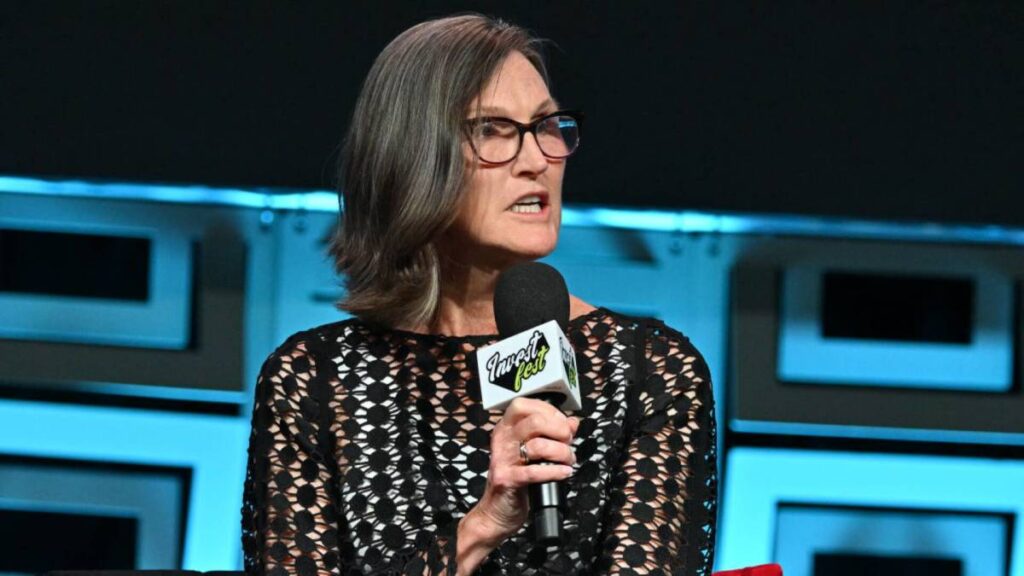

Cathie Wood, CEO of Ark Investment Management, is an active trader.

She often buys her favorite tech stocks when they fall and sells them when they rise.

This is what she did last week.

🔌Free Newsletter From TheStreet – TheStreet🔌

Investors and analysts have mixed opinions on Cathie Wood. Supporters see her as a visionary in tech investing, but critics say she’s only a mediocre fund manager.

Wood’s followers affectionately dubbed her “Mama Cathie” after she drew widespread attention with a remarkable 153% return in 2020.

However, her longer-term performance isn’t so hot.

The flagship ARK Innovation ETF (ARKK) , with $5.4 billion under management, has returned 20.18% year-to-date through Dec. 16, with an annualized three-year return of -11.60% and a five-year return of 5.29%.

In comparison, the S&P 500 is up 29.06% this year, with a three-year annualized return of 10.88% and a five-year return of 15.55%.

Cathie Wood’s investment strategy is straightforward: Her ARK ETFs typically buy shares in emerging, high-tech companies in fields such as artificial intelligence, blockchain, DNA sequencing, energy storage, and robotics.

Wood believes these companies will transform industries, but their volatility causes significant swings in ARK funds’ values.

Investment research firm Morningstar has sharply criticized Cathie Wood and the ARK Innovation ETF.

Related: Cathie Wood buys $30 million of under-the-radar AI stock

Amy Arnott, Morningstar portfolio strategist, has calculated that Ark Innovation destroyed $7.1 billion of shareholder wealth from its 2014 inception through 2023. That put the ETF as No. 3 on her wealth destruction list for mutual funds and ETFs for the past decade.

Wood defended herself in a July posting on Ark’s website. She acknowledged that “the macro environment and some stock picks have challenged our recent performance” while reaffirming her “commitment to investing in disruptive innovation.”

Wood recently expressed optimism about a shift to looser regulations under Donald Trump’s presidency, particularly regarding technology, cryptocurrencies, and digital assets.

“In the last four years, we saw massive concentration toward very few stocks,” Wood said on CNN’s Inside Politics Sunday on Dec. 1. “I think the market’s going to broaden out right now and reward companies who are at the leading edge of innovation.”

Despite Wood’s confidence, some investors appear unconvinced. The ARK Innovation ETF saw a net outflow of nearly $3 billion over the past year, according to data from ETF research firm VettaFi.