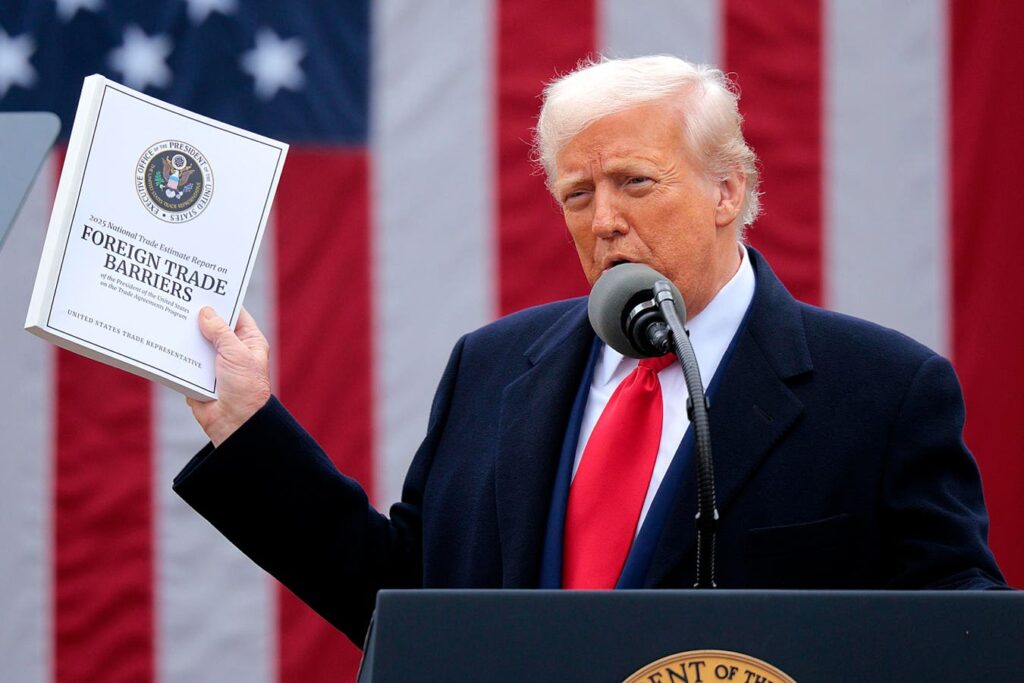

WASHINGTON, DC – APRIL 02: U.S. President Donald Trump holds up a copy of a 2025 National Trade … More

There’s a stark difference between recently positive economic news, and what forecasts, including President Trump’s suggest about tariffs. April’s jobs report was strong with a healthy 177,000 jobs added and unemployment stable at 4.2%. Rather than sharply rising prices, we’ve seen some slight disinflation to March 2025. The stock market has rallied sharply off April’s lows. This is good news and all implies a limited U.S. economic impact from tariffs for the initial months of 2025.

However, predictions for the U.S. economy remain generally pessimistic. Consumer surveys show declining confidence in the economy, according to research from the University of Michigan. Even President Trump recently sounded a note of caution on tariffs. He suggested that children should cut back on dolls and pencils as reported by USA Today. However, he pushed back on the idea that tariffs could mean price rises, saying. “No. I think tariffs are going to be great for us because it’s going to make us rich.”

Recession Risk

Prediction markets see an elevated chance of a U.S. recession in 2025. Forecasting site Kalshi puts the probability at just over 60% currently. This forecast is more grounded in current data because U.S. growth did decline in the first quarter according to the most recent estimate from the Bureau of Economic Analysis. However that decline was largely due to rising imports ahead of tariffs, it didn’t suggest any real weakening of the U.S. consumer, which is what often triggers recessions.

A rule of thumb is that two quarters of negative growth typically represent a recession. However that may be unlikely in the first half of the year because nowcasts for economic growth from both the Atlanta and New York Federal Reserves are signaling positive economic growth in the second quarter, though there is plenty of additional economic data to be reported. Those nowcasts will update as it does.

Incoming Data

Of course, robust current data and negative predictions could both prove true if the economy should weaken in upcoming reports. However, April was when major tariffs were announced and yet unemployment remained robust for that month.

Nonetheless, companies are starting to pull guidance of financial performance in 2025 in the face of uncertainty. For example, toy maker Mattel has withdrawn guidance and stated it expects to, “Where necessary, taking pricing action in its U.S. business.” Although it is also, “Accelerating diversification of its supply chain and further reducing reliance on China-sourced product.” Ford recently estimated that tariffs may cut their earnings before interest and tax in 2025 by $1.5 billion.

Declining Travel To The U.S.

A secondary impact of U.S. policies appears to be declining international visitors to the U.S. Tourism from Europe appears to be down sharply for data reported to March, it’s possible the shifting timing of Easter has an impact here, falling in March in 2024 and April in 2025.

Additionally, there’s not a direct tariff cause here, tourism to the U.S. appears to have dropped maybe as a reaction to a more isolationist U.S. policy in general. There is no specific tariff being paid by tourists. That said, Americans, if not international visitors, still appear to be traveling at similar rates than previously.

What To Look For

Upcoming economic data will be key. Jobs reports for May scheduled for release on June 2 and for June scheduled for July 3 will be closely watched. If there’s no evidence of tariff impact in these reports, then the soft survey data and forecasts may have shown excessive pessimism.

Inflation data will matter too, in terms of assessing the extent that tariffs are impacting prices. Consumer Price Index inflation for April as scheduled for release on May 13 is expected to be relatively mild. Yet, CPI releases for subsequent months may be more informative concerning tariffs.

The Producer Price Index inflation releases may also be useful, because PPI can capture price changes in raw materials and interim products upstream of consumers potentially seeing the effects in later months. April’s PPI data will be released on May 15 with May’s on June 12.

For now, despite all the fears about tariffs, the hard economic data, notwithstanding negative growth in the first quarter, has been perhaps surprisingly robust in the face of many negative forecasts.

It will be several months before economists can start to assess the impact of any tariffs, and of course the tariffs themselves are potentially subject to negotiation and adjustment too, creating further uncertainty. For now, there’s a relatively unusual mix of elevated economic concern paired with generally robust economic data.