Cyclical or Secular U.S. Dollar Weakness?

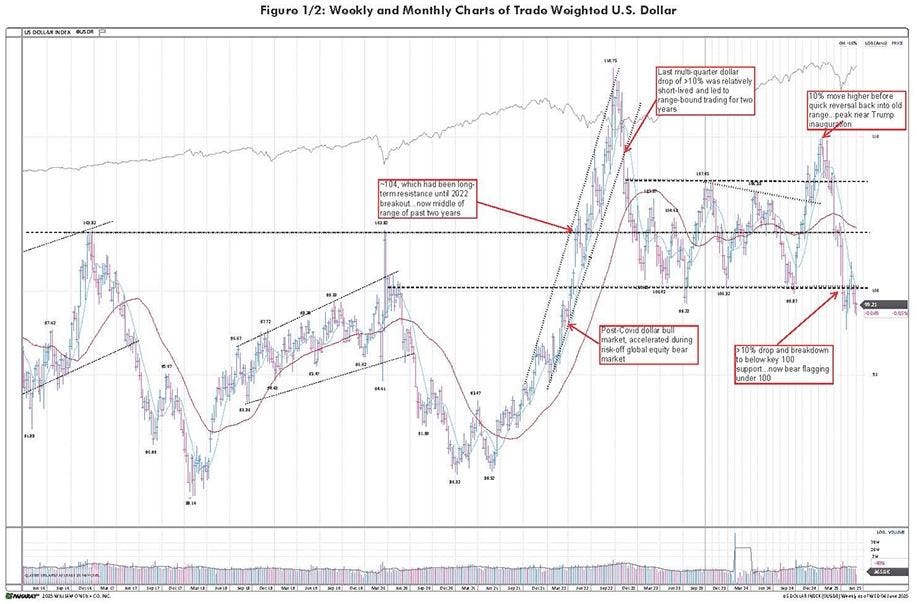

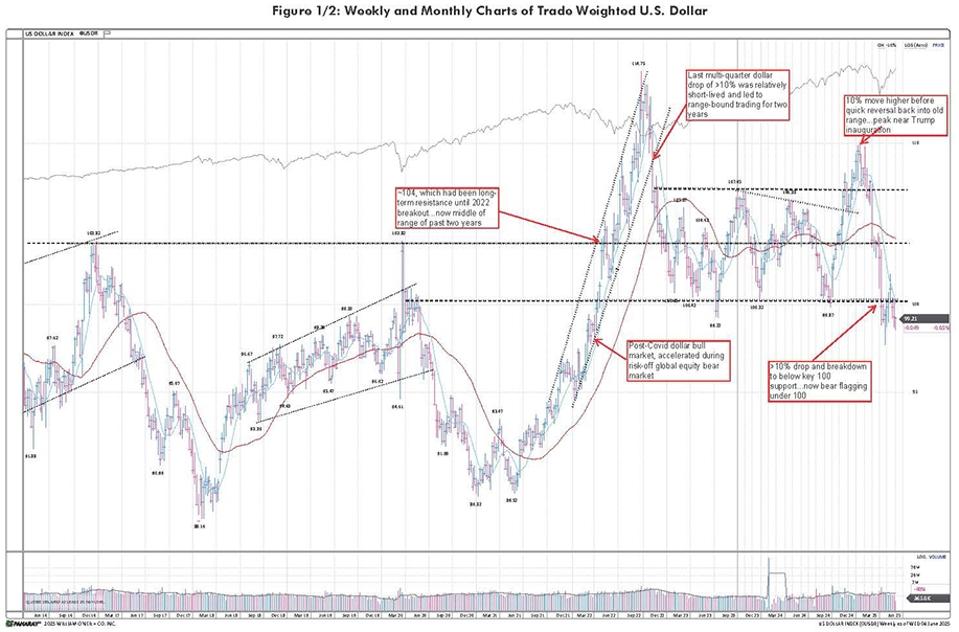

As seen on the Datagraphs® below, the U.S. Dollar Index has declined from a high in January from roughly 110 to 97 in April. Recently, it has risen slightly but remains near its 52-week lows. On a longer-term monthly chart, it is testing what looks to be very key support level at an uptrending line which has been in place for over a decade. A break below could confirm the first secular dollar bear market since the 2003-2008 period.

There are several reasons for this decline. First, U.S. debt levels continue to rise, forcing the U.S. Treasury to continue to issue more notes and bonds. This oversupply of U.S. debt has weakened the dollar. Also, the ongoing trade turmoil has reduced the demand for dollars from U.S. trade partners. The U.S. runs a large financial account surplus. However, if international trade dislocations continue, the U.S. is likely to see lessening demand for the dollar and U.S. financial assets. This would represent a meaningful trend reversal from the last five years. Finally, the expectation of the Fed easing later in the year has also impacted demand for the currency.

Figure 1/2: Weekly and Monthly Charts of Trade Weighted U.S. Dollar

The dollar’s movement has a significant impact on foreign demand for U.S. financial assets. When the outlook for the dollar is positive – meaning an expected increase in relative value versus other currencies – demand for U.S. financial assets and real estate tends to rise. Conversely, when the outlook calls for dollar weakness, foreign buyers often reduce their purchases of dollar-denominated assets.

However, a declining dollar often coincides with Fed rate cuts which can boost corporate earnings – particularly among U.S. multinationals whose overseas sales are translated into higher dollar profits. The table shows stock market index performance during dollar bear markets over the past 40 years. Surprisingly, periods of dollar weakness have tended to coincide with strong stock market returns. Historically, a median 18% decline in the dollar over approximately 14 months has led to a 21% increase in the S&P 500, well above the index’s average annual return.

Table 1: Index Performance During Major U.S. Dollar Downtrends, 1985–2025

By sector, cyclical stocks have tended to the be the best performers during these periods of dollar decline. This likely due to Fed easing as well as the economically stimulating effect of more demand for U.S. exports since they are now less expensive for foreign buyers. As shown on the table below, Basic Material and Consumer Cyclical have had the largest gains during these periods. Of note, Technology has also been a strong sector.

Table 2: U.S. Sector Performance During Major U.S. Dollar Downtrends, 1985–2025

Within the five leading sectors historically during periods of dollar weakness (Basic Material, Capital Equipment, Consumer Cyclical, Energy, and Technology), here are a handful of the industry groups within those sectors that are ranked within the top-third or so of all groups currently.

Table 3: Top U.S. Industry Groups Within Key Sectors

Further, within these industry groups, several companies with relatively high international revenue exposure also show promising technical setups.

Table 4: Watchlist of U.S. Stocks within Leading Industry Groups with High International Exposure

In terms of international markets, as was shown in Table 1, the outperformance during dollar bear markets has been significant. We believe this may be due to several factors. First, as previously mentioned, often the Fed is easing thereby increasing demand for more speculative assets as well as stoking future economic demand. Next, a weaker dollar reduces demand for U.S. dollar-denominated assets. So, foreign investors will seek out non-dollar markets for investment. A weaker dollar also grants some reprieve particularly in emerging markets, by reducing the local currency cost to service dollar-denominated debt. Finally, many foreign markets have higher commodities exposure versus the U.S. and stand to benefit as most commodities are priced in dollars.

Figure 3: USD Bear Market Performance of Global Baskets

During the longest secular U.S. dollar bear market, here are how some key global currencies performed versus the dollar. Notably, gold was the top performer on the table below. Indeed, in this current period, gold and gold stocks have been very strong performers with the commodity up over 27% year to date as of intraday June 5. Next, historically when the dollar has been weak, there is demand for an alternative currency that has liquidity and is relatively stable. This has driven demand for the euro given its supply and organized trading markets. On the other hand, the Mexican peso, which is closely tied to the U.S. economy and U.S. trade has been the worst performer among major currencies.

Figure 4: Key Currency Performance During Last Secular Dollar Bear Market, 2003–2008

Since the dollar peaked in early 2025, here is how the same currencies have reacted. Again, the euro has been one of the top performers. However, on this table only the Indian rupee has actually declined while the Mexican peso has risen +8%.

Figure 5: Key Currency Performance, YTD 2025

A few favorable segments across international markets which could benefit from stronger local currencies, with markets that may be most sensitive in each category.

- Banks/Investment Management: Inflows, FX reserve appreciation, and improved credit quality.

- EU/U.K., Latin America, Southeast Asia, South Africa.

- Commodities: Higher commodity prices in USD terms, lower costs in local currency. Lower local currency prices and increased export demand.

- Australia, Canada, Norway, Brazil, South Africa, Indonesia.

- Domestic Retail: Imported goods or inputs into final products priced in USD decrease, and lower imported energy costs. Also, consumer purchasing power can rise in relative terms, and drive higher consumer confidence.

- EU/U.K., Japan, Korea, India.

- Foreign Travel: Possibly cheaper airfare on lower fuel costs. Inbound travel to the U.S. becomes relatively more attractive.

- EU/U.K., Japan, Australia, Canada, China.

- Infrastructure: Lower cost of capital and higher capital expenditure on better purchasing power.

- India, Korea, Saudi Arabia.

Here are a few dozen names that have recently emerged out of periods of consolidation which fit well within the above context.

Table 5: Watchlist of International Stocks Related to Groups Benefiting from Weak U.S. Dollar

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Company, made significant contributions to the data compilation, analysis, and writing for this article.

The William O’Neil + Co. Research Analysts made significant contributions to the data compilation, analysis, and writing for this article.

Disclaimer

No part of the authors’ compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed herein. William O’Neil + Co., its affiliates, and/or their respective officers, directors, or employees may have interests, or long or short positions, and may at any time make purchases or sales as a principal or agent of the securities referred to herein.

William O’Neil + Co. Incorporated is an SEC Registered Investment Adviser. Employees of William O’Neil + Company and its affiliates may now or in the future have positions in securities mentioned in this communication. Our content should not be relied upon as the sole factor in determining whether to buy, sell, or hold a stock. For important information about reports, our business, and legal notices please go to www.williamoneil.com/legal.

©2025, William O’Neil + Company, Inc. All Rights Reserved.