As Bitcoin (BTC) continues to consolidate slightly below the $120,000 level, the dominance of new investors is steadily rising. However, on-chain data shows that BTC is still far from overheating, suggesting the premier cryptocurrency may have more room to run before a significant correction sets in.

Bitcoin May Still Have Some Room To Run

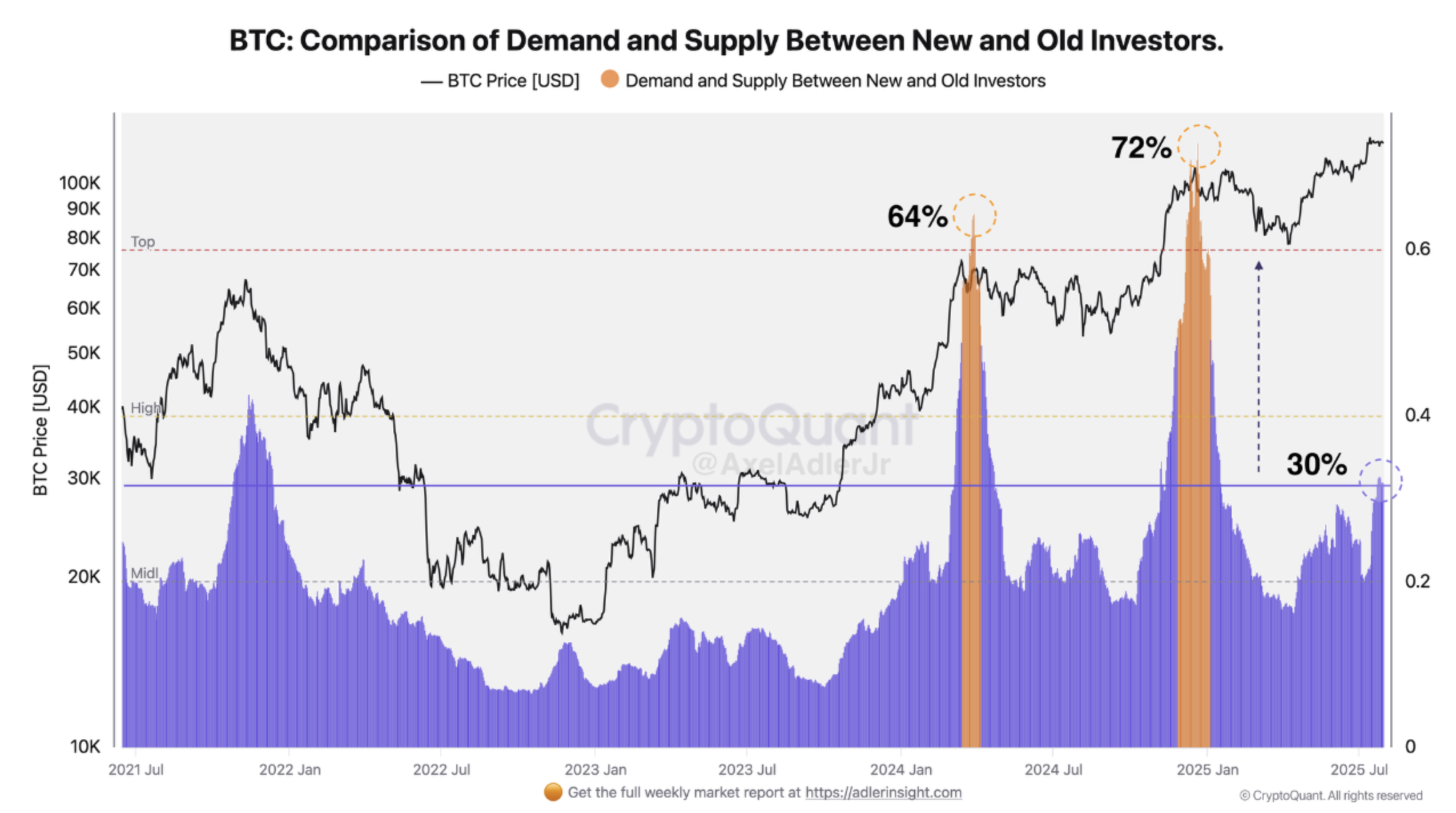

According to a CryptoQuant Quicktake post by contributor AxelAdlerJr, new investor dominance in Bitcoin is gradually increasing – currently hovering around 30%, which is only halfway to the historical “overheated” threshold.

Related Reading

The analyst shared the following chart, which highlights two past instances – marked in orange – when new investor dominance reached overheated levels and coincided with BTC local price tops.

The first instance occurred in March 2024 when the metric hit 64%, and the second in December 2024 when it peaked at 72%. In both cases, BTC experienced a significant pullback, leading to the formation of local bottoms.

Notably, as the influx of new liquidity dried up during these phases, long-term holders began actively taking profits. This added further pressure on BTC’s price.

Currently, while new investor dominance is trending higher, it remains well below the euphoria zone – typically between 60% and 70% – suggesting more upside potential in BTC’s bullish momentum before exhaustion.

Meanwhile, older holders continue to sell moderately. The chart indicates a coefficient of 0.3, showing that the supply of three-year-old BTC is still absorbing fresh demand without sharp disruptions.

From a long-term perspective, the market remains balanced, and the risk of large-scale capitulation from veteran wallets appears low. AxelAdlerJr concluded:

If the indicator’s growth accelerates and approaches the historical corridor of 0.6-0.7, one should expect intensified profit-taking and, consequently, a correction. For now, the supply/demand structure remains in a healthy late bull cycle phase, when new money is coming in but old players have not yet transitioned to mass selling.

Is BTC Price About To Stall?

While the data above suggests that Bitcoin still has room to grow, other indicators point to waning momentum. One such signal is the recent decline in the Bitcoin Coinbase Premium Gap, which has broken its long streak of positive values.

Related Reading

Fellow CryptoQuant analyst ArabChain confirmed this development in their analysis. They noted that US investor enthusiasm for BTC appears to be cooling at current price levels.

That said, positive macroeconomic factors – such as BTC’s historical correlation with global M2 money supply expansion – could still lead the digital asset to new all-time highs in the near term. At press time, BTC trades at $118,371, up 0.6% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com