After the massive crash on October 10 – which saw Bitcoin (BTC) touch $102,000 before recovering some losses – some analysts now predict that the top cryptocurrency may be on the verge of another bullish rally as it enters the ‘disbelief phase.’

Bitcoin In Disbelief Phase – Trouble For Bears?

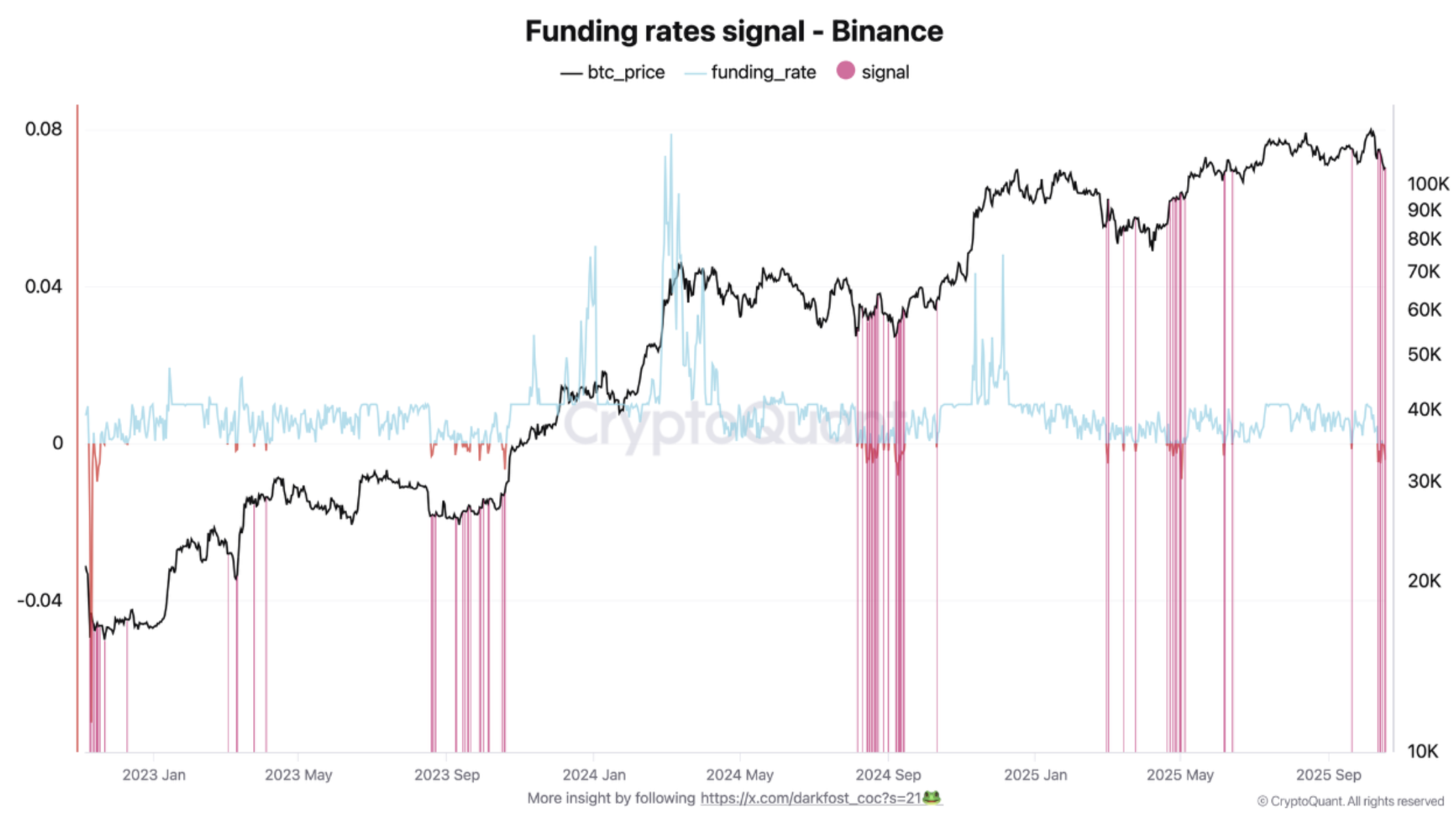

According to a CryptoQuant Quicktake post by contributor Darkfost, Bitcoin appears to be entering the disbelief phase, which increases the possibility of a rebound to the upside. The contributor emphasized the slightly negative funding rate to support their analysis.

Related Reading

For the uninitiated, the Bitcoin disbelief phase occurs when a new uptrend begins, but most investors remain skeptical after a recent correction, doubting that the recovery is real. During this phase, lingering bearish sentiment and short positions often act as fuel for a stronger rally once confidence returns.

Darkfost stated that investors’ skepticism toward BTC returning to bullish mode can be gauged through BTC funding rates in the derivatives market. Funding rates remained negative at -0.004% on the exchange for six out of seven days over the past week, indicating traders are still slightly bearish.

The likely reason behind traders’ short bias is the October 10 crypto market crash that led to a liquidation worth $19 billion. Since then, traders have consistently chosen to short the market instead of getting trapped in another price pullback.

However, the longer BTC remains in the disbelief phase, the stronger the potential for an explosive upside move becomes. Darkfost added:

If the current uptrend continues to establish itself, the growing pile of short positions against it could become a powerful fuel for the next leg higher. As these shorts get liquidated, it would drive prices upward, triggering a short squeeze.

If a short squeeze happens, then BTC could quickly rally to major liquidity zones around $113,000 level, and even as high as $126,000 region, where significant short orders liquidations are clustered.

The analyst shared two previous instance where such a pattern played out. In September 2024, BTC fell to $54,000 before surging to a new all-time high beyond $100,000.

Similarly, in April 2025, the flagship digital asset rallied from $85,000 to $111,000, before climbing even higher to $123,000. To conclude, the Bitcoin market may be on the verge of another short squeeze, fueled by investors’ skepticism.

BTC Investors Need To Be Cautious

Although BTC is giving hints of a looming short squeeze, investors should still exercise some caution before entering the market in hopes of an instant turnaround in sentiment. For example, Bitcoin activity recently slumped below its 365-day average, raising fears of a loss of momentum.

Related Reading

That said, some crypto analysts forecast that BTC is likely done with the price correction and is set to surge in the coming days. At press time, BTC trades at $110,814, up 2.8% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com