Bitcoin (BTC) has declined more than 10% from its latest all-time high (ATH) of $124,128, recorded on Binance in August 2025. However, fresh on-chain data suggests that the cryptocurrency may be preparing for its next bullish wave, as miners are starting to show a structural shift in behavior.

Bitcoin Miners Shift Strategy – New High Ahead?

According to a CryptoQuant Quicktake post by contributor Avocado_onchain, recent on-chain data hints at a structural shift in Bitcoin miner behavior. At the same time, various other metrics point toward increasing resilience in the Bitcoin network.

Related Reading

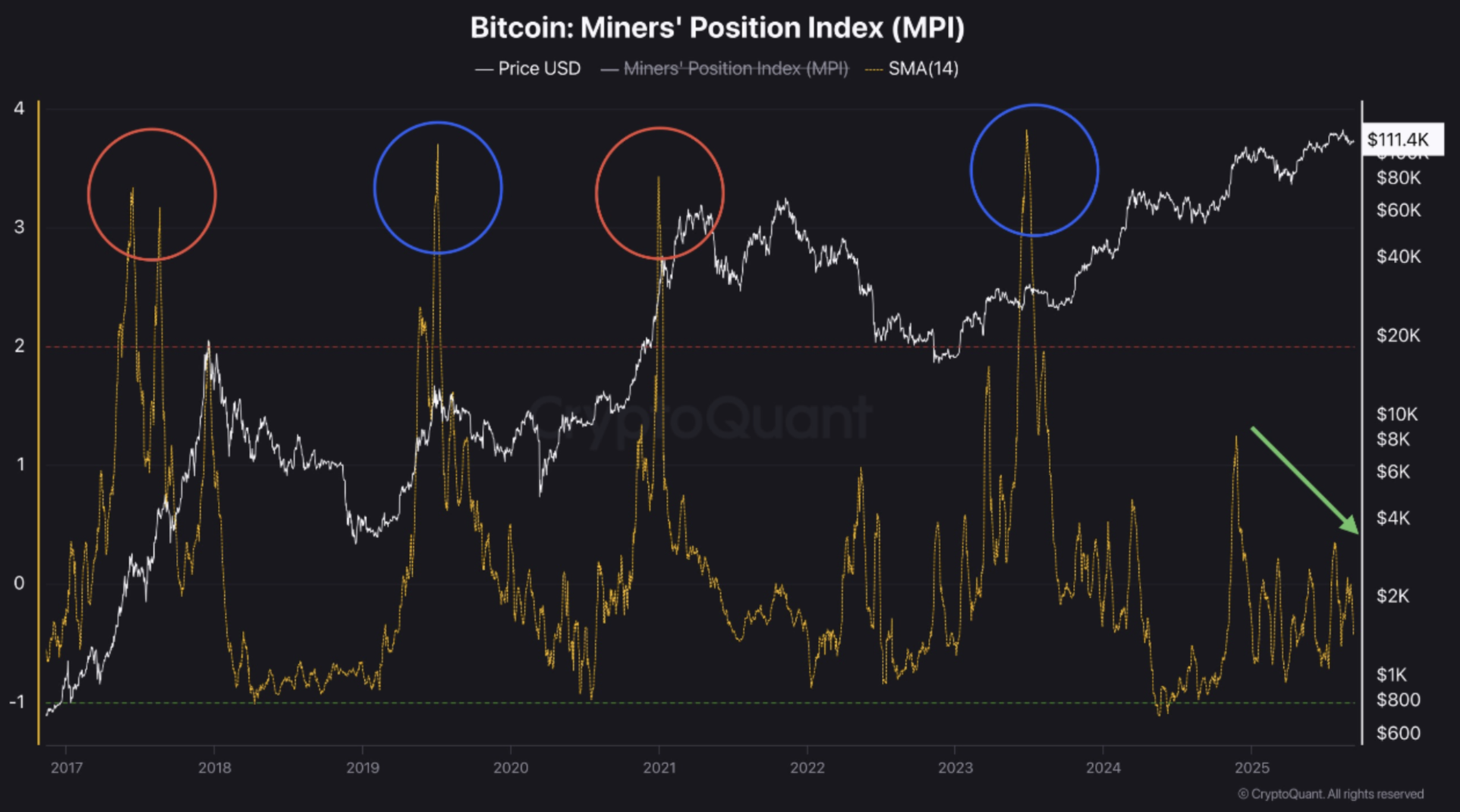

The analyst brought attention to the Miners’ Position Index (MPI), a metric that has historically shown sharp increases in two scenarios – before a halving when miners strategically sell their holdings, and in late stages of a bull market when they dump their holdings on retail investors.

For the uninitiated, the MPI measures the ratio of Bitcoin miners’ outflows – coins sent to exchanges – relative to their one-year moving average. A high MPI indicates that miners are selling more BTC than usual – signaling increased selling pressure – while a low MPI suggests miners are holding or accumulating.

However, the current market cycle shows a different trend. While some pre-halving selling was evident, the late bull market sell-offs have been noticeably absent. According to Avocado_onchain, there could be two major reasons for the lack of sell-off.

First, the approval and success of spot Bitcoin exchange-traded funds (ETFs) may have had some influence on holders. According to data from SoSoValue, the total net assets tied in spot BTC ETFs currently stand at $144.3 billion – representing 6.5% of BTC’s total market cap.

The other potential reason for lukewarm sales of BTC at this stage of the market could be the digital asset’s rapidly rising adoption as a strategic reserve asset by major economies around the world. As a result, miners may be shifting from short-term gains to long-term accumulation.

In addition, Bitcoin mining difficulty also recently reached a new ATH, as its growth curve developed a so-called “banana zone” of sharp increases. The surge in mining difficulty reflects rising participation in the Bitcoin network, in addition to strengthening its security.

Opinion On BTC Is Split

While the miners appear to be holding BTC for the long haul, some analysts predict that the top cryptocurrency may not be out of the woods yet. Crypto analyst Daan Crypto remarked that BTC may be heading below $100,000.

Related Reading

That said, other analysts are more optimistic about BTC’s prospects. In a recent analysis, fellow CryptoQuant contributor CoinCare stated that BTC may have another major leg up in the bull cycle.

Meanwhile, Fundstrat’s Tom Lee forecasted that BTC may surge to $200,000 by the end of 2025. At press time, BTC trades at $114,139, up 1.5% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com