(Bloomberg) — Turkey’s central bank is expected to deliver its first interest rate cut in nearly two years on Thursday, with major banks divided on the size of the reduction.

Most Read from Bloomberg

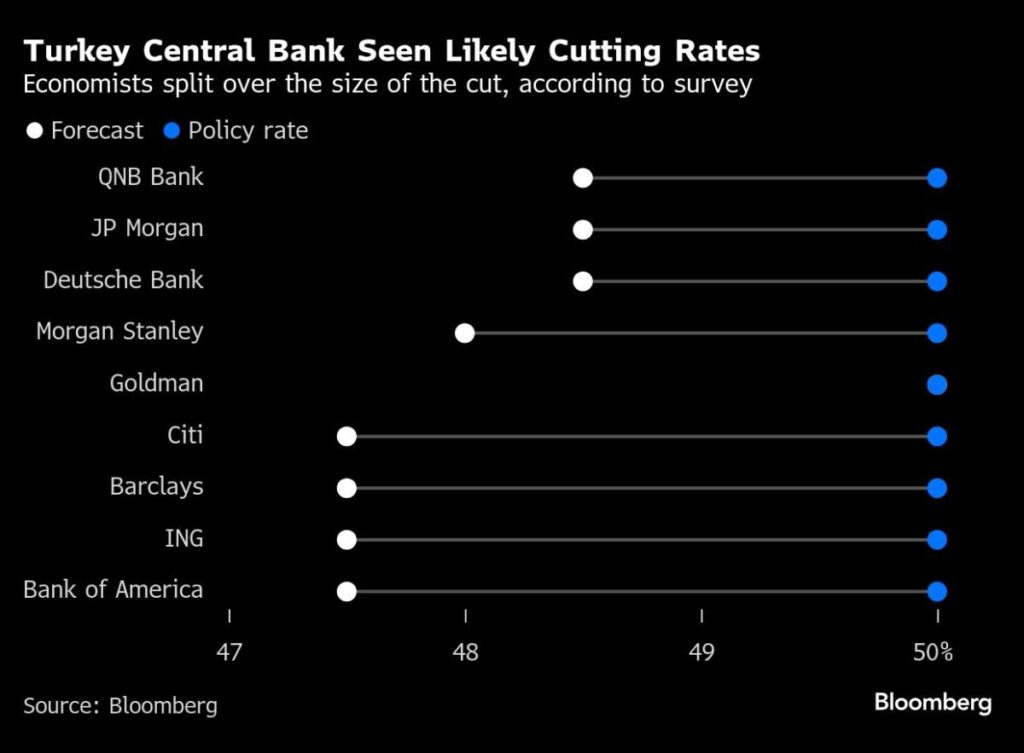

Policymakers led by Governor Fatih Karahan will lower the benchmark rate of one week repo to 48.25% from 50%, according to the median estimate in a Bloomberg survey of analysts.

Predictions vary in the absence of clear guidance by the central bank. JPMorgan Chase & Co. and Deutsche Bank AG expect a 150-basis-points cut while Citigroup Inc. and Bank of America Corp. are penciling in a reduction of 250 basis points. Some officials have called for caution against what investors might perceive as aggressive moves, as the bank prepares to reverse its most aggressive tightening cycle in years.

What Bloomberg Economics Says…

“Looking ahead, we expect the central bank to lower rates at nearly all of its monthly meetings next year, cutting the policy rate to 25% by end-2025. The easing of financial conditions will also feature looser macroprudential rules — we especially see the central bank focusing on this in the second half of the year.”

— Selva Bahar Baziki, economist. Click here to read more.

Still, some investors expect the bank might opt for a more cautious approach. That was reflected in a report by Goldman Sachs Group Inc. economists, who said the monetary authority will likely hold rates for a ninth month with elevated levels of inflation and loan growth making a rate cut “premature” at this point.

Governor Karahan boosted market expectations for lower borrowing costs at this year’s last inflation report presentation, saying demand and services inflation were slowing. That was also reflected in the last Monetary Policy Committee policy statement.

That shift was followed by a slight deterioration in markets’ outlook on prices, a key parameter for policymakers as they decide on the rates trajectory. Households and businesses’ inflation expectations also remain elevated. The bank has sought to assuage concerns, saying that lower borrowing costs wouldn’t necessarily result in looser policy.

Deputy Governor Cevdet Akcay told investors that the bank’s stance will remain tight and any easing cycle doesn’t necessarily have to be uninterrupted, Bloomberg reported last month.