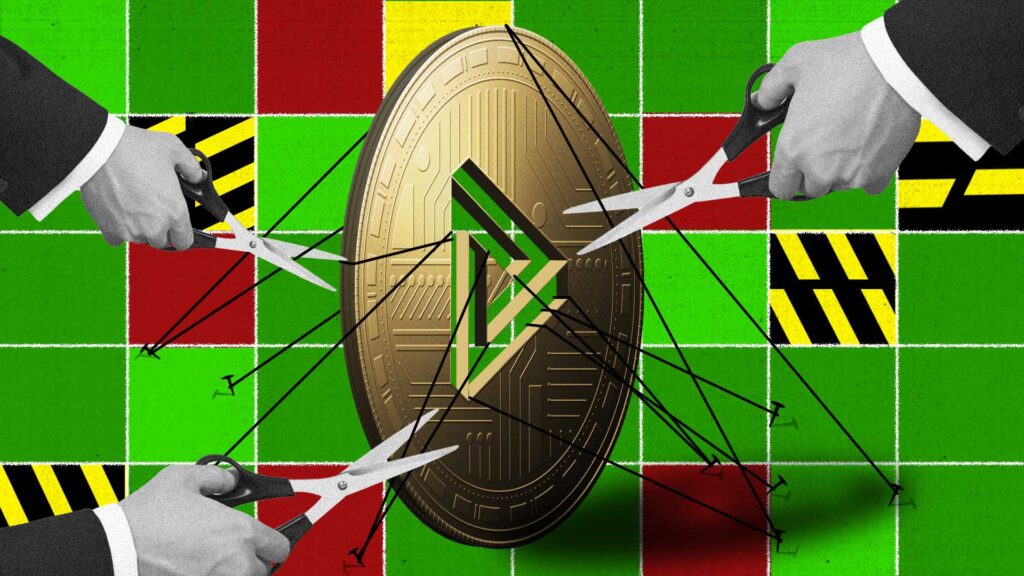

In the past decade, as the use of cryptocurrency has picked up and its market value has soared past $3 trillion, governments have been struggling to regulate the technologically novel and financially volatile industry.

Across jurisdictions, authorities have been tasked with protecting consumers and safeguarding financial systems, often while still supporting innovation.

The result? A global patchwork of policies that range from total bans to full legal embraces, with many countries stuck in the middle.

Cryptocurrency is mostly legal in 45 nations, partially banned in 20 and generally banned in 10, according to the Atlantic Council, a Washington-based, nonpartisan think tank, which analyzed crypto regulation in 75 countries. To make sense of this uneven and unsettled landscape, the International Consortium of Investigative Journalists has sorted global regulatory regimes into four groups based on their approaches:

Red light: Countries that strongly restrict crypto or ban it altogether

Yellow light: Countries that allow crypto with close oversight

Green light: Countries that embrace the industry with friendly crypto laws

Under construction: Countries where crypto is unregulated or stuck in a legal gray zone

Experts are divided over where the United States, traditionally a leader in global financial regulation, would fall on this scale.

Under U.S. President Donald Trump — whose own family has made a reportedly lucrative foray into the crypto business — enforcement actions against the industry have been rolled back, and Trump has made repeated remarks supportive of crypto.

At the same time, the U.S. has recently moved toward a regulatory framework for crypto — albeit one that has the strong support of the industry. Trump signed the Genius Act into law in July. It requires issuers of stablecoins (cryptocurrency with a value pegged 1-to-1 to another asset, like the U.S. dollar) to have sufficient reserves and adhere to anti-money laundering rules. Two other measures — the Digital Asset Market Clarity Act and the Anti-CBDC Surveillance State Act — have passed the House and, as of publication, remain under consideration in the Senate. The first would clarify how different digital assets are regulated, while the second blocks the Federal Reserve from making its own digital version of the dollar unless Congress approves it.

While supporters say these measures will boost innovation and provide regulatory clarity, critics point to loopholes around stablecoins issued by foreign companies and other flaws that could weaken consumer protections. Some lawmakers even warn that the new rules could “open the floodgates” to a financial meltdown.

No matter how you classify the Trump administration’s crypto-friendly approach, whatever the U.S. does — or doesn’t — do will reverberate far beyond its borders. Loopholes in one country create problems elsewhere.

“Beyond preventing money laundering and financing of terrorism, we also need to put in place effective digital assets regulations worldwide to protect the people, the users of this technology,” said Claudia M. Hernández, an attorney and digital assets specialist based in El Salvador. “We need laws that foster international cooperation and clarity. You can’t prosecute crimes that you don’t contemplate in your laws.”

Here is where other countries stand on the regulatory spectrum:

🇨🇳 China

With the second largest economy in the world, China is one of the most prominent examples of countries that ban cryptocurrency. In September 2021, the People’s Bank of China declared all cryptocurrency transactions illegal, citing concerns about financial risk, capital leaving the country and the high energy consumption of crypto mining operations. People involved in illegal crypto trading can be fined, have their assets confiscated and face criminal charges, particularly in cases linked to money laundering or fraud. Authorities have enforced the ban by conducting police raids, shutting down crypto exchanges, and censoring crypto-related content on the internet.

Still, underground traders have reportedly found ways to circumvent the ban. In 2023, at least 60 million people in China are estimated to have owned crypto, according to the latest data released by Triple-A, a global payments firm.

Although China has cracked down on private cryptocurrencies, it launched a Central Bank Digital Currency, known as the digital yuan, in 2019 and has built a low-cost platform for developers to build applications that use blockchains — decentralized distributed ledgers — called the Blockchain-based Service Network (BSN). Central Bank Digital Currencies, or CBDC, are digital versions of national currencies, with the same value as fiat money — money issued by governments like the yuan or the U.S. dollar.

🇩🇿 Algeria

On July 24, 2025, Algeria enacted Law No. 25‑10, criminalizing all crypto-related activities. This includes owning, issuing, trading and mining crypto, as well as promoting it. Violators face up to one year in prison and fines between 200,000 and 1,000,000 Algerian dinars (approximately $1,500 to $7,700). The punishment is harsher if the activities involve money laundering and the financing of terrorism. The new law strengthened an initial ban issued in 2018. Local news outlets reported that the sweeping 2025 restrictions aim to protect the country’s financial stability and to satisfy lawmakers’ concerns about fraud, tax evasion and illicit transactions.

Despite the ban, the country ranked second among North African nations with the fastest-growing crypto economies between 2022 and 2024, placing closely behind Libya, according to a report by the analytics firm Chainalysis.

🇪🇺 European Union

The European Union’s Markets in Crypto-Assets (MiCA) regulation came into full effect on Dec. 30, 2024, creating a single set of rules for crypto companies across all 27 EU countries. Officials said the goal of the law was to make the market more predictable, prevent companies from shopping around for more crypto-friendly jurisdictions (regulatory arbitrage) and protect consumers. Under MiCA, crypto companies must obtain a license to operate and stablecoin issuers must keep enough money in reserve to match the value of the digital tokens they issue. Anyone launching a new crypto token must also publish a detailed document, called a white paper, explaining how it works and outlining relevant risks. Companies must report on the energy usage required to operate their blockchains, which can consume substantial amounts of electricity. MiCA also tries to block foreign crypto firms from quietly targeting EU users without following EU laws.

Critics of MiCA have warned that it’s challenging to police the movement of stablecoins across borders, potentially weakening the impact of the law. Others have said that small crypto startups may not be able to afford the cost of compliance, which could hurt innovation in Europe.

🇯🇵 Japan

Japan was one of the first countries to set up rules for cryptocurrencies. The country’s Financial Services Agency (FSA) oversees crypto regulations, mainly under two laws: the Payment Services Act and the Financial Instruments Exchange Act. Crypto exchanges must register with the FSA, verify customer identities (know your customer, or KYC) and follow anti-money laundering rules. They’re also required to report suspicious transactions to authorities.

In 2023, Japan introduced new rules for stablecoins, allowing them to be issued only by licensed banks, trust companies and registered payment providers. These issuers must follow different rules depending on the license they hold. In 2025, the FSA proposed legislation to treat some crypto-assets as financial products, giving regulators more power to address insider trading and market manipulation. Currently, an individual’s profits from selling virtual currency in Japan are taxed as miscellaneous income, meaning they’re subject to a progressive tax rate that can go from 15% to as high as 55%. The country’s tax agency recently proposed reforms that would shift to a flat 20% tax rate on crypto gains. Japan’s legislature is expected to consider the proposal later this year.

🇸🇻 El Salvador

In 2021, El Salvador became the first country to adopt bitcoin as legal tender, alongside the U.S. dollar (it is a dollarized economy). The country’s Bitcoin Law required businesses to accept bitcoin as payment for goods and services, with exceptions for those lacking internet access. The government also launched the Chivo Wallet , offering $30 in bitcoin to citizens who signed up. It has made repeated public purchases of bitcoin and announced plans for “Bitcoin City,” which President Nayib Bukele promised would have “no income tax, forever,” as well as zero taxes on property, procurement, or carbon dioxide emissions.

However, the law’s impact has been mixed. Surveys suggest low public trust in the government’s plan, and bitcoin use in daily life remains limited. Many businesses and citizens continue to rely on the dollar, and technical issues have plagued the Chivo system. This year, the government significantly rolled back the law establishing bitcoin as legal tender, and stopped requiring businesses to accept it as payment. The International Monetary Fund required it to, as part of a $1.4 billion financial assistance program granted to the country. The IMF had previously warned El Salvador of crypto’s risks to financial stability, consumer protection and transparency. Regardless, Bukele has continued to promote pro-crypto policies, saying it is a strategy to attract investment and a path to economic independence.

🇦🇪 United Arab Emirates

The UAE aims to attract crypto business by positioning itself as an innovative hub for digital assets. Since 2018, the country has introduced laws to define virtual assets, and set licensing requirements and anti-money laundering standards. Experts described the UAE’s regulatory regime as “layered,” with regulations divided between federal authorities like the Securities and Commodities Authority and the Central Bank, and emirate-level bodies, including Dubai’s Virtual Assets Regulatory Authority (VARA) and Abu Dhabi’s Financial Services Regulatory Authority (FSRA). While some observers say this multi-jurisdictional model allows for flexibility, others say it can create confusion and potential regulatory overlap.

In February 2023, the Emirate of Ras Al Khaimah established the RAK Digital Assets Oasis, a “free zone” dedicated to digital and virtual asset companies, promoting it as the first of its kind. The UAE is known for its dozens of “free zones” — special territories for businesses where there are no taxes and regulation is minimal. These areas generally have their own rules and regulators, often overseen by royally appointed officials and largely exempt from wider UAE laws.

The UAE does not tax personal income or capital gains on crypto trading profits, and some crypto-related business activities are exempt from value-added tax, or VAT.

In 2022, the UAE was included on the Financial Action Task Force’s list of countries that require increased monitoring for weaknesses in anti-money laundering and counterterrorism financing. FATF is an intergovernmental watchdog that sets standards for nations’ anti-money laundering laws. In an effort to get off that list, UAE authorities issued new guidance warning that unlicensed crypto providers, misleading marketing, weak disclosures, and failure to report suspicious transactions could trigger enforcement actions. FATF took the UAE off the so-called “gray list” in February 2024.

🇮🇳 India

In India, banks initially were banned from dealing with virtual currencies in 2018, but this was overturned by the country’s Supreme Court in 2020. Currently, crypto companies must register with the Finance Ministry’s Financial Intelligence Unit and follow anti-money laundering rules, but there is no comprehensive crypto law yet. Proposed legislation, such as the Cryptocurrency and Regulation of Official Digital Currency Bill, have faced delays or ultimately not passed into law. India imposes a 30% tax on crypto gains under the income tax law, but the government hasn’t clarified the legal status of digital currencies. In September 2024, in its most recent assessment, FATF said India is still in the early stages of making sure crypto companies follow anti-money laundering rules, and government oversight is just beginning.

Despite the regulatory uncertainty, India has one of the fastest-growing crypto markets globally, with millions of users driven by expanding internet access among an increasingly tech-savvy population. Critics argue the government’s slow and unclear approach discourages innovation and fails to protect consumers.

🇳🇬 Nigeria

Nigeria’s approach to cryptocurrency regulation has shifted over the years. In February 2021, the Central Bank of Nigeria (CBN) reaffirmed the country’s 2017 ban on crypto transactions through commercial banks, citing concerns over fraud and the stability of the local currency. But later that year, in October 2021, Nigeria became one of the first African countries to launch a central bank digital currency, the eNaira, aimed at helping more people access money and financial services and reducing transaction risks. Adoption of the eNaira has been slow, with limited public awareness and infrastructure challenges.

By late 2023, some crypto restrictions were eased, allowing banks to service accounts for licensed crypto firms under the digital-asset rules of the country’s Securities and Exchange Commission. Despite this, enforcement remained inconsistent, with reports of unlicensed operations continuing. In March 2025, Nigeria passed the Investments and Securities Act, which recognizes cryptocurrencies as securities and puts them under the authority of the SEC.

Nigeria has one of the highest crypto adoption rates globally, driven largely by young people seeking ways around rising inflation and limited banking access. Analysts have cautioned that the country’s shifting policies may undermine efforts to fully benefit from digital assets and expose users to risks.

Sources:

Contributors: Hamish Boland-Rudder, Sam Ellefson, Joanna Robin, Annys Shin, Rick Sia, Dean Starkman, Spencer Woodman and Angie Wu

Design and development: Antonio Cucho