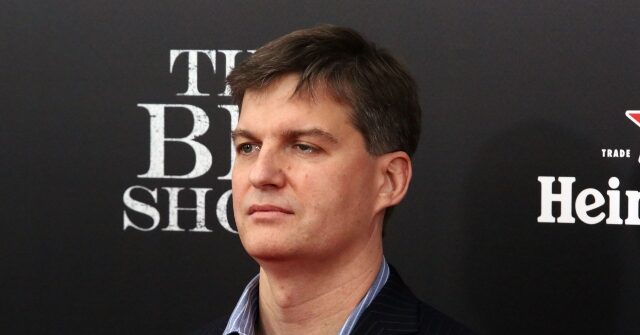

Michael Burry, the investor who gained fame for his role in “The Big Short,” has recently accused major technology companies of using aggressive accounting tactics to artificially boost their earnings amidst the AI boom. The fresh accusations come shortly after Burry went public with claims of an “AI bubble.”

CNBC reports that in a recent post on X, Michael Burry, the investor made famous by The Big Short, alleged that “hyperscalers” — the major cloud and AI infrastructure providers — are understating their depreciation expenses by estimating that chips will have a longer lifespan than is realistic. Burry argues that this practice artificially inflates the companies’ reported earnings.

“Understating depreciation by extending useful life of assets artificially boosts earnings – one of the more common frauds of the modern era,” Burry wrote in his post. He adds that “Massively ramping capex through purchase of Nvidia chips/servers on a 2-3 yr product cycle should not result in the extension of useful lives of compute equipment. Yet this is exactly what all the hyperscalers have done. By my estimates they will understate depreciation by $176 billion 2026-2028.”

Burry estimates that from 2026 through 2028, this accounting maneuver would understate depreciation by approximately $176 billion, inflating reported earnings across the industry. He specifically called out Oracle and Mark Zuckerberg’s Meta, stating that their profits could be overstated by roughly 27 percent and 21 percent, respectively, by 2028.

While Burry’s accusation is serious, it may be difficult to prove due to the leeway companies are given in estimating depreciation under generally accepted accounting principles (GAAP). When paying for a large asset upfront, such as semiconductors or servers, a company is allowed to spread out the cost of that asset as a yearly expense based on the company’s estimate of how rapidly that asset depreciates in value. By estimating a longer life cycle for the asset, companies can lower the yearly depreciation expense that impacts their bottom line. Burry promised he will release additional details of his findings on November 25.

Breitbart News reported in early November that Burry publicly announced short positions on major AI players, claiming tech companies have formed an AI bubble:

In a series of 13F regulatory filings released on Monday, Michael Burry’s Scion Asset Management revealed that it had bought put options on Nvidia and Palantir, indicating a bearish stance on the two companies. The disclosures came just days after Burry posted a cryptic warning to retail investors about market exuberance on social media, including an image of his character from The Big Short movie and a warning that “sometimes, we see bubbles.”

Burry’s disclosure prompted a sharp reaction from Palantir CEO Alex Karp, who called the wagers “super weird” and “batshit crazy.”

Read more at CNBC here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship.