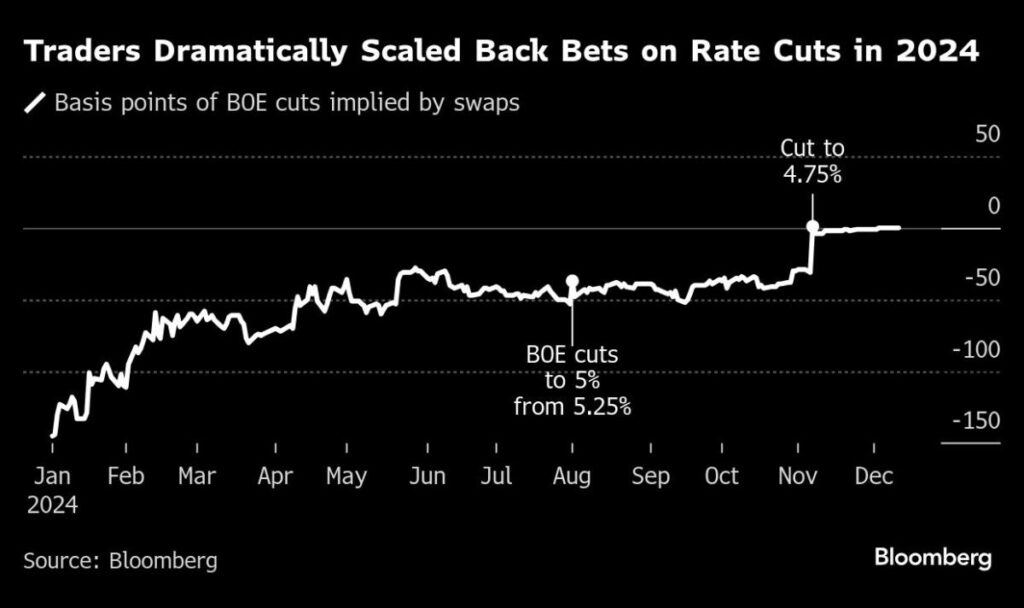

(Bloomberg) — The Bank of England entered the year with investors expecting six interest-rate cuts, a sudden easing that promised to breathe life into the UK economy. It will end 2024 holding borrowing costs a full percentage point higher than forecast 12 months ago.

The British central bank is expected to leave rates unchanged at 4.75% at its meeting on Thursday and maintain its guidance that a “gradual approach to removing policy restraint remains appropriate.” While BOE Governor Andrew Bailey has said that four cuts over the course of 2025 are likely, markets — perhaps stung by their aggressive bets a year ago — are pricing in just three, starting in February.

The Dec. 19 decision, in what is projected to be a wait-and-see meeting, will conclude a very different year to the one predicted by traders and some economists in January when Britain was emerging from a mild recession with rates at a 16-year high.

Then, markets were forecasting six quarter-point-cuts to 3.75% in 2024 – a path endorsed by Goldman Sachs economist Sven Jari Stehn. Instead, the BOE made just two, in August and November, as officials fretted that easing too quickly into a tight labor market risked reigniting inflation.

Their reluctance to lift the brakes has left the BOE lagging behind the easing cycles of its US and eurozone counterparts and made the pound the best-performing Group of 10 currency this year.

The result is that monetary policy has borne down harder on inflation, which has fallen faster than the BOE forecast and is now just above the 2% target. Bailey said it was a sign of success.

But businesses, consumers and homeowners accused the bank of inflicting unnecessary pain. The BOE even came under political pressure to cut rates ahead the July general election, with the then-Conservative chancellor, Jeremy Hunt, repeatedly invoking the prospect of cheaper money as he sought a feel-good factor in the economy. His intervention was criticised by economists and former officials for encroaching on the independence of the central bank.

Pricing at the start of the year was heavily influenced by developments in the US. Money markets bet that both the BOE and the Federal Reserve would deliver one and half points of cuts. Expectations soon changed after it became clear the US economy was faring much better than expected, and that the BOE was unconvinced it had won the battle to tame underlying prices pressures in the services sector.

The Monetary Policy Committee once again heads into the new year with little clarity about the outlook and the economy at a crossroads. In 2024, the UK election hung over the outlook. Now, incoming US president Donald Trump is threatening a global trade war while, domestically, the Labour government’s first budget in October has left unanswered questions.

Business and consumer sentiment has weakend further since the budget, when Chancellor of the Exchequer Rachel Reeves announced a £26 billion ($32.9 billion) tax hit on employers. Meanwhile, growth has stalled and inflation is showing signs of picking up. That is complicating policy for the bank, which “has expressed uncertainty on the pass-through of fiscal measures,” said Bank of America UK economist Sonali Punhani.

Depending on how businesses respond to the payroll-tax increase and another big rise in the minimum wage, inflation could prove stickier or growth could be weaker. Labour has also borrowed heavily to boost public investment, which both the Office for Budget Responsibility and the BOE judge will lift prices.

“The bulk of the MPC seems content to simply monitor the near-term developments and reconvene in February, perhaps with more conviction on the path ahead,” Morgan Stanley Chief UK Economist Bruna Skarica said.

A deluge of data this week may help clarify things. Consumer price figures on Wednesday are forecast to show inflation increasing 0.3 percentage point to 2.6% in November. That’s above the 2.4% forecast by BOE, which is expecting price growth to accelerate on energy prices before drifting back toward target. Economists see services inflation staying stubbornly high at 5.1%.

Regular wage growth, another gauge of underlying pressures, is expected to climb slightly to 5% when jobs data is released on Tuesday. The BOE consensus is that pay growth of more than 3% or so is incompatible with 2% inflation.

Morgan Stanley’s Skarica said any sign that employment was softening may convince the MPC’s newest member Alan Taylor, to join fellow external Swati Dhingra in calling for a rate cut, which would move the vote split to 7-2.

In November, the sole dissenter was Catherine Mann, who backed holding rates when the rest of the nine-member committee voted to cut.

“Next year is all about how the UK absorbs the budget changes,” said Matthew Amis, an investment director at abrdn. “If the private sector is able to pass the extra costs onto the consumer, then that will be inflationary and we struggle to see the BOE cutting three times.”

Amis said he was leaing toward a second scenario in which the private sector struggles to pass on the extra costs and resorts to job cuts. “In this instance, we think the gradual rate cut profile seems unrealistic and the MPC have to speed up the pace of rate cuts in the first half,” he said.

The BOE is now falling behind both the European Central Bank, which has cut its deposit rate four times since June to 3% from 4%, and the US Federal Reserve, which has cut twice – including a big half point reduction in September – to a range of 4.5%-4.75%. The Fed may cut again on Dec. 18, the day before the BOE meeting.

The differing pace of rate cuts has caused cross currents in currency markets. Earlier this week, the pound closed at its strongest level against the euro in more than eight years, while the yield spread between gilts and German peers is approaching the widest in more than two years.

Nomura economist George Buckley said that would leave the BOE “in between” the ECB, which is cutting fast as growth falters, and the Fed, which he expects will pause cuts in March. Like most economists, Buckley believes the BOE will wait this month and cut by a quarter-point in February. “We see policy divergence emerging,” he said.

Mike Riddell, portfolio manager at FIL Investment Management Ltd, said: “The path for the BOE looks a lot like the Fed — but one of those economies is growing at around 3% rate, and one isn’t growing at all.”

–With assistance from Tom Rees.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.