(Bloomberg) — US equity futures declined after Thursday’s muted session on Wall Street, while European stocks gained in subdued holiday trading as the year draws to a close.

Most Read from Bloomberg

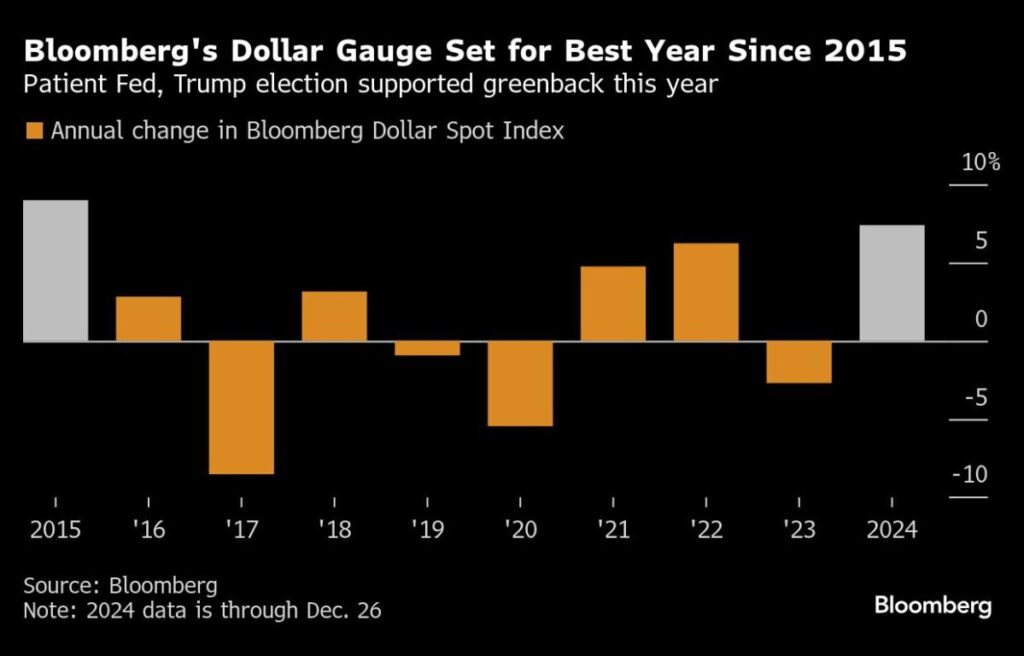

The 10-year Treasury yield hovered near a seven-month high and a gauge of the dollar was steady, on track for its best year since 2015.

The S&P 500 ended Thursday flat, while the tech-heavy Nasdaq 100 fell 0.1% in quiet post-holiday session as mixed jobless claims data did little to alter bets on the Federal Reserve’s policy outlook. With the economy remaining resilient, investors are concerned President-elect Donald Trump’s policies — which could include tariffs and tax cuts — will stoke price rises, forcing a more hawkish stance from the central bank.

“The most important move in this year-end is the rise of the US 10-year bond; this shows how much everybody is waiting for Trump’s inauguration and its impact on inflation,” said David Kruk, head of trading at La Financiere de L’Echiquier in Paris. “Other than that, most of the trades are technical ones, short-covering and profit taking but there’s no big trend going on as is typical during this time of the year.”

The Stoxx Europe 600 index climbed 0.5% as trading resumed after a two-day break, with volumes at about 60% of the 20-day average for the time of day. Delivery Hero SE shares plunged after Taiwan’s anti-trust regulator vetoed the sale of its Foodpanda business to Uber Technologies Inc.

The MSCI Asia Pacific index climbed for the fifth straight day, its longest such streak since July. Shares in Tokyo jumped after the yen dropped to a five-month low of 158 per dollar in the previous session, following Bank of Japan Governor Kazuo Ueda’s comments Wednesday that avoided giving a clear signal on interest rates next month.

The Japanese currency rebounded slightly Friday, after Finance Minister Katsunobu Kato said the government will take appropriate steps against excessive movements in the foreign exchange market. Data released Friday also showed inflation in Tokyo accelerated for a second month, with retail sales also beating estimates.

Japan’s latest economic performance suggests the need for the BOJ to keep considering tightening policy in the coming months. A summary of opinions from the central bank’s December meeting showed mixed views among its board members on the timing of another rate hike partly due to uncertainties over the US economy.

Elsewhere in Asia, Hong Kong and mainland Chinese shares fluctuated. Equities rose in Australia, with their South Korean counterparts declining as the country’s political turmoil continued.