(Bloomberg) — The dollar weakened for a fifth day as traders looked past a reprieve on the imposition of certain electronic tariffs and after President Donald Trump downplayed his exemption for the technology sector.

Most Read from Bloomberg

The Bloomberg Dollar Spot Index was down 0.2% after tumbling to its lowest since October in early Asian trading. The gauge has slumped almost 6% this year amid escalating trade tensions with China, uncertainty over US policy and concern economic growth will slow.

The dollar’s decline resumed after Trump said on Sunday he will still apply tariffs to phones, computers and popular consumer electronics, downplaying an earlier reprieve as a procedural step in his efforts to overhaul US trade. “NOBODY is getting ‘off the hook,’” the president said in a social media post as trading began in Asia.

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen.

“For the US dollar to rally on a sustained basis, a swift peace settlement of the trade war is needed before long-lasting harm is done on the US economy,” said Dane Cekov, a senior macro and currency strategist at Sparebank 1 Markets AS in Oslo. “The US dollar will continue to weaken in the months to come as Trump’s tariffs’ impact appears in hard data such as consumption, inflation and labor market figures.”

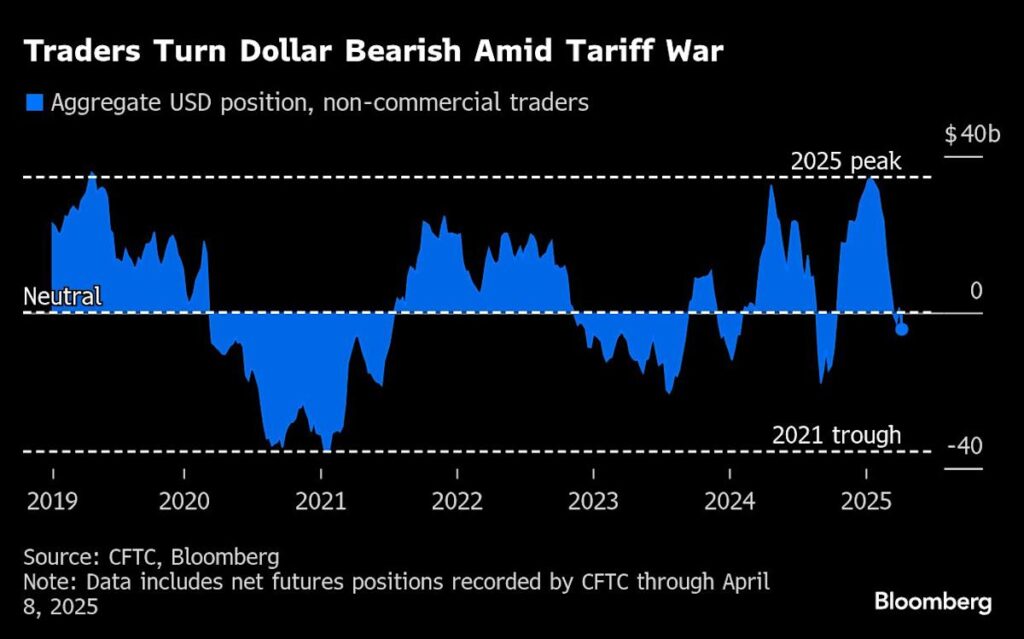

Almost 80% of respondents to a Bloomberg survey predicted the dollar would weaken further over the next month, the biggest proportion of bears since the surveys began in 2022. A gauge of greenback volatility remains close to a two-year high, while speculative traders added to short positions in the US currency in the week though April 8, data from the Commodity Futures Trading Commission show.

Federal Reserve Bank of Minneapolis President Neel Kashkari on Sunday downplayed expectations the central bank would step in to support financial markets after his Boston counterpart Susan Collins suggested that was a possibility. “Investors in the US and around the world are trying to determine what is the new normal in America” and the Fed has “zero ability to affect that,” Kashkari said.

Strategists at the biggest Wall Street banks see the potential for further weakness in the dollar as the impact of Trump’s tariff implementation works its way through the economy and markets.