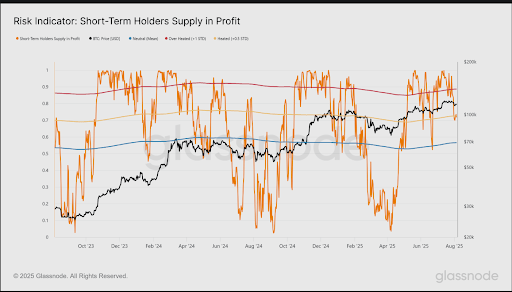

Onchain analytics platform Glassnode has revealed that most Bitcoin short-term holders are in profit. This development has raised the possibility of the flagship crypto facing another sell-off from this category of holders, who may be unable to hold during this period of sideways action.

70% of Bitcoin Short-Term Holders Are in Profit

A Glassnode report revealed that 70% of the Bitcoin short-term holders’ supply is in profit despite the recent Bitcoin price pull-back. The platform noted that the deeper the correction, the more their supply is likely to fall into loss, a development which could affect these holders’ confidence.

Related Reading

The report further stated that, considering that the Bitcoin price is currently trading within a relatively thin air-gap, the sell pressure is likely to come from late-stage profit-taking, should this happen. For now, the sell pressure from these Bitcoin short-term holders looks to be relatively low.

Glassnode pointed out the percentage of spent volume originating from Bitcoin short-term holders who were in profit to assess how much this corrective phase has influenced these investors. This metric measures the number of recently acquired coins that are taking profit. The platform noted that the proportion of short-term holders spent coins taking profit has cooled off, currently at 45%, which is a neutral position.

Glassnode stated that this suggests that the market is in a relatively balanced position, calming fears about a potential sell-off from Bitcoin short-term holders. Meanwhile, the platform also alluded to the Bitcoin ETFs, which also create sell-side pressure for the flagship crypto. These ETFs recorded a net outflow of 1,500 BTC on August 5, the largest wave of sell-side pressure since April 2025.

The report noted that outflows from the Bitcoin ETFs have been relatively brief events, with only a few instances of an extended streak of daily outflows, which create sustained sell-side pressure. Glassnode believes that keeping an eye on the ETF flows will help to identify whether this latest outflow is just a repeat of the short-lived trend or a shift in investors’ sentiment.

$116,900 Is The Resistance Level BTC Needs To Break Above

Glassnode indicated that the Bitcoin price needs to break above the $116,900 level decisively to build any momentum for the next leg up. This level serves as the cost basis of local top buyers who bought BTC over the last month. The platform claimed that a sustained price move above this level would signal that the demand side is regaining control.

Related Reading

Furthermore, it also offers early confirmation that the Bitcoin price has found reliable support and could continue its move to the upside. On the other hand, if BTC remains below this level for a longer period, Glassnode remarked that it increases the risk of a deeper correction. Bitcoin could drop toward the lower bound of the air gap near $110,000.

At the time of writing, the Bitcoin price is trading at around $116,800, up over 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Pixabay, chart from Tradingview.com