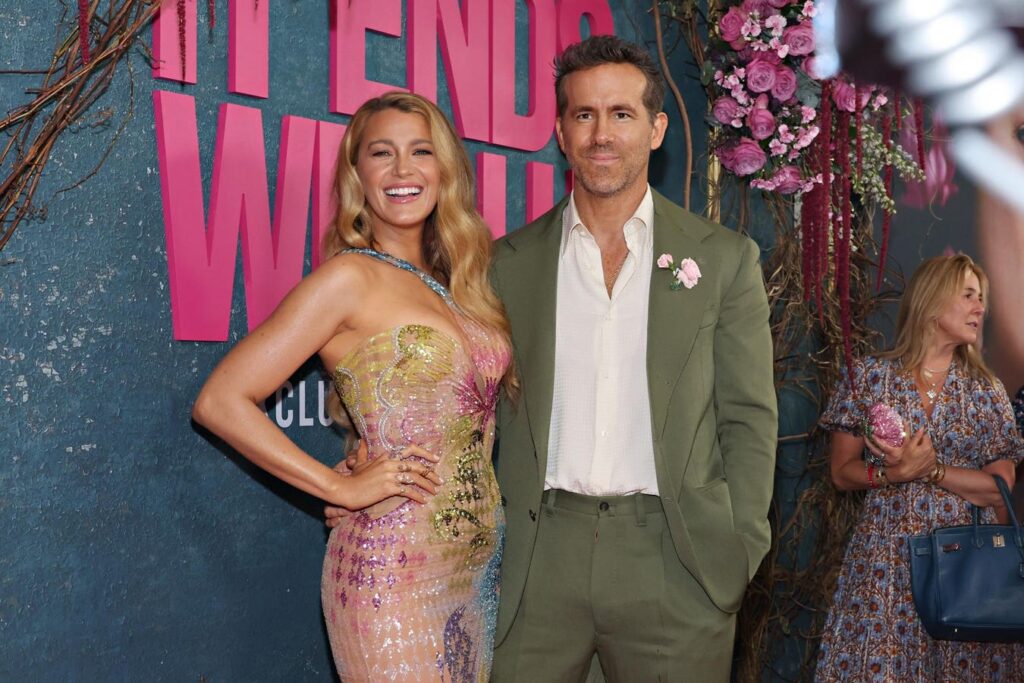

NEW YORK, NEW YORK – AUGUST 06: (L-R) Blake Lively and Ryan Reynolds attend the “It Ends With Us” … [+]

Blake Lively’s lawsuit against her It Ends With Us co-star and director Justin Baldoni has caused a media stir in Hollywood and beyond. According to TMZ, the suit alleges that Baldoni exhibited behavior that caused her severe emotional distress. According to the lawsuit, the movie was supposed to conform to requirements including “no more showing nude videos or images of women to Blake, no more mention of Baldoni’s alleged previous ‘pornography addiction,’ no more discussions about sexual conquests in front of Blake and others, no further mentions of cast and crew’s genitalia, no more inquiries about Blake’s weight, and no further mention of Blake’s dead father.”

Lively’s lawsuit says that Sony Pictures approved her requests, but that Baldoni began a campaign to destroy her reputation. In a statement, Lively said, “I hope that my legal action helps pull back the curtain on these sinister retaliatory tactics to harm people who speak up about misconduct and helps protect others who may be targeted.” She has a list of celebrity supporters, but Baldoni is reportedly poised to file a countersuit alleging that it was Lively who mounted a smear campaign against him. As more develops about the lawsuit, the tax issues may be far down the line in this bitter dispute.

However, there will inevitably be tax issues if any money changes hands, for both Lively and Baldoni. If Lively recovers any money, is it taxable? Most lawsuit settlements are taxable, and in some cases, your legal fees can’t be deducted unless you qualify for one of the ways to deduct them. Given her business, Lively should not have any trouble deducting her legal fees, but could she do better than paying tax on all of it?

Her suit is for reputation damages and for emotional distress. Some tax cases support viewing damage to professional reputation and damage to one’s ability to conduct their business as capital gain rather than ordinary income. Paying tax at capital gain rates is a lot better than paying tax on ordinary income. But how about the emotional distress damages?

They are taxable, even in the context of sexual harassment. Compensatory damages for personal physical injuries are tax free under Section 104 of the tax code. But what is “physical” isn’t clear, and tax issues arise in nearly every sexual harassment settlement. If you make claims for emotional distress, your damages are taxable. If you claim that the defendant caused you physical injuries or caused you to become physically sick, your damages may be tax free. But many sexual harassment plaintiffs have a hard time doing that. Even if there is groping or other assaults, taxes may apply.

However, a pending tax bill would exempt sex abuse and assault settlements. In the meantime, some plaintiffs claim the harassment gave them post-traumatic stress disorder, and PTSD is arguably physical for tax purposes. Although the IRS taxes most lawsuit settlements, some plaintiffs win on the tax front. For example, in Domeny v. Commissioner, Ms. Domeny suffered from multiple sclerosis. Her MS got worse because of stress caused by workplace problems, including an embezzling employer. Her employer terminated her, leading to another spike in her MS symptoms. She settled her employment case and claimed some of the money as tax free. The IRS disagreed, but Ms. Domeny won in tax court.

In Parkinson v. Commissioner, a man suffered a heart attack while at work. He sued alleging that the employer’s misconduct caused him to suffer a heart attack at work. He settled and claimed that his payment was tax free. When the IRS disagreed, he went to tax court. The IRS said that it was just a taxable emotional distress recovery. but the court agreed with Mr. Parkinson that intentional infliction of emotional distress can result in bodily harm.

Whenever possible, settlement agreements should be specific about taxes. Tax language in a settlement agreement does not bind the IRS, but the IRS does pay attention if you have a settlement agreement that is explicit about taxes. It pays to be explicit in the settlement agreement about tax forms, too. If you are the plaintiff, you don’t want to be surprised by an IRS Form 1099 that arrives around Jan. 31 the year after you settle your case.

How about Baldoni’s taxes if he pays to settle the suit? Since 2018, the tax law denies tax deductions for confidential settlements in sexual harassment and sex abuse cases. It is sometimes called the Harvey Weinstein tax, and related legal fees are also not deductible. The overwhelming majority of legal settlement agreements have a confidentiality or nondisclosure provision. In some cases, plaintiff and defendant agree on a particular tax allocation so the defendant can still try to write off most of a confidential sexual harassment settlement. Other defendants assemble a separate “confidentiality preference agreement” that they hope will sidestep the Weinstein tax deduction limits.

Whatever happens in the Lively-Baldoni dispute, there are going to be tax issues for both sides. They both may have tax lawyers to advise them. Many sexual harassment victims do not and may be surprised at tax time the year after they settle.