The DividendRank formula at Dividend Channel ranks a coverage universe of thousands of dividend stocks, according to a proprietary formula designed to identify those stocks that combine two important characteristics — strong fundamentals and a valuation that looks inexpensive. PepsiCo presently has an excellent rank, in the top 25% of the coverage universe, which suggests it is among the top most “interesting” ideas that merit further research by investors.

Start slideshow: 10 Oversold Dividend Stocks »

But making PepsiCo an even more interesting and timely stock to look at, is the fact that in trading on Thursday, shares of PEP entered into oversold territory, changing hands as low as $152.04 per share. We define oversold territory using the Relative Strength Index, or RSI, which is a technical analysis indicator used to measure momentum on a scale of zero to 100. A stock is considered to be oversold if the RSI reading falls below 30.

In the case of PepsiCo Inc, the RSI reading has hit 29.9 — by comparison, the universe of dividend stocks covered by Dividend Channel currently has an average RSI of 39.5. A falling stock price — all else being equal — creates a better opportunity for dividend investors to capture a higher yield. Indeed, PEP’s recent annualized dividend of 5.42/share (currently paid in quarterly installments) works out to an annual yield of 3.51% based upon the recent $154.43 share price.

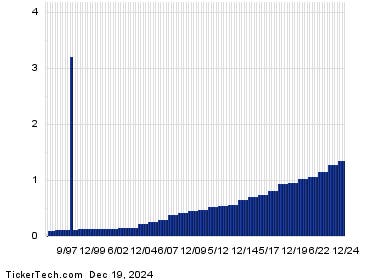

A bullish investor could look at PEP’s 29.9 RSI reading today as a sign that the recent heavy selling is in the process of exhausting itself, and begin to look for entry point opportunities on the buy side. Among the fundamental datapoints dividend investors should investigate to decide if they are bullish on PEP is its dividend history. In general, dividends are not always predictable; but, looking at the history chart below can help in judging whether the most recent dividend is likely to continue.

Pep

Other Top Dividends