(Bloomberg) — European shares held firm at the open, tracking a range-bound session in Asia as investors awaited the Federal Reserve’s final policy decision of the year.

Most Read from Bloomberg

The Stoxx 600 index was little changed after declining for four straight sessions. US futures contracts edged higher after both the S&P 500 and Nasdaq 100 shed 0.4% Tuesday. A gauge of Asian equities rose 0.1%, led by gains in Hong Kong and mainland China.

Commerzbank AG advanced as much as 4.3% after UniCredit SpA said it has boosted its stake in the German lender. In Japan, shares of Nissan Motor Co. jumped the most since at least 1974 on news that the ailing carmaker is exploring a possible merger with Honda Motor Co.

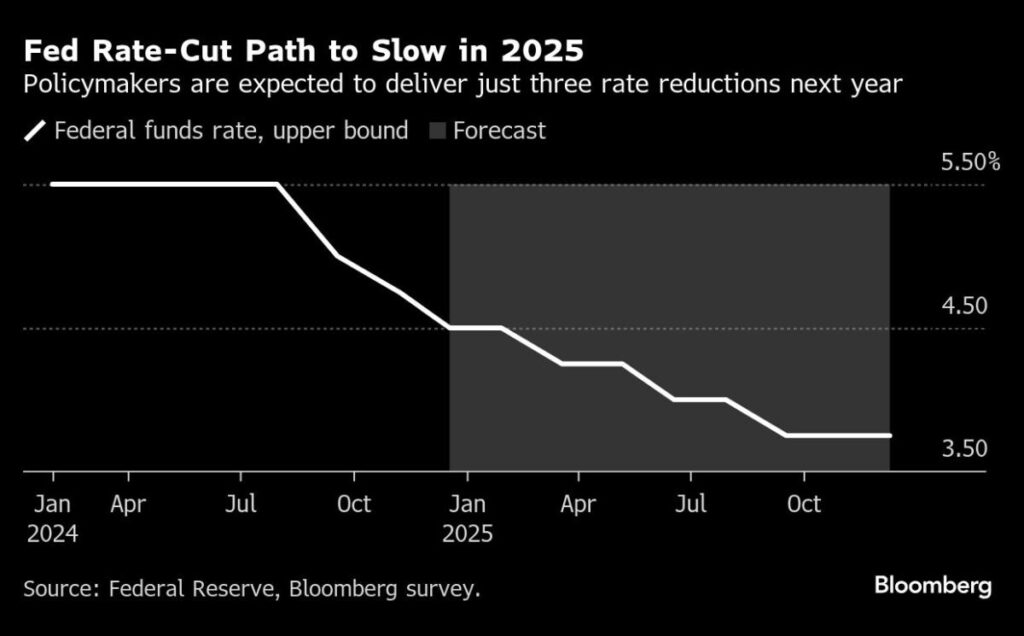

While the Fed is widely expected to cut interest rates by another 25 basis points on Wednesday, the focus is on its outlook for next year as inflation decelerates more slowly than previously anticipated. The central bank’s meeting also comes as US economic data showed a mixed picture, with retail sales increasing at a firm pace and industrial production unexpectedly declining.

“Today the message will be that they remain data-dependent and that every meeting will be live,” said Alberto Tocchio, portfolio manager at Kairos Partners. This means “that the market could expect max three cuts for next year.”

Bank of America Corp. sees the Fed lowering interest rates to the 3.75% level — or three more cuts from where they are currently, Chief Executive Officer Brian Moynihan said on Bloomberg Television.

“They need to bring it down a little bit, they just have to be more careful because the economy is stronger than we thought three months ago, six months ago but still has potential weaknesses” he said. “We haven’t even talked about what is going on outside the United States that could affect it — not tariffs but wars.”

US Treasuries rose slightly while Bloomberg’s dollar gauge was little changed. The yen turned steady ahead of the Bank of Japan’s policy decision Thursday.

UK inflation rose to an eight-month high in November, drifting further above the Bank of England’s 2% target and supporting expectations that it will hold interest rates at its final meeting of the year. The pound fell 0.2%

In China, longer-dated government debt fell as a media report on the central bank’s discussions about risks for financial institutions renewed concerns over authorities’ pushback against a relentless bond rally.

Indonesia’s central bank kept its key rate unchanged at 6%, as expected, after the nation’s anti-graft agency searched its headquarters as part of a probe into the monetary authority’s use of corporate social responsibility funds.