The outlook for 2026 includes continued growth and higher profit margins with IT spending expected to grow 9.8% to more than $6 trillion.

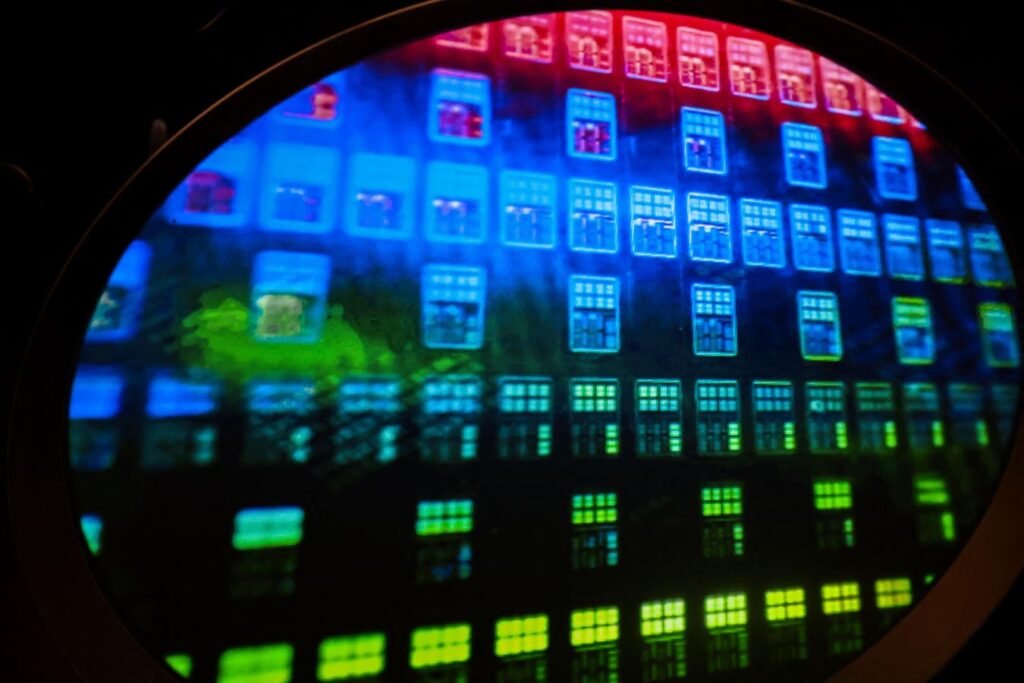

AFP via Getty Images

The three best tech stocks to buy in 2026 are companies you may never have heard of. They include Vertiv, an Ohio-based provider of technology for removing heat from and providing power to data centers; chipmaker Taiwan Semiconductor; and Datadog, which provides cloud monitoring and security services.

I picked these three companies based on their revenue growth, profitability and odds of beating investor expectations next year. I listed the companies below based on their stock price performance so far in 2025.

Before we take a more in-depth look at the business model, performance and upside potential of Vertiv, TSMC and Datadog, let’s assess the tech sector’s prospects for 2026.

The Tech Sector In 2026

The tech sector is growing and has high profit potential. In 2025, investments in AI could total $1.5 trillion, according to the research and advisory firm Gartner, with significant investment in cloud computing and cybersecurity. Worldwide IT spending is projected to increase 8.5% from 2024 to $5.5 trillion, Gartner added.

The outlook for 2026 includes continued growth and higher profit margins with IT spending expected to grow 9.8% to more than $6 trillion. Software spending is forecast to grow 15% while Gartner forecasts that data center spending is expected to grow faster – at around 19% – due to further AI infrastructure buildouts.

Operating leverage, continued efficiency gains from AI and automation, and slowing wage growth are expected to keep tech profits high and growing in 2026.

3 Top Technology Stocks To Invest In 2026

These three technology companies each benefit from investments in AI and data centers that have been driving growth in the technology sector.

The soaring investment in data centers to train and operate AI chatbots propels Vertiv. The company’s liquid cooling systems keep data centers cool enough to run nearly non-stop.

TSMC manufactures the chips that Nvidia designs – making this company an essential hardware provider for the AI industry.

Demand for AI-tuned cloud-security products has driven Datadog to offer new AI technologies and security tools – driving the company’s expectations-beating revenue growth.

1. Vertiv (VRT)

Business Overview

- Stock Price (Nov. 6, 2025): $185,78

- Stock price change year-to-date: 57%

- Revenue (Q3 25): $2.68 billion

- Revenue growth (Q3 25): 29%

- Net margin: 15%

Vertiv keeps data centers running. The company’s power and cooling hardware enables data centers to maintain their proper temperature and provides the electricity required to operate almost continuously. Vertiv’s partnerships with Nvidia and other AI leaders create the opportunity to develop advanced liquid cooling and high voltage power architectures required for high-density AI workloads, the company writes.

Why VRT Stock Is A Top Choice

Vertiv is enjoying rapid growth, is profitable and is likely to beat analyst expectations. Vertiv revenue rose 29% in the latest quarter on rising demand from companies building AI data centers. Organic orders also grew by 60% in Q3 2025, leading to a record backlog of $9.5 billion, which suggests continued strong growth, noted Yahoo! Finance.

Vertiv is profitable and has been expanding its margins. Its adjusted EPS have grown substantially, from $0.53 in 2022 to an expected midpoint of $4.10 in 2025. Adjusted operating margins expanded to 22.3% in Q3 2025, Yahoo! Finance reported,

Analyst sentiment is bullish, and the company consistently surpasses Wall Street expectations and raises its own guidance. Management recently raised its full-year 2025 and preliminary 2026 estimates.

Vertiv’s strong execution, expanding margins, order backlog and important role in AI infrastructure buildouts, positions it well to meet and potentially beat analysts’ high expectations, SeekingAlpha said.

Taiwan Semiconductor offers manufacturing services and specialized packaging to the biggest players in artificial intelligence.

AFP via Getty Images

2. Taiwan Semiconductor Manufacturing (TSM)

Business Overview

- Stock price (Nov. 6, 202525): $290.24

- Stock price change year-to-date: 44%

- Revenue (Q3 25): $990 million

- Revenue growth (Q3 25): 30.3%

- Net margin: 45.7%

Taiwan Semiconductor manufactures chips based on designs provided by other companies; it doesn’t design its own chips. This model allows TSMC to build trust and partnerships with Apple, NVIDIA and other technology companies by providing manufacturing services and specialized packaging. The strategy offers customers the benefits of having their own virtual fab without the high cost and complexity of owning and operating them, the company said.

Why TSM Stock Is A Top Choice

As the primary contract manufacturer for high-performance semiconductors, including those from Nvidia and Broadcom, TSMC is essential to the tech industry. TSMC holds an estimated 90% share of the high-performance semiconductor manufacturing market, a position that is unlikely to change soon with the high costs of setting up rival foundries. New technology could drive increased sales in the coming years, Stockrow reported.

Given its essential role in the AI chip supply chain, analysts are confident in TSMC’s sustained performance and long-term growth prospects, making it a key infrastructure play for the AI boom, Bloomberg reported.

This confidence comes from strong AI demand, as reflected in TSM’s operating statistics: 41% revenue growth; a 39% surge in net income; raised full-year 2025 revenue growth guidance to about 35%; and price increases in the range of 8% to 10%.

Customers pay Datadog for subscriptions based on the volume of data monitored, the number of servers, and the features or products used.

dpa/picture alliance via Getty Images

3. Datadog (DDOG)

Business Overview

- Stock Price (Nov. 6, 2025): $188.89

- Stock price change year-to-date: 31.3%

- Revenue (Q3 25): $886 million

- Revenue growth (Q3 25): 28%

- Net margin: 4%

Datadog operates a software as a service (SaaS) business model, providing a unified monitoring and security platform for cloud applications. Customers pay for subscriptions based on the volume of data monitored, the number of servers, and the specific features or products used. Datadog follows a land-and-expand sales motion. To wit, the company initially sells customers a few products and encourages them to buy more over time, with 83% of customers using at least two products and 52% using four or more as of June 2025 according to Barchart.

Why DDOG Stock Is A Top Choice

Datadog is growing rapidly and generates strong cash flow. With continued cloud migration and greater AI adoption, analysts expect Datadog to beat expectations in 2026.

Datadog’s revenue grew 28% in Q3 2025. The company’s enterprise customer base is expanding — the number of clients generating $100,000 or more in annual recurring revenue increased by 16% in the latest quarter. The company earned a 4% net margin and generated $214 million in free cash flow, according to the company’s Q3 earnings report.

Datadog has consistently surpassed analyst revenue and profit expectations. Analysts expect the company to beat expectations in 2026, SeekingAlpha reported, citing the company’s strong market position, innovation in AI and security, and the ongoing shift to the cloud.

Bottom Line

Vertiv, Taiwan Semiconductor, and Datadog may not be household names, but they are among the top performing companies behind the expanding demand for AI and the data centers that make generative AI possible. That’s why these companies are growing, profitable and likely to exceed expectations. The biggest risk for investors in these stocks would be a slowdown in the capital flowing into AI data centers.