Following another rejection from the $120,000 region on July 21, Bitcoin (BTC) is now holding steady around the $115,000 level. However, realized price data suggests that BTC’s surface-level calm may be nearing its end.

Old Bitcoin Whales Stop Realizing Gains

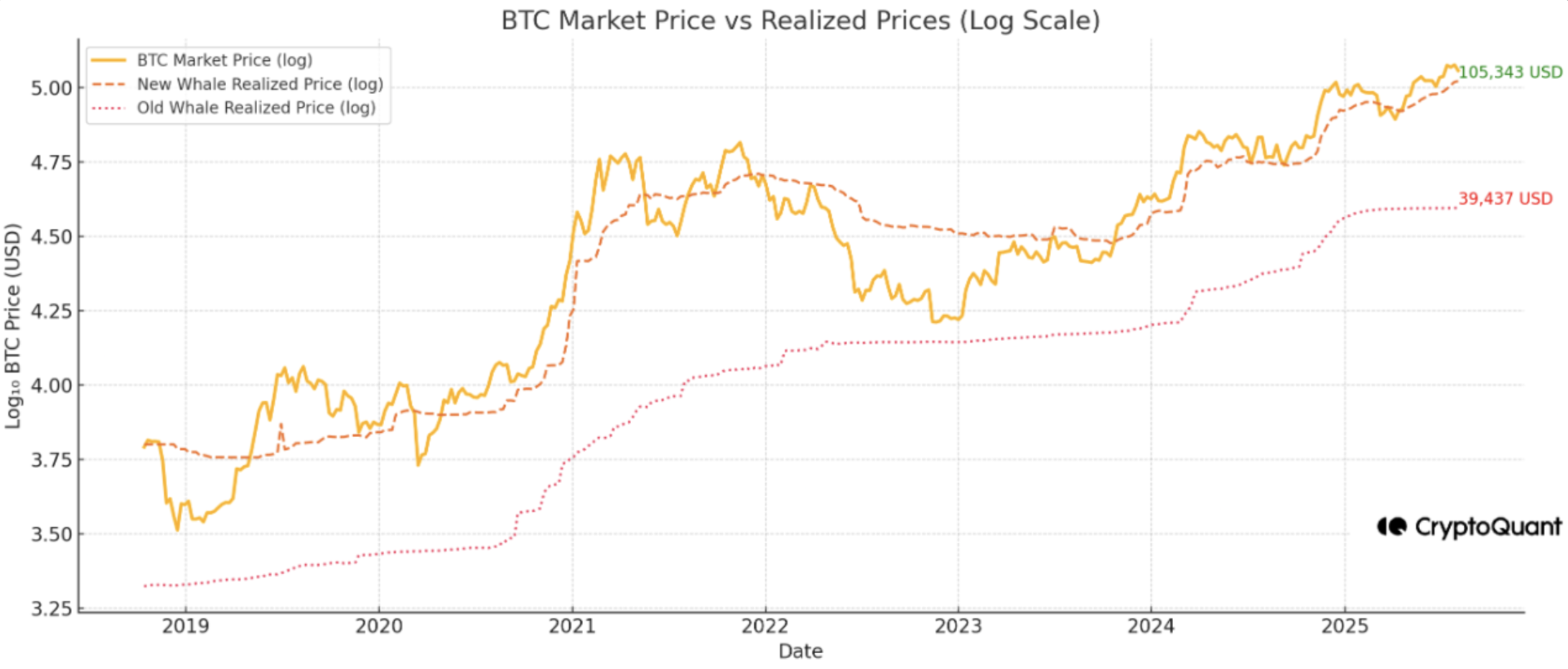

According to a CryptoQuant Quicktake post by contributor Kripto Mevsimi, Bitcoin whale behavior indicates that the asset may be walking a tightrope. While “old whales” have stopped realizing profits, newer whales remain slightly in the green – though only marginally.

Related Reading

Here, old whales refer to large BTC holders who have held the digital asset for more than a year. New whales – including institutional players – are those who entered the market within the past year.

Kripto Mevsimi notes that the current balance between old capital and newly invested capital may not hold much longer. A decisive break in either direction could push BTC into a new price range.

The chart below illustrates the rising realized cap of old whales from 2022 to 2024, confirming that this cohort steadily realized profits during that period. Notably, this quiet distribution phase coincided with mid-cycle market conditions.

However, since early 2025, the realized cap for old whales has flattened – signalling a pause in profit-taking. Their average cost basis of $39,400 puts them well in profit, suggesting they are likely waiting for higher prices before re-entering the market.

In contrast, the average cost basis for newer whales is approximately $105,300 – a level that now serves as their psychological breakeven. As long as BTC remains above this threshold, these newer investors are unlikely to sell in large numbers.

That said, a drop below this critical level could trigger risk-off behavior among new whales. Kripto Mevsimi suggests that such a move could escalate current conditions from moderate profit-taking to panic selling, potentially triggering a wave of leverage unwinds.

Keep An Eye On Realized Price

It’s worth noting that recent activity has been minimal across both BTC investor cohorts – old whales and new whales alike. As the CryptoQuant analyst puts it:

Old whales are idle. New whales are exposed. Neither is pressing the market – yet. But once the range breaks, the reaction could be sharp.

In short, Bitcoin holders should closely monitor realized price levels. If BTC maintains a price above $105,000, newer capital is likely to remain stable. However, a drop below that could weaken the floor and invite downside pressure.

Related Reading

Conversely, a breakout toward a new all-time high – possibly around the $130,000 mark – could bring old whales back into play, expanding their realized cap. That said, a few warning signs point to potential short-term weakness.

For instance, BTC deposits to Binance have been rising steadily after months of decline, indicating that selling pressure may increase in the near future. At press time, BTC trades at $113,500, down 0.3% over the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com