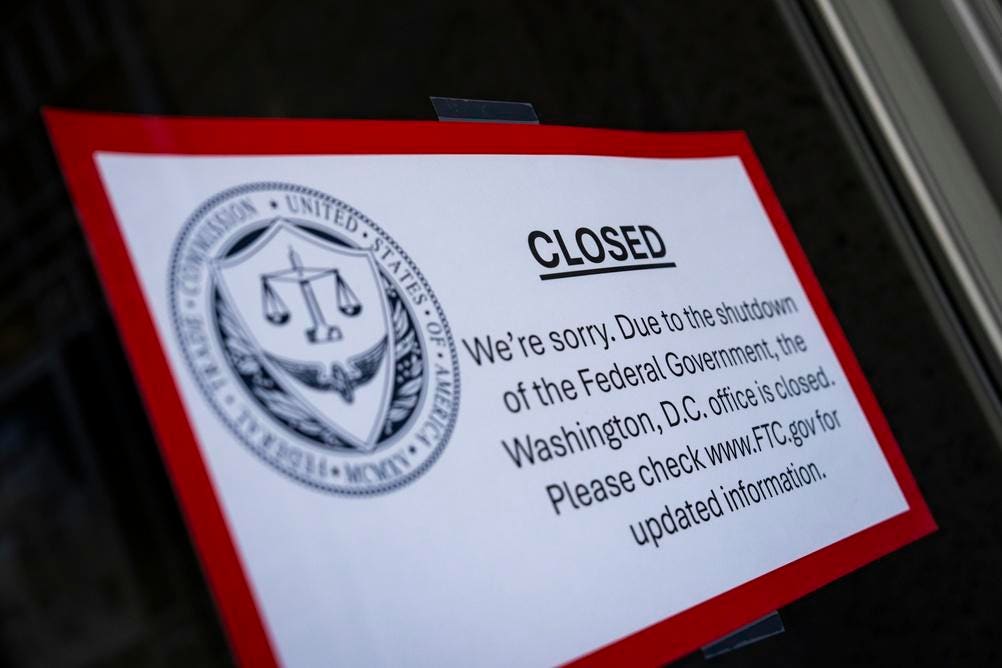

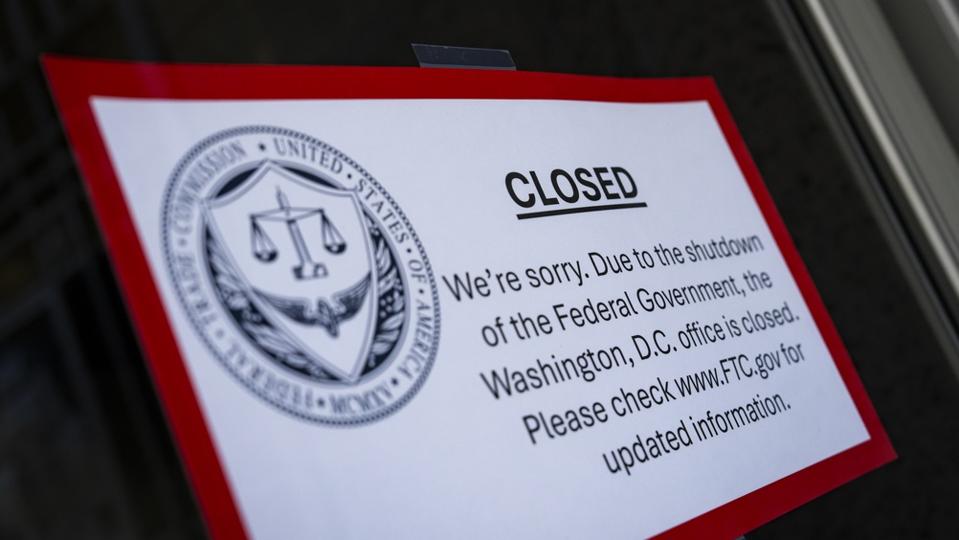

The Federal Trade Commission was closed when Congress failed to reach a budget agreement. For how long remains to be seen.

Getty Images

Even short government shutdowns can change the investing landscape. This effect of the latest budget impasse in Congress could be more pronounced given lingering high inflation, a weakening job market, high valuations and Wall Street’s expectation that the Fed will continue its interest-rate reductions.

These circumstances create an environment ripe for volatility. You may want to insulate your portfolio by adding stable, resilient positions. Here are six options to consider.

5 Stocks to Buy Now for October 2025

These featured stocks were identified based on the following parameters:

- Beta under 0.8. Beta measures volatility relative to the market. The market’s beta is 1, and stocks that are less volatile than the market have betas below 1. Beta measurements here are calculated from the company’s recent five-year history.

- Debt-to-equity, or DTE, below 1. DTE is a leverage metric indicating how dependent the company is on debt. A low DTE is a sign of financial stability.

- Three-year free cash-flow growth over 10%. Rising free cash flow or FCF provides more flexibility for growth initiatives, dividends and share buybacks.

- Positive analyst outlooks and ratings. Analysts aren’t infallible, but their opinions and coverage can further validate investment choices.

These six companies, ordered from largest market capitalization to smallest, meet the requirements.

Metrics included in the reviews of each company are sourced from company reports and stockanalysis.com.

1. Walmart (WMT)

Walmart by the numbers:

- Stock price: $102.67

- Beta: 0.65

- DTE: 0.69

- FCF growth: 36.4%

- Dividend yield: 0.9%

Walmart Business Overview

Walmart, the global mass market retailer, has more than 10,000 store locations and a portfolio of ecommerce sites. The company also owns the Sam’s Club chain.

Why WMT Stock Is A Top Choice

Over the last 10 years, Walmart has built a competitive ecommerce business to complement its strong brick-and-mortar footprint. The retailer’s global, omni-channel approach with a low-cost focus supports:

- Deep customer relationships, which encourages brand loyalty.

- Significant negotiating power with suppliers to keep prices low for Walmart and its customers.

- An advertising business that relies on varied customer touchpoints, which diversifies revenue.

- A well-rounded subscription offering, Walmart+, which further encourages brand loyalty while diversifying revenue.

Walmart is positioned to navigate any near-term economic disruptions caused by tariffs and other policy changes.

Highlights from Walmart’s second quarter ending in July include 5.6% constant-currency sales growth, a 25% increase in global ecommerce sales and 46% growth in the global advertising business. Walmart had $9.4 billion in cash and equivalents on its balance sheet at the end of July.

2. Boston Scientific Corporation (BSX)

Boston Scientific by the numbers:

- Stock price: $96.71

- Beta: 0.61

- DTE: 0.53

- FCF growth: 80.5%

- Dividend yield: NA

Boston Scientific Corporation Business Overview

Boston Scientific produces medical devices and therapies that treat cardiovascular, respiratory and digestive conditions, among others. The company has two reporting segments: Cardiovascular and Medsurg.

Cardiovascular includes the successful Watchman and Farapulse businesses, among other things. The Watchman device lowers stroke risk for patients with a certain type of irregular heartbeat. Farapulse safely removes cardiac tissue, a procedure used to treat irregular heartbeats.

Medsurg develops solutions for GI and pulmonary conditions, kidney stones, urinary incontinence, movement disorders and more.

Why BSX Stock Is A Top Choice

Boston Scientific has business momentum, and the leadership team believes it will continue. Reasons for the optimism include the company’s active innovation pipeline, a range of growth opportunities and an improving operating margin. Boston Scientific also has a strong record of increasing sales and successful strategic acquisitions.

The company recently projected 10% annual organic revenue growth between 2026 and 2028, along with half-point annual improvements in adjusted operating margin. In the first half of 2025, Boston Scientific increased organic revenue by 18% and adjusted EPS by 28% over the prior year.

3. Ferrari N.V. (RACE)

Ferrari N.V. by the numbers:

- Stock price: $491.63

- Beta: 0.70

- DTE: 0.89

- FCF growth: 22.4%

- Dividend yield: 0.7%

Ferrari N.V. Business Overview

Ferrari manufacturers and sells supercars. The company’s success relies heavily on its strong brand loyalty and careful production strategy. Ferrari makes only enough cars to fall slightly short of demand. The carmaker also participates in racing events and lifestyle activities, both of which support the brand identity and provide additional revenue.

Why RACE Stock Is A Top Choice

Ferrari’s revenue and profit trajectories have been impressive, especially given the high price of its product. Between 2021 and 2024, revenues grew more than 56% and net income increased almost 92%. In the same timeframe, Ferrari’s operating margin increased from 25% to 28.2%.

Thanks to its conservative production cadence, brand strength and pricing power, Ferrari can maintain an 18- to 24-month backlog, which provides business visibility. According to investment bank Berenberg, existing Ferrari owners accounted for 81% of the company’s 2024 sales.

In the second quarter of 2025, Ferrari shipped 3,494 cars. Revenues grew 4.4% and diluted EPS increased 3.9% from the prior-year period.

4. Corteva (CTVA)

Corteva by the numbers:

- Stock price: $64.30

- Beta: 0.76

- DTE: 0.14

- FCF growth: 32.0%

- Dividend yield: 1.1%

Corteva Business Overview

Corteva provides seed, crop protection products and digital solutions to farmers in the U.S. and around the world. Corteva announced on Oct. 1 that it would spin off its seed business. After the split, Corteva will focus on herbicides, insecticides and biological crop protection products. It is currently the world’s fourth largest crop protection business.

Why CTVA Stock Is A Top Choice

Post spin-off, Corteva will continue to work on improving its production operations, cost efficiencies and innovation. In the last five years, Corteva’s crop protection business has trimmed margins by 2 percentage points and differentiated itself through innovation.

The Corteva leadership team says the new Corteva will have an ample balance sheet to support future growth and legacy obligations. Legacy obligations will include liabilities related to PFAS and other environmental claims. Corteva recently announced a joint settlement with the state of New Jersey involving environment claims against its products.

Highlights from Corteva’s second quarter included 6% net sales growth and 34% EPS growth versus the prior-year quarter.

5. TKO Group Holdings (TKO)

TKO Group Holdings by the numbers:

- Stock price: $198.13

- Beta: 0.27

- DTE: 0.30

- FCF growth: 30.3%

- Dividend yield: 0.8%

TKO Group Holdings Business Overview

TKO is a sports and entertainment company that owns three sports franchises: World Wrestling Entertainment, the mixed martial arts organization UFC, and the bull riding organization PBR. TKO also operates the experiential travel company On Location and the sports marketing agency IMG. Revenue streams include live events, media rights, brand partnerships and travel.

Why TKO Stock Is A Top Choice

TKO closed on its purchase of PBR, On Location and IMG in February. The acquisition adds diversity to an already layered revenue engine. Media rights account for most of the company’s revenue—and these are high-margin, high-visibility sales.

Expanding media distribution also helps grow the sports’ fan-base, which in turn enhances monetization opportunities across the TKO ecosystem. With an increasing number of highly engaged fans, TKO can attract better partnerships, negotiate more lucrative distribution contracts and sell more live event tickets and hospitality packages.

In the second quarter of 2025, TKO reported 10% revenue growth, 75% adjusted EBITDA growth and 491% net income growth. At quarter-end, the company had $535.1 million in cash on its balance sheet.

6. Tencent Music Entertainment (TME)

Tencent Music Entertainment by the numbers:

- Stock price: $22.94

- Beta: 0.50

- DTE: 0.05

- FCF growth: 12.3%

- Dividend yield: 0.8%

Tencent Music Entertainment Business Overview

Tencent operates streaming entertainment platforms in China, including QQ Music, Kugou Music, Kuwo Music and Wesing. The platforms offer recorded and live music, online karaoke, podcasts, audiobooks and video content.

TME is a subsidiary of Tencent Holdings Limited, which trades over-the-counter in the U.S. as ticker TCEHY.

Why TME Is A Top Choice

The company’s subscription business is the primary growth driver. With an expanding subscriber base and rising average revenue per user, the subscription model is performing well. Tencent is also seeing momentum in music-related services, including advertising, merchandise and concerts. Partnership initiatives with labels, artists and producers have also been successful.

Tencent Music beat consensus EPS estimates for the last three quarters. After its last earnings report in August, at least five analysts raised their price targets for the stock. The second quarter highlights included 17.9% revenue growth and 44.9% growth in diluted EPS.

Bottom Line

No stock is without risk, but companies with rising cash flow, low debt and proven business models can often weather tough storms. That type of resilience may be useful to your portfolio if this government is shutdown longer.

For more investing ideas, see best stocks for 2025.