As Bitcoin (BTC) continues to trade in the high $100,000 range following the October 9 crypto market crash, some bullish signs are starting to emerge. Notably, stablecoin reserves on leading crypto exchanges like Binance are entering all-time high (ATH) territory, hinting at a potential rally for BTC.

Stablecoin Reserves Rise – Will Bitcoin Benefit?

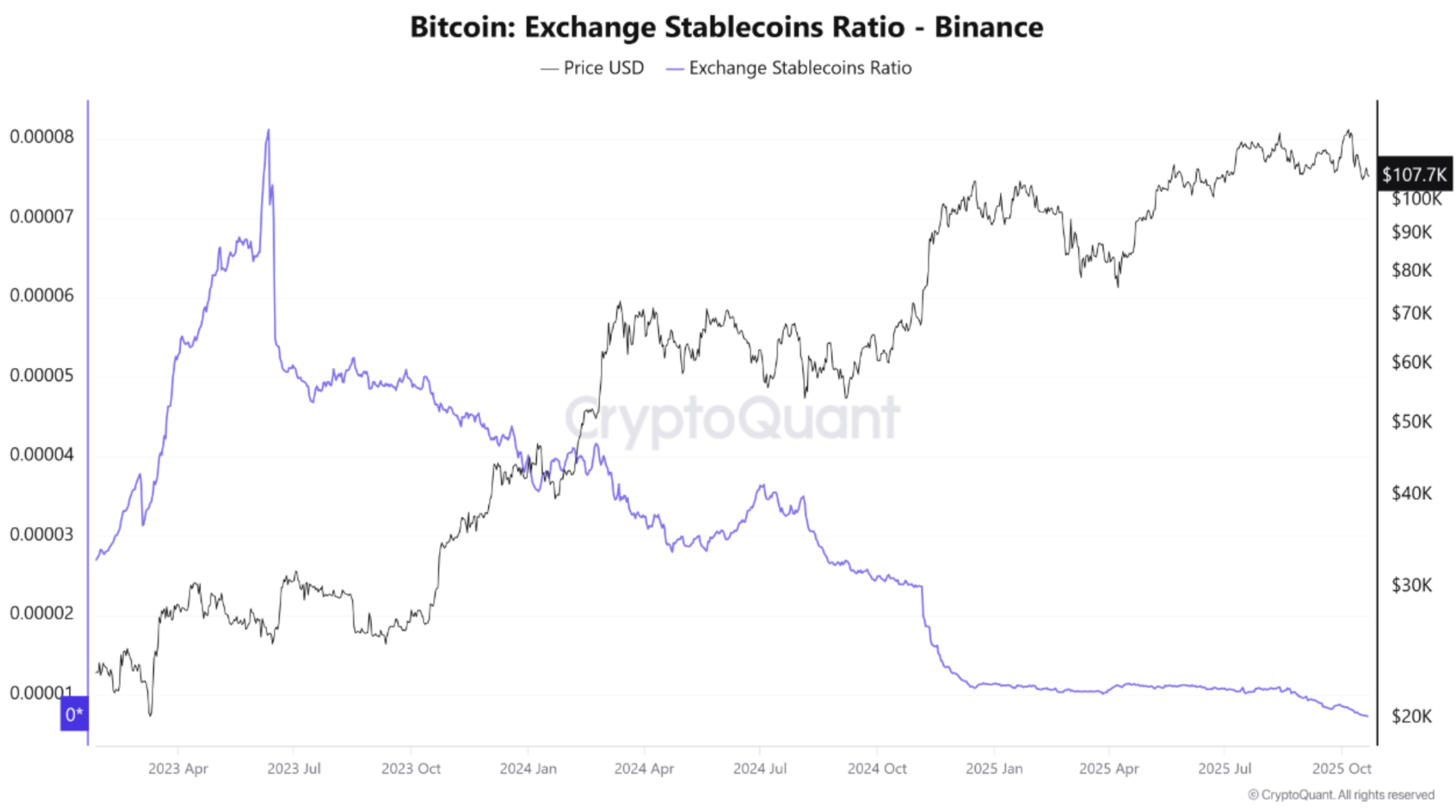

According to a CryptoQuant Quicktake post by contributor PelinayPA, Binance stablecoin reserves are approaching ATH levels, indicating that investors are ready to deploy funds to accumulate BTC at current or lower levels.

Related Reading

The CryptoQuant analyst highlighted the rapidly falling Bitcoin-Stablecoin Ratio (ESR). For the uninitiated, the ESR measures the proportion of Bitcoin reserves to stablecoin reserves on exchanges like Binance.

The ratio also gives hints about the market’s potential buying power and selling pressure. Past data shows that whenever the ESR falls sharply during market volatility, BTC’s price tends to surge.

Essentially, a declining ESR means that stablecoin reserves are growing in comparison to BTC reserves on exchanges. This shows an increase in available “dry powder” on exchanges, which can quickly be used to buy more BTC and initiate another bull rally.

Conversely, when the ESR rises, it means that stablecoin reserves are falling while BTC supply on exchanges is increasing. This points toward an increase in short-term selling pressure as traders deposit BTC to exchanges to sell.

Currently, the ESR has fallen to historically low levels, implying that Binance holds relatively large stablecoin reserves compared to BTC reserves. According to PelinayPA, such a setup can have two interpretations:

In a positive scenario, the abundance of stablecoins suggests significant latent buying power. If market confidence returns, this could trigger a strong wave of buying pressure and mark the start of a new bullish phase.

Meanwhile, the negative scenario assumes that this liquidity would remain inactive, reflecting investor hesitation and a market in standby mode after the recent bloodbath that resulted in liquidations worth $19 billion.

Will The Gold Rotation Help BTC?

Following the crypto market crash earlier this month, which sent BTC from an ATH of more than $126,000 all the way down to $102,000, several whales faced liquidations. Despite the crash, some analysts are confident that the BTC top is not in yet.

Related Reading

One of the factors that can significantly benefit BTC in the near term is the capital rotation from gold to the digital asset. In a new report, Bitwise predicted that capital rotation from gold into BTC could propel it to $242,000.

That said, veteran trader Peter Brandt recently forecasted that BTC could crash 50% from current price levels. At press time, BTC trades at $108,268, down 0.3% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com