(Bloomberg) — China’s first polysilicon futures debuted on Thursday, as a new hedging tool for a market that has been contending with massive price volatility.

Most Read from Bloomberg

The first day of trading on the Guangzhou Futures Exchange saw prices for the solar-making material on the most-active June contract rally to their upper limit of 44,000 yuan a ton after producers pledged to cut output. The market ended 7.7% higher at 41,570 yuan a ton. A total of 331,253 lots changed hands, over 90% of them for June.

The bourse is offering seven contracts for delivery starting from June. The margin requirement is 9% of the contract value. Prices will be allowed to rise or fall by 7% from the previous settlement, after a swing of 14% was allowed on the first day.

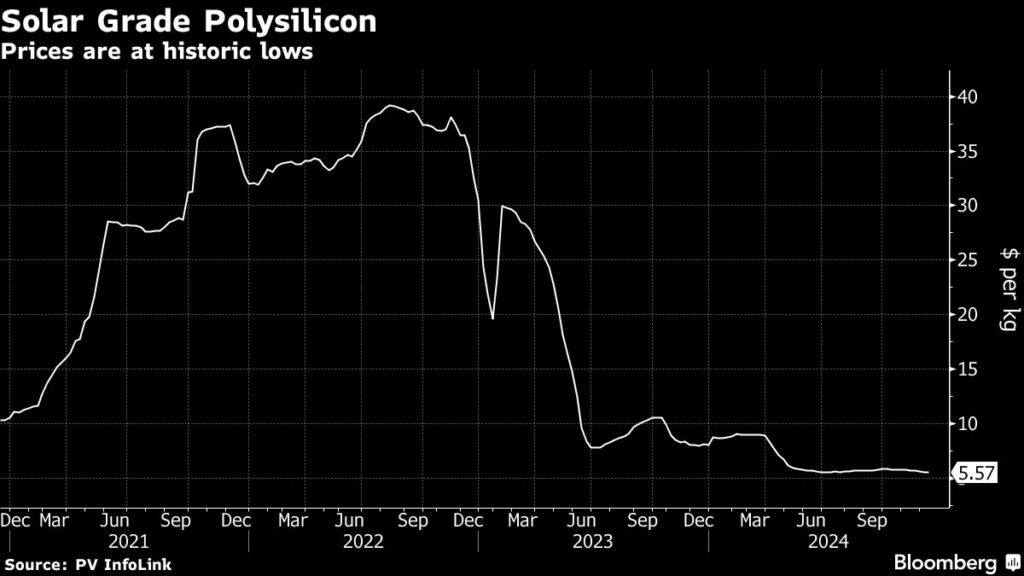

China is the world’s biggest producer of polysilicon, used in solar panels, and the industry is struggling with a huge surplus that has seen prices tumble nearly 90% over the past two years. Like other parts of the solar supply chain, far too much capacity has been built relative to demand, which has slashed profitability.

Polysilicon makers have responded by reducing output, including unspecified cuts announced this week by two of the biggest producers Tongwei Co. and Xinjiang Daqo New Energy Co.

China is betting on clean tech to drive economic growth, and the Guangzhou exchange has found success trading other green materials such as lithium, used in electric vehicle batteries, which launched last year. Polysilicon options contracts will be added on Dec. 27.

(Updates with closing price in second paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.