With more than 100 S&P 500 (^GSPC) companies set to report first quarter financial results this week, investors will be closely listening to how individual outlooks are shaping up amid shifting policies from the Trump administration.

Technology stocks, which have led the selling action during the tariff-induced market drawdown, will be in particular focus. Each of the so-called “Magnificent Seven” stocks are now off 23% or more from their most recent 52-week high.

Given that the market has already sold off extensively over the past month, several Wall Street strategists have pointed out that simply watching how stocks react the day after a major earnings release will be a telling sign of whether the market has bottomed.

“Ultimately, the importance of the Q1 reporting period will be in the information it provides as to what is priced into single stocks as C-suites start providing some tariff context,” Citi equity strategist Scott Chronert wrote in a note to clients ahead of the earnings rush.

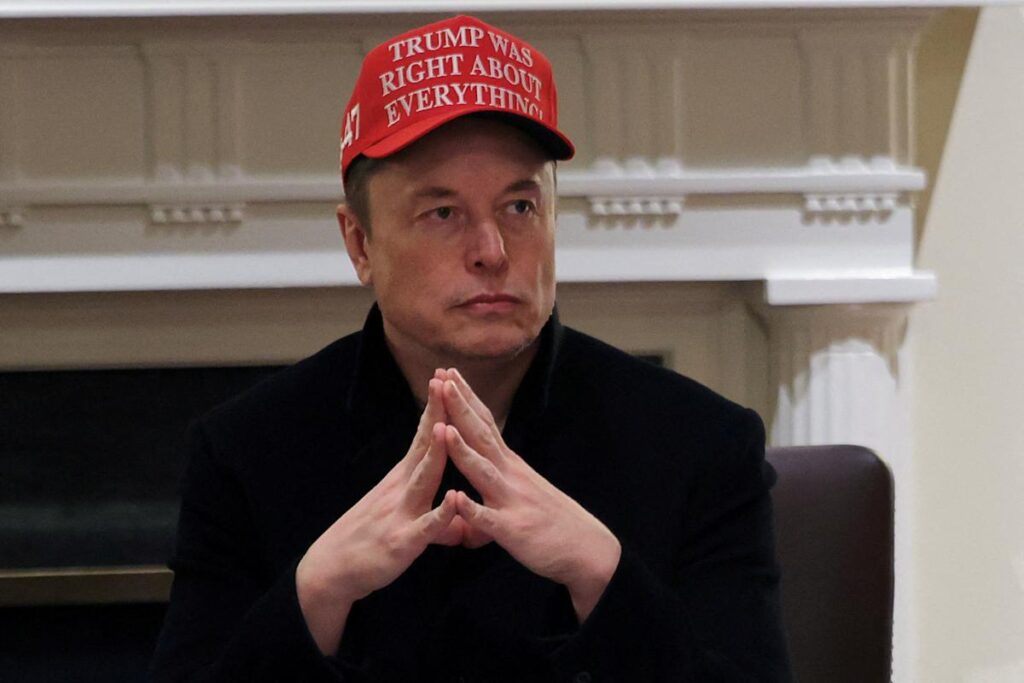

Alphabet (GOOGL, GOOG) and Tesla (TSLA) are set to report this week. Shares of the search giant are down nearly 29% from their recent 52-week high. Tesla stock is down about 54% from its recent 52-week high.

A fair amount of bad news has already likely been priced into Tesla’s stock, with disappointing deliveries for the quarter already known and 2025 annual earnings estimates already down about 20% in the past four months. But the question remains whether the stock has been rerated low enough ahead of its earnings release Tuesday.

Fundstrat head of research Tom Lee wrote in a note to clients on Monday that Tesla’s stock reaction after it reports earnings on Tuesday night will “tell us how ‘washed out’ key names” in the stock market have become. Truist Co-CIO Keith Lerner told Yahoo Finance that the stock market sell-off of the past month has occurred in anticipation of a weakening earnings outlook for corporations as Trump’s tariffs take hold. This, Lerner said, makes the upcoming earnings less about what companies say and more about how the stocks “act.”

Read more: The latest news and updates on Trump’s tariffs

Investors are already expecting companies to cut earnings guidance, Lerner said. But if a company makes that move and the stock moves higher following the news, it will be an important sign that bad news has already been priced in.

“That’s the key in our view,” Lerner said.

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.