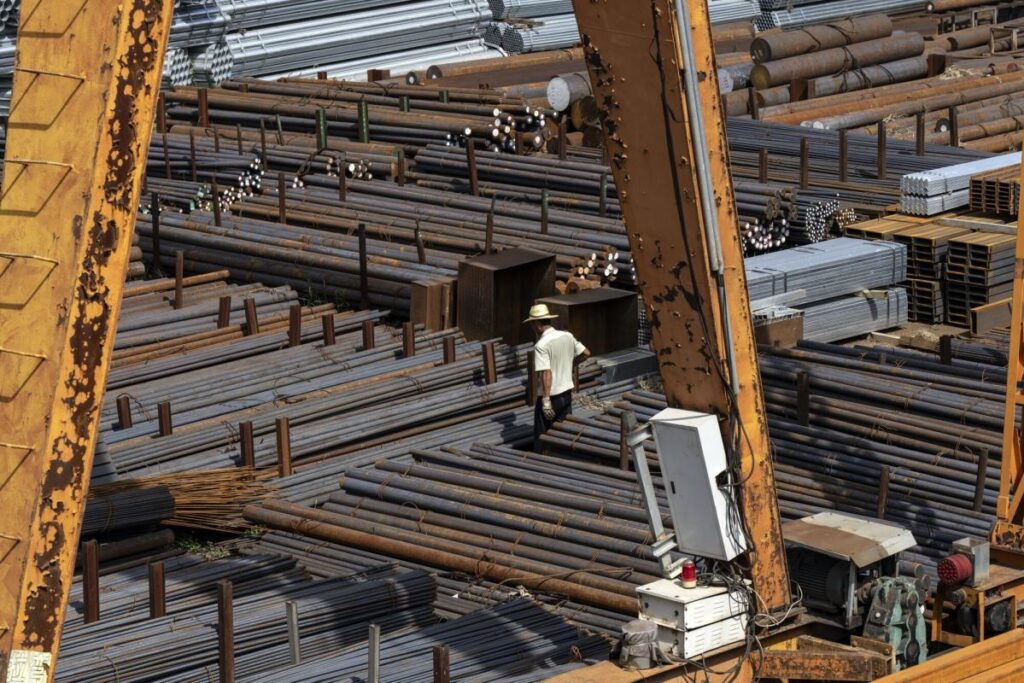

(Bloomberg) — Base metals were broadly higher as global equities rallied and Reuters reported that China’s policymakers are planning to boost bond sales.

Most Read from Bloomberg

Nickel, zinc and aluminum all rose more than 1% on the London Metal Exchange, while copper also advanced. China may sell a record 3 trillion yuan ($411 billion) of special treasury bonds next year, Reuters reported, a move aimed at bolstering the slowing economy.

Fears of faltering Chinese demand have weighed on base metals, with the LMEX Index down about 8% this quarter. Investors are also fretting about the prospect of trade turmoil when US President-elect Donald Trump returns to the White House.

But global risk assets — including commodities — took support this week from US data that showed the slowest increase in personal consumption spending since May, reigniting bets on more monetary easing from the Federal Reserve.

Aluminum also rose Tuesday after orders to withdraw stockpiles from LME warehouses rose to the highest since mid-October. Traders asked to withdraw more than 82,000 tons of the metal, primarily from inventories in South Korea.

Aluminum climbed 1.6% on the LME as of 10:30 a.m. in London. Nickel increased 1.2%, while zinc was up 1.8%. Copper added 0.7%.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.