(Bloomberg) — Usually, when sentiment toward US stocks turns this grim, volatility is elevated and analysts are slashing expectations for returns, it’s a cue for risk-taking investors to pile in.

Most Read from Bloomberg

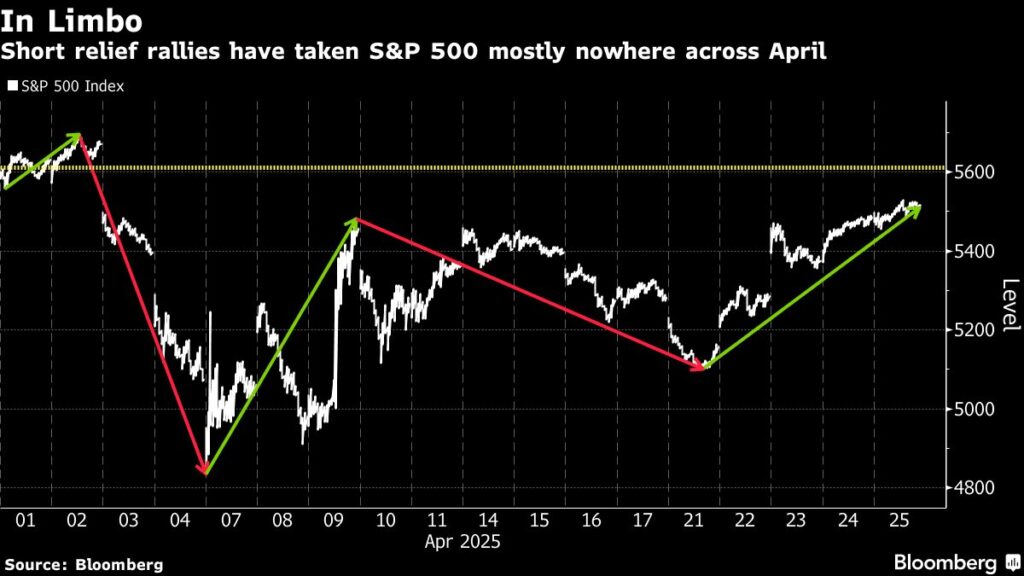

But Wall Street, whipsawed by tariff policies that change on a dime and on edge over the potential for economic data to sour, is finding that playbook doesn’t apply, even as the S&P 500 Index (^GSPC) has clawed back nearly half of its slide since a February peak.

For HSBC Holdings Plc’s Max Kettner, it’s the first time in years he’s setting aside the cues from the positioning and sentiment measures he typically monitors and discounting the odds of a rebound.

“I’d advise clients to disregard such signals at the current juncture, precisely because policy uncertainty is still so elevated and is unlikely to go away anytime soon,” the firm’s chief multi-asset strategist said.

Investors are left to contend with a new reality: generally reliable buying indicators have been broken by capricious policy announcements from the White House, making it nearly impossible to predict where stocks will go next.

By one measure, investors are unprecedentedly pessimistic. Traditionally, such a view is a greenlight for dip-buyers to wade in.

The closely watched American Association of Individual Investors survey has extended a streak of bearish readings of 50% or more to a record nine weeks, data from Bespoke Investment Group show. Since 1987 there have only been three other periods where sentiment has been that bad for even five straight weeks. The stock-market moves that followed were mixed.

“The news kept getting worse during those streaks,” said Bespoke Investment Group co-founder Paul Hickey. “These days, investors remain concerned because of what seems to be a near certainty of economic weakness over the horizon.”

At close: April 25 at 4:52:33 PM EDT

At Bank of America Corp. (BAC), strategists led by Michael Hartnett view the recent advance as a pain trade, squeezing stocks higher. They’re advising clients to sell into rallies and warning that the conditions are missing for a sustained climb, with trade policies likely to continue driving investors out of US equities as recession and inflation risks mount.

A recent BofA survey found that fund managers are “max bearish” on the macro-environment — pessimism that historically suggested an upcoming reversal. However, they are “not quite max bearish on the market” based on their allocations, implying further room for stocks to drop.