Bitcoin surged past the $120,000 mark, reaching an intraday high of $122,300 — just shy of its all-time high at $123,000. The move marks a strong bullish continuation after weeks of upward momentum, fueling hopes among traders that a new record could be imminent. However, seasoned investors are approaching the rally with caution, warning that current price action could represent a relief rally before another consolidation phase.

Related Reading

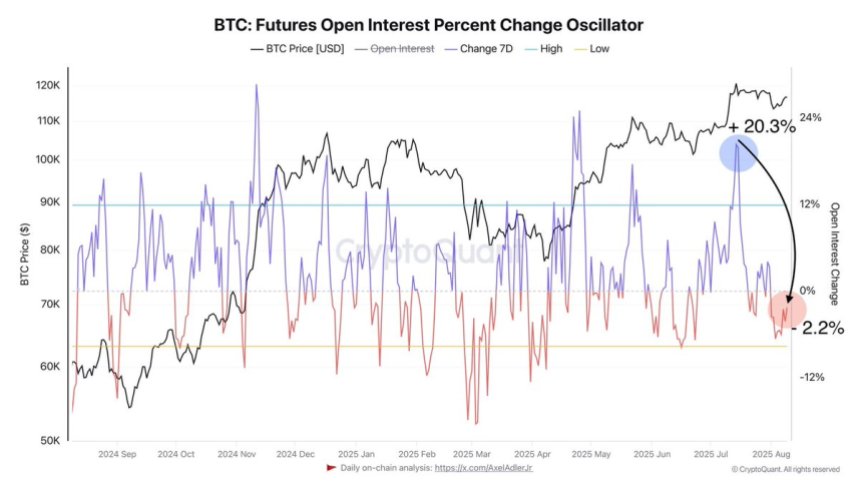

Fresh data from CryptoQuant adds a layer of complexity to the market outlook. After a sharp rise in average weekly open interest to over 20% — peaking on July 14 — the metric has since dropped significantly, now turning negative. This shift suggests that short-term risk appetite has diminished, potentially reducing speculative momentum in the near term.

While open interest declines are not inherently bearish, they can indicate a cooling phase after periods of aggressive leverage. In some cases, such pullbacks in open interest, especially when paired with increased liquidations, have preceded attractive buying opportunities. For now, Bitcoin’s position near record highs offers both promise and risk, with the next few sessions likely to determine whether the market pushes higher or pauses for consolidation.

Open Interest Signals Cooling Risk Appetite

Top analyst Darkfost has shared fresh market insights, highlighting a notable shift in Bitcoin’s derivatives landscape. According to his analysis, the current weekly average for open interest change sits at -2.2%, marking a sharp reversal from the +20% levels seen just weeks ago. This drop signals that short-term risk appetite among traders has clearly diminished, with many participants reducing leveraged positions after an extended bullish run.

Liquidations are a key factor in this development. Darkfost points out that when open interest experiences a sharp short-term drop alongside a spike in liquidations, it often presents a window for profitable long entries. This setup typically occurs when overleveraged positions are wiped out, allowing stronger hands to accumulate at more favorable levels. While not a precise buy signal, it remains a valuable tool for gauging market conditions and identifying potentially favorable entry zones.

The current backdrop is particularly intriguing as Ethereum pushes toward all-time highs, drawing increased attention to the broader crypto market. Bitcoin’s stability above the $120K level, combined with improving sentiment across altcoins, sets the stage for potentially strong follow-through in the coming weeks. However, traders will be watching derivatives metrics closely for signs of renewed leverage or further cooling before committing to larger positions.

Related Reading

Bitcoin Tests Key Resistance Just Below All-Time High

Bitcoin has surged to $121,337, marking a strong breakout from its recent consolidation phase and pushing to its highest level since setting the all-time high at $123K. The daily chart shows a decisive move above the $119K zone, confirming bullish momentum after holding support at the 50-day moving average near $114,155.

This rally brings BTC within striking distance of the $123,217–$124,000 resistance area, a critical zone that previously capped upside attempts in July. A clean break and daily close above this level could open the door for a new all-time high, potentially triggering further upside momentum as traders chase the breakout.

Related Reading

With Ethereum nearing its own record highs and altcoins showing renewed strength, Bitcoin’s performance in the coming sessions will be pivotal for broader market sentiment. If BTC manages to secure a sustained move above $124K, it could fuel a market-wide surge. However, failure to break higher may see a period of consolidation before the next decisive move.

Featured image from Dall-E, chart from TradingView